GBP/USD Forecast to Stay Below 1.35

The Pound to Dollar exchange rate has been rising through the course of 2017 and those with the luxury of waiting for a better exchange rate have seen their patience pay off as the purchasing power of Sterling improved.

Between June 21 and August 1, GBP/USD rose 5.1% from a low of 1.2587 to a high of 1.3243. The last time this rate was achieved was in September 2016.

The recovery has been triggered by a number of drivers, most notably a broadbased decline in USD and hopes that the UK will avoid a disruptive Brexit.

However, strength over the past month has been triggered by three Monetary Policy Committee members voting for a rate hike at the Bank of England (BoE) meeting on June 15.

The move has put the Bank into the driving seat for Sterling once more.

The big question now is whether gains over the remainder of 2017 will be delivered - i.e would you best be served by sitting back and watching the Pound continue to recover?

Risks of Correction Grow

Understandably there are a wide range of views concerning the outlook with a number of analysts now starting to express concern as to how high the GBP/USD has risen.

“We remain cautious over the latest bout of GBP strength,” says a research note from DBS Bank in Singapore. Analysts at the global financial services giant believe the Bank of England’s meeting on August 3 could see fewer (if any) member calling for a hike.

Such a scenario would certainly weigh on Sterling and potentially bring about a decline as expectations for an interest rate at some point in the near-future have actually risen over recent months.

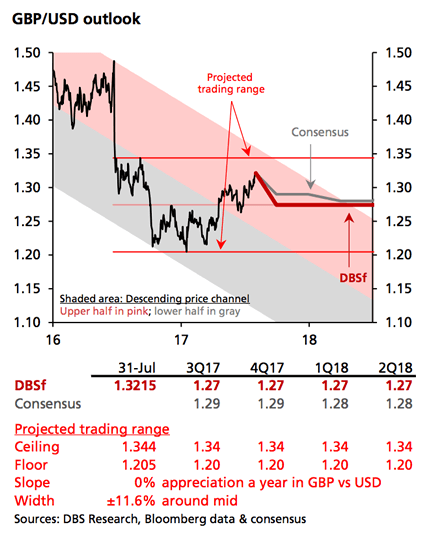

If we look at the latest projections for the Pound against the Dollar, we can see ceiling at 1.35 is seen.

So a plateau or retracement could occur at anytime, if the projections are to hold any credibility of course.

The risk for DBS is that the Bank of England is more amiable to an interest rate rise than expected.

DBS note one of the three hawks, Kristin Forbes, has been replaced by Silvana Tenreyro, who shares BOE Governor Mark Carney’s view that Brexit will hurt the UK economy.

However we would remind readers that it was Carney himself who hinted at the need for a potential interest rate rise when addressing fellow central bankers in Sintra, Portugal at the end of June.

Nevertheless, he is unlikely to vote for a rate rise as such a move would certainly be only forthcoming if the rest of the committee voted in a similar fashion.

BOE chief economist Andy Haldane is likely to reconsider his position to join the hawks.

“Looking ahead, Brexit uncertainties will weigh on business investment and consumer spending. Consensus now sees UK growth decelerating into a lower 1.2-1.5% range into 2018,” say DNB.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.