GBP/USD: Forecast for Coming Week

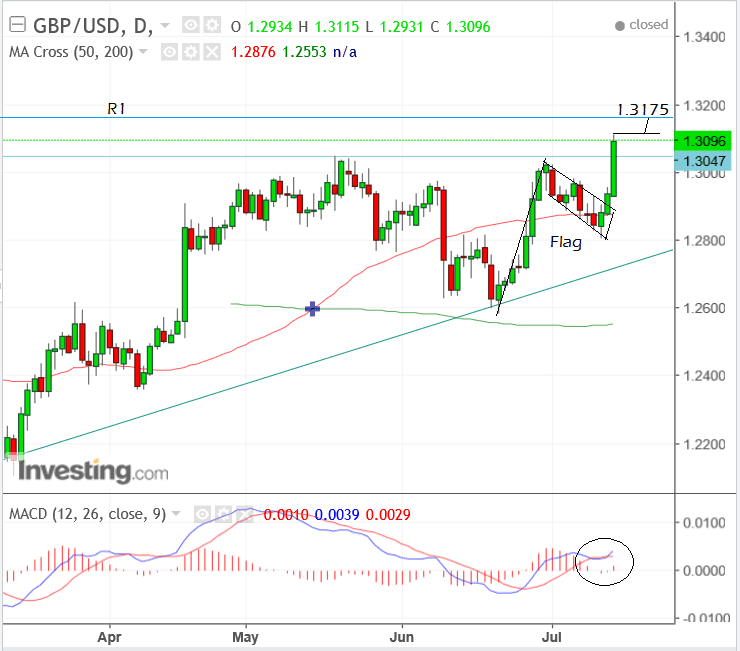

The Pound to Dollar exchange rate (GBP/USD) has rallied strongly, breaking clearly above 1.3000 and continuing its uptrend.

The rise was due more to Dollar weakness than Pound strength after the release of poor US Inflation and Retail Sales data.

From a technical viewpoint, the short-term uptrend looks likely to continue.

The MACD (bottom pane below) is above the zero-line supporting this inference as a reading above zero is indicative of an up-trending environment.

We expect a break above the 1.3115 highs as confirming a continuation up to the next target at 1.3175 where the R1 monthly pivot is situated.

The R1 pivot provides the next target to the upside as it is likely to act as an obstacle to greater gains.

The break higher after the pull-back is consistent with the prior evolution of a bullish flag pattern, as noted in our mideweek technical outlook, despite our bearish base case.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Data to Watch for the Pound

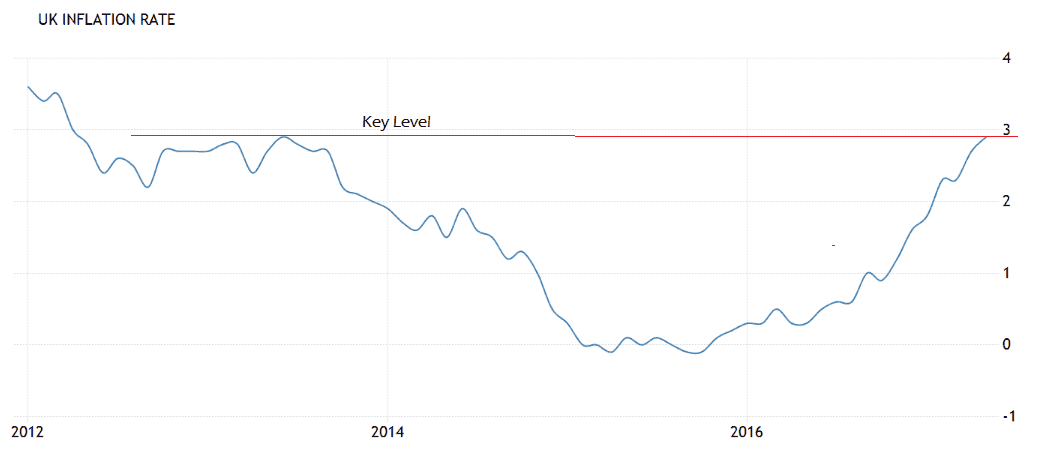

The standout release for Sterling in the week ahead is June Inflation data which is out at 9.30 BST on Tuesday July 18.

The release is important because it impacts on the decision making of the Bank of England (BOE), which in turn is a major driver of the Pound.

Inflation has risen steeply after the Pound weakened following the referendum, which had the consequence of pushing up the prices of imports.

Inflation in May stood at 2.9% year-on-year (yoy: ie compared to May 2016), and 0.3% month-on-month (mom).

The consensus amongst analysts is that it will remain at 2.9% in June yoy but rise at a lesser 0.2% mom.

However, Canadian Investment Bank TD Securities think the market is being too dovish and forecast a higher 3.0% rise in inflation.

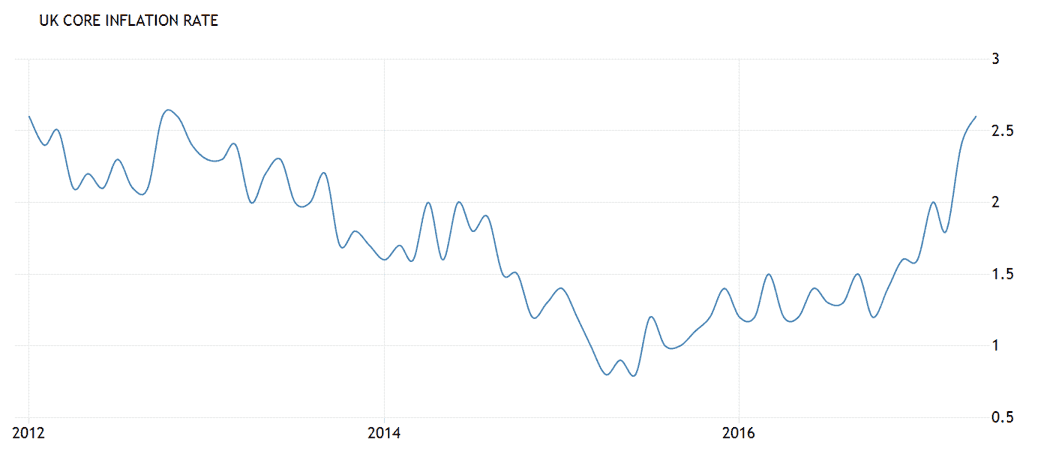

TD expect Core inflation to come out at 2.6% which is the same as the market.

A rise in the cost of utilities is likely to be the driving force behind higher broad inflation and stable core.

“Inflation is likely to have continued its march upward in June, in part due to utility price increases. Core inflation, meanwhile, is likely to have remained stable.”

Nor do TD see this as the “peak for inflation” as core could rise 1 or 2 basis points and headline could rise to the “min-3% range”, which would, “head up the debate about a (single) rate hike later this year.

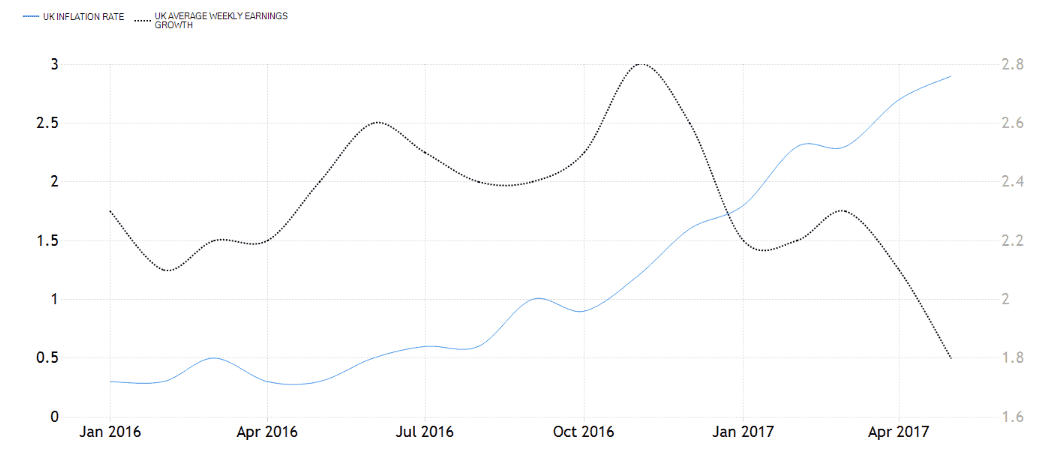

Incidentally the divergence between slowing average earnings in the UK and rising inflation is probably the root cause of the slowdown in the high street or “consumption” as economists like to call it.

The drag on growth from people spending less money is likely to keep the hawks at the BOE in check and limit any possibility of a rate hike.

We know Carney for one won’t change his view until the “trade-off” facing the MPC “continues to lessen” by which he means the trade-off between slowing growth and rising inflation.

Which brings us on to the other major release of the week for Sterling – Retail Sales on Thursday, July 20 at 9.30.

The market is currently being very optimistic about the gains expected in June.

They see headline Sales rising 2.6% yoy – which is a big jump from the previous 0.9% print; and Core increasing 2.4% from May’s very much lower 0.6% rise.

The market also expects a monthly rise of 0.4% for headline and 0.5% for core from -1.2% and -1.6% respectively in May.

This turnaround appears hugely optimistic from both our and TD Securities perspective, and seems to have little logic backing it up.

TD are of the opinion that Sales will not rise by anything (0.0%) mom in June rather than the 0.4% suggested by the market – we agree.

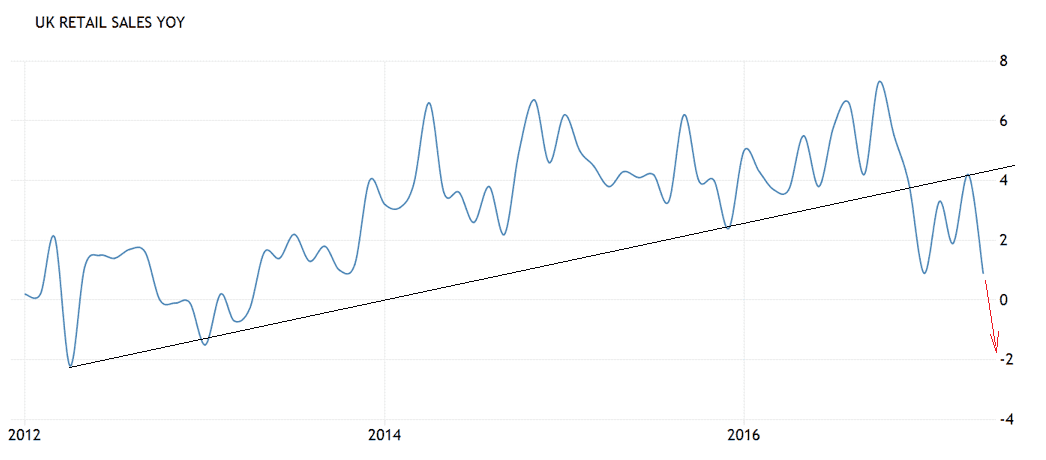

The picture below showing historical Retail Sales data shows a breakdown in the prior up-trend which gives the outlook a definite bearish hue.

The look and feel of the chart betokens a more negative print next Thursday than a more positive, which would also make more sense given the fall in real earnings.

BK Asset Management’s Kathy Lien, however, thinks there is a chance of a better-than-expected print:

“The smaller decline in shop prices and the uptick in the BRC retail sales monitor points to stronger numbers that should help rather than hurt the GBP/USD rally,”

Whilst this fits with the bullish technical outlook we, nevertheless, retain a negative bias.

Data for the Dollar

Politics may be a significant driver for the Dollar in the week ahead.

A new health care bill proposed by Republicans to replace Medicare could be voted on as soon as next week.

The problem is that a number of Republican senators have expressed reservations about the bill which they think is too tough and will result in millions of Americans losing free access to healthcare, so its passage is likely to be fraught with complications.

Trump has made it clear that the expected tax reforms cannot be implemented until the bill has been passed and savings have been made on healthcare. Tax reforms – or rather cuts – were one plank of Trump’s promised fiscal stimulus reforms which so supported the Dollar previously.

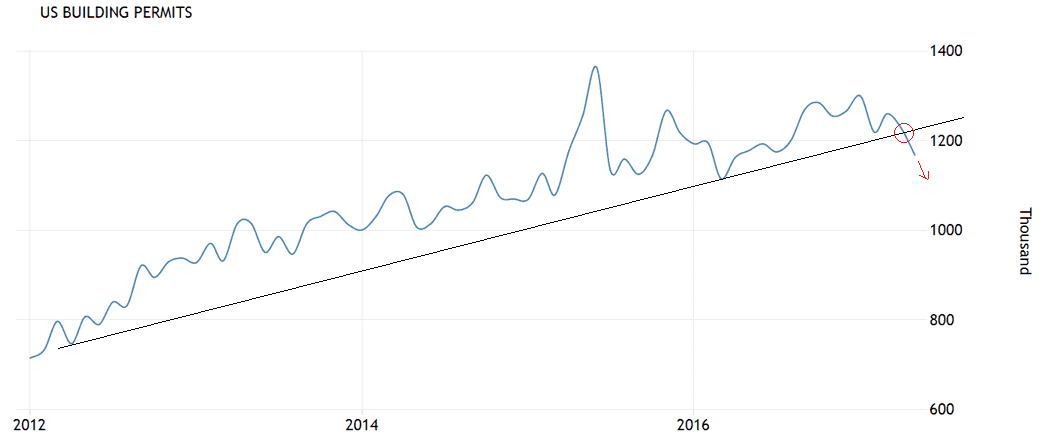

Housing Declines

On the hard data front, housing, comes front and centre in the week ahead.

Housing is key because it is often said to ‘lead the economy’, thus it can be an early warning of either a slowdown or growth.

Both Housing Starts and Building Permits data (June) are released at 13.30 BST on Wednesday, July 19.

Markets are expecting housing stats to bounce back after declining substantially last month, however, looking at the historical charts of the two releases we are sceptical.

Both show the data sets starting to decline and reverse their uptrends.

Both also show breaks below key trendlines for the data which are extremely bearish indicators for future results.

Given Housing leads the economy, a decline is not a positive forward indicator for US growth.