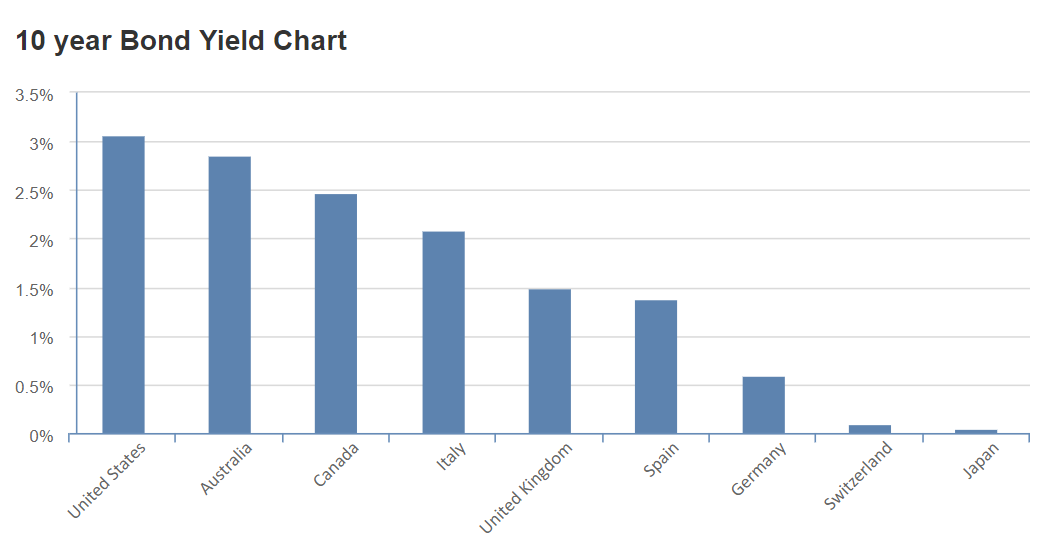

The Big Story: US Bond Yields Rise Above 3.0% for First Time Since 2011 and Why it Matters for FX Markets

- US Treasury bond yields have risen to above 3.0% for first time in 7 years

- The move has had a profound effect on financial markets and pushed up the Dollar

- Other macro-factors have assisted the Dollar in its rise

© RCP, Adobe Stock

Famously, veteran investor Jim Rogers - who started the Quantum Fund with George Soros - once said that on his first day on Wall Street he didn't even know what a bond was.

Given his education - Yale first and then Oxford for his second degree - he most likely wasn't being literal; what he probably meant was he didn't know how bonds worked in all their exasperating complexity.

In their simplest form they are just a type of loan agreement that is paid in full at a set expiry date, with the yield being the compensation paid to bondholders for holding the debt. Yield is paid to offset erosion caused by inflation; thus rising yields signal higher inflation expectations.

The big news story in foreign exchange markets markets at present centres around bonds, more specifically US Treasury Bonds (USTS), which are IOU's from the US government. The 'yield' on the benchmark 10-year UST has risen above the 3.0% mark for the first time since 2011 which has triggered a strong comeback by the Dollar and fears that stock markets might soon come under pressure.

(Image courtesy of Investing.com)

The outsized inflation expectations in the US reflected by the rise in 10-year UST yields bring with them a whole train of other assumptions about the US economy.

Higher inflation is normally a result of higher wages, higher spending, greater growth, a stronger Dollar and also possibly a weaker stock market because higher inflation pushes up interest rates which makes borrowing more expensive, and thus impacts on companies' bottom lines.

Thus the move above 3.0% has had a profound impact on a wide variety of markets.

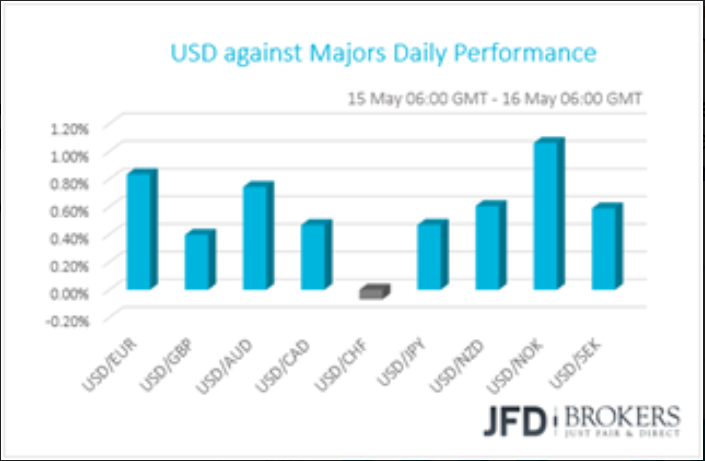

The effect on FX is quite simple: the rise in 10-year yields has catapulted the US Dollar higher against almost all other currencies bar the Swiss Franc.

"The Dollar continued to gain yesterday as the US 10-Year Treasury yields continued to soar, hitting 3.095, a level last seen in July 2011," says Charalambos Pissouros, a senior market analyst at JFD Brokers in Limassol, in a note out on Wednesday.

The rise in yields has been put down to the resilient spending-power of the US consumer after US retail sales data showed an increase of 0.3% in April.

"The 10-Year yields gathered momentum after the US retail sales data showed that both headline and core sales rose +0.3% mom in April," says Pissouros.

In actual fact US retail sales undershot market expectations of 0.4% so the data was not as good as had been expected, arguing if anything for a different market reaction - a point made by Kit Juckes, the macro strategist at Société Générale.

"Sometimes the market is positioned in such a way that news has no impact but gives the appearance of being the straw that broke the bull's back, for the bond market anyway. It hurt the Dollar bear's back quite a lot too," says Juckes.

Ultimately, the effect of higher inflation will be to put pressure on the US Federal Reserve to raise base interest rates in an attempt to head off rising prices.

Whilst the Fed had been expected to increase interest rates at a relatively fast pace of 3 x 0.25% rate rises this year anyway, expectations appear to have risen to potentially 4, or 3-4.

The possibility of hike number two happening in June has increased from 40% before yesterday to 46% after, according to market gauges.

A higher base interest rate is a major bullish driver for the US Dollar. This is because higher interest rates attract greater inflows of foreign capital from foreign investors seeking to park their funds somewhere where they can expect to earn high returns.

There may even be a feedback loop between rising yields and the rising Dollar with one helping the other higher like a couple of mountaineers scaling a rock face.

"Last week, the dollar fell as US yields fell; this week, the dollar rose as US yields rose. The interesting question is, which market is leading which?" Says Marshall Gittler, chief strategist at ACLS Global.

"In fact, there may well be some feedback between the two markets in which higher yields push the dollar higher, and the higher dollar pushes yields up too," adds Gittler.

"That’s because a stronger dollar reduces the likelihood of foreign central bank intervention and thereby eliminates one major source of demand for Treasuries," he concludes.

Reverse 'RoW'

The Dollar is also be rising for another reason: in 2017 the Dollar lost ground due to expectations that the 'Rest of the World' (RoW) would catch up with America both in terms of growth and higher interest rates.

Yet the reality is that the reverse has happened and the US appears to be diverging more not less with RoW.

Global growth was almost universally hit in Q1 which has reduced the negative effect of 'RoW' on the Dollar. Since then the effect has, if anything, reversed as US growth has broken away from the pack rather than converged, pushing the Dollar higher.

Global growth has also been hit by other factors such as rising oil prices which have put pressure on many countries which have to import large amounts of oil, especially India which has seen the Rupee lose ground as a result.

The collapse of the Turkish Lira and a deepening financial crisis in Argentina has also hit the outlook for emerging market FX, which had previously been so rosy under the RoW thesis.

"A more hawkish US rate hike outlook coupled with higher oil prices have set the stage for the return of emerging market jitters in May," says Philip Wee, FX strategist at DBS Economics.

"This was led by the sell-offs in the Argentina peso (-22.6% ytd as at 15 May) and the Turkish lira (-14.4%) to new all-time lows," he adds.

Argentina was forced to seek a standby facility with the International Monetary Fund (IMF) on May 8, and the Lira's rout was attributed to fears of a loss in central bank independence and Moody’s negative outlook on the Turkish banking system.

The strengthening Dollar could also be a factor increasing the disparity between emerging markets (EM) and the US.

This is partly due to the widespread practice of EM corporations taking out Dollar denominated loans which exposes them to a higher repayment burden if the Dollar appreciates.

"In the emerging markets, conditions continue to be challenging amid a resurgent USD and higher USD rates. There is considerably less tolerance by investors on perceived shortfalls in external funding, inflation or fiscal risks," says Wee.

"Much of this has been playing out in Argentina and Turkey. For Asia, the higher yielding government bonds (Indonesia, India, and Malaysia) have sold off significantly over the past few months as rate hike fears mount," adds Wee.

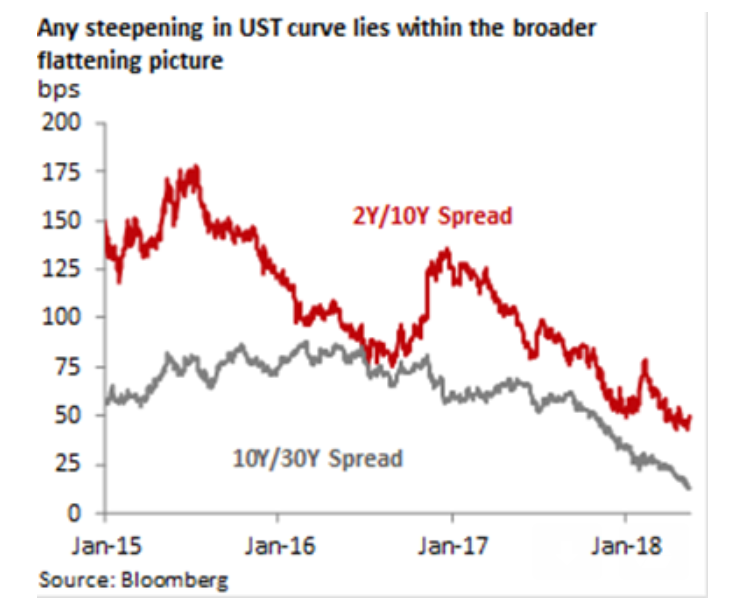

The Dollar's rise can partially be put down to a steepening in the UST yield curve which compares the yields on USTs of different durations - from 1-30 years.

When the yield curve is steep it correlates with a higher Dollar, yet Wee says the steepening is coming to an end, signaling a possible slowdown in the USD's rally.

"By and large, the bear steepening should be viewed as a countertrend move that is unlikely to be sustained for an extended period," says Wee.

(Image courtesy of DBS Economics)

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here