Pound / Dollar: Hot UK Inflation Beats the Drum for Further Rate Hikes

- Written by: Gary Howes

- UK inflation at new 30 year high

- BoE rate hike expectations increase again

- Aiding GBP exchange rates higher

- But GBP at risk if rate hike expectations retreat

Image © Adobe Images

Hotter than expected inflation figures means the Bank of England will have little choice but to pursue further interest rate hikes, which could keep Pound Sterling supported in the near-term.

The Pound to Dollar exchange rate rose to a high at 1.3298 on the day UK CPI inflation was reported to have risen 6.2% year-on-year in February, which was more than the 5.9% increase markets were expecting and a significant increase on the 5.5% reported in January.

Inflation rose 0.8% month-on-month in February according to the ONS, beating expectations for a 0.6% rise and hotter than the -0.1% reading of January.

But gains for GBP/USD were unwound somewhat as the Dollar recovered ground against all major currencies amidst a softer tone to global stock markets, suggesting broader trends in investor sentiment continue to dominate FX price action.

But inflation data suggests the UK currency can continue to rely on expectations for higher interest rates for support: core inflation - which aims to strip out external inflationary forces - rose 5.2% in February, ahead of the 5.0% expected by markets and January's 4.4% reading.

"Prices rose steeply in February as prices increased for a range of goods and services, for products as diverse as food to toys and games," says Grant Fitzner, Chief Economist at the ONS.

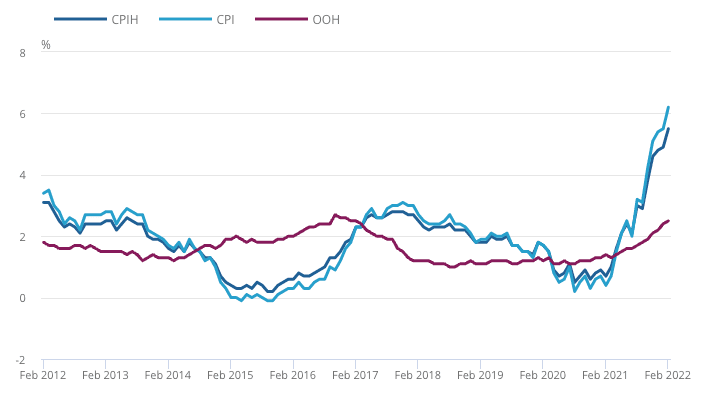

Above: The annual inflation rate is the highest since March 1992. Source: Office for National Statistics – Consumer price inflation.

- Reference rates at publication:

GBP/USD spot: 1.3263 - High street bank rates (indicative band): 1.2799-1.2892

- Payment specialist rates (indicative band): 1.3144-1.3177

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

"Markets and developed economies are continuing to digest soaring inflation alongside the uncertainty surrounding Russia’s war on Ukraine. Mapping to prior events has been a common discipline, but the truth is that no investors have lived through these exact circumstances. Given this delicate market environment, investors will need to watch the data and markets closely and allocate accordingly. Diversification, active management and prudence will be key," says Paul Craig, portfolio manager at Quilter Investors.

The figures are consistent with expectations for further interest rate hikes at the Bank of England in coming months, which offers a mechanical boost to Sterling.

The Pound to Dollar exchange rate was seen higher at 1.3270 in the wake of the data release.

Markets have this week raised expectations for the number of Bank of England rate hikes that are likely to fall in 2022, boosting the value of the British Pound in the process.

On Monday money markets showed investors to be anticipating 111 points of rate hikes from the Bank of England in 2022, this shot up to 130 as of Tuesday and by Wednesday it was at 138.

Accordingly, the Pound rallied against the Dollar, Euro and the majority of G10 currencies, confirming the importance to rate hike expectations for the currency.

If this trend can continue the Pound can go higher, but the obvious risk for Sterling 'bulls' at this juncture is that expectations are pared back.

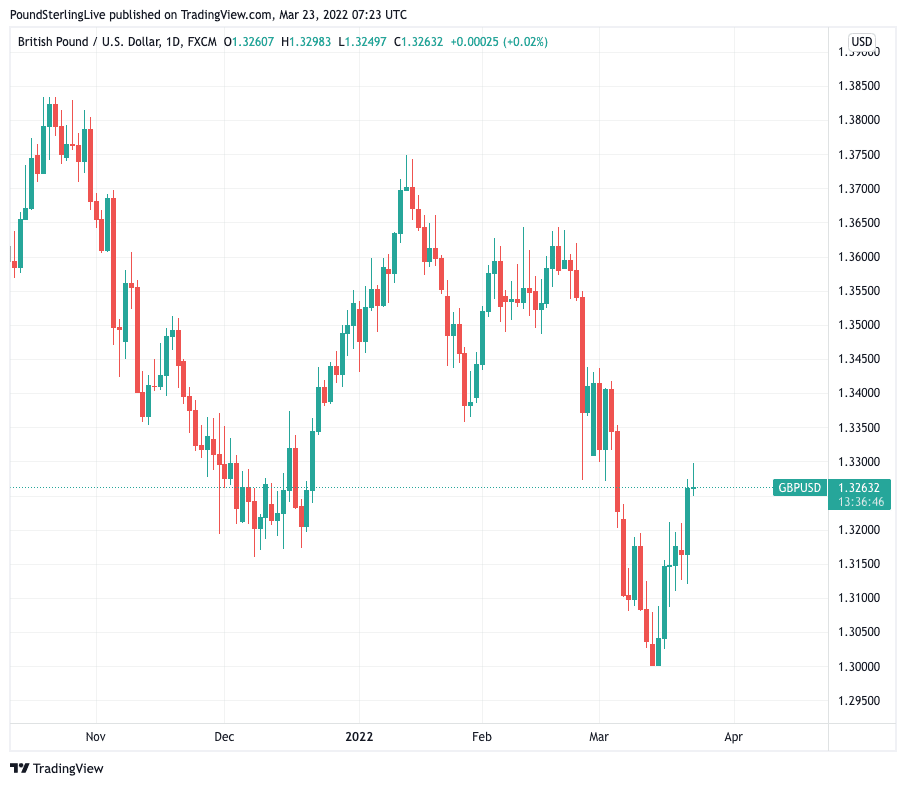

Above: GBP/USD at daily intervals, showing Sterling is recovering near-term, but medium-term is under pressure.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Economists warn that inflationary pressures are only likely to rise further, adding more pressure on the Bank of England to raise rates.

"Last week the Bank of England hiked interest rates for a third time up to 0.75% to battle soaring inflation, which it now expects to hit 8% later this spring. Many are already feeling the squeeze financially, yet there is no doubt much worse to come considering we are facing a major cost-of-living crisis alongside other fiscal pressures," says Craig.

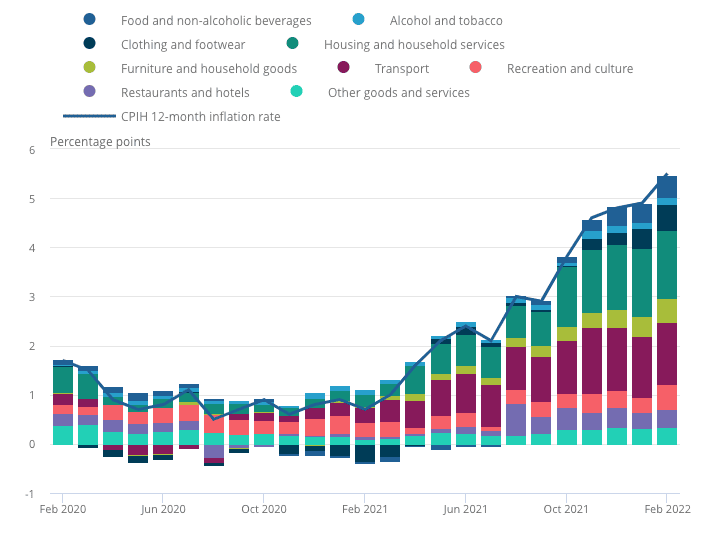

Paul Dales, Chief UK Economist at Capital Economics points out a lot of the rise was due to unfavourable base effects as the Covid-19 lockdown in early 2021 meant that price changes were soft a year ago.

He says the increases in clothing inflation from 6.3% to 8.9% was at least partly due to subdued price changes a year ago rather than unusually big increases this February.

By the same token furniture inflation rose 8.4% to 9.1% and recreation/culture inflation from 2.9% to 4.9%.

But Capital Economics identifies "genuine price rises" in February which took food and drink price increases from 4.3% to 5.1%, "and we suspect it will soon climb above 6%".

Heaping pressure on consumers will be the largest jump in fuel prices on record which are to fall in March.

"The recent rise in the average petrol price to a new record high of £1.78 per litre will mean that fuel prices will jump by 12% m/m in March. That would be the largest increase on record and would add 0.3ppts to CPI inflation," says Dales.

Furthermore, the 54% rise in utility prices on April 01 will add an extra 1.4 points to CPI inflation adds Dales.

Above: Comtributions to inflation, ONS.

Capital Economics looks for CPI inflation to peak at 8.3% in April, but risks to this figure are to the upside.

Analysis from independent research providers Pantheon Macroeconomics finds surging inflation will mean the UK economic recovery is likely to slow sharply as households feel the pinch.

Furthermore, they anticipate domestically generated inflation to remain relatively limited which should allow the Bank of England to step back from raising interest rates.

"We expect the Committee to pause raising Bank Rate, once it has increase it to 1.00% in May," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

"Further rate hikes would increase the risk of a recession and the chances that CPI inflation ultimately would significantly undershoot the 2% target in the medium term," he adds.

With as many as 138 points of rate hikes priced into 2022 by the market there is obvious scope for disappointment if the Bank does indeed halt raising rates.

This would offer a mechanical headwind to Sterling exchange rates and potentially press the Pound-Dollar exchange rate towards 1.30 and even below.

"We think it will be tough for the GBP to gain ground against the USD while a re-pricing of hike expectations weighs on it. Smaller than expected damage from the war in Ukraine may be GBP positive but even prior to the war the BoE seemed unlikely to meet lofty market expectations," says FX strategist Shaun Osborne at Scotiabank.