Pound / Dollar Week Ahead Forecast: Steadying Near 1.3550 as Fed Decision Eyed

- Written by: James Skinner

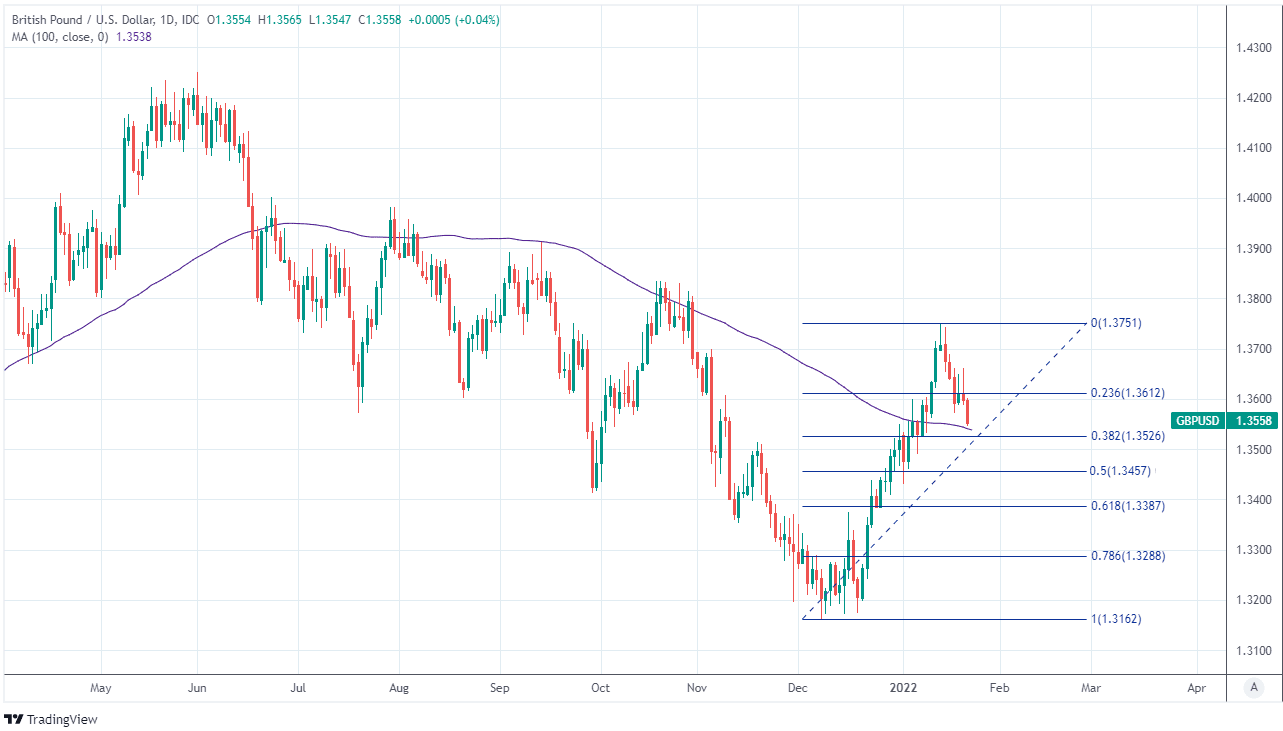

- GBP/USD looking to stabilise near 1.3550

- Well supported between 1.3526 - 1.3538

- Market volatility, strong USD risks to GBP

- Fed decision & PCE price update in focus

Image © Adobe Images

The Pound to Dollar rate was dealt a setback last week as the U.S. currency found its feet in volatile trading for risk assets, although Sterling remains well-supported above the nearby 1.35 handle and may even attempt to recover its own footing ahead of this week’s Federal Reserve (Fed) decision.

Pound Sterling was already in retreat from a rallying greenback last week when a poor December retail sales report pushed the Pound to Dollar rate back beneath 1.36 on Friday and almost as far as the 100-day moving-average at 1.3538.

“While the move to the low 1.36s/high 1.35s reflected in part a correction of its overbought status, the drive under 1.36 to the mid-1.35s at writing has taken the wind out of the GBP’s sails. Below this area, the 100-day MA at 1.3543 and the 38.2% Fib retracement of the Dec-Jan move at 1.3525 stand as supports,” says Juan Manuel Herrera, a strategist at Scotiabank.

“We expect the GBP to recover from its current slump toward the 1.38 level as additional BoE hikes come in, but the current risk setting looks set to prevent GBP upside for now,” Herrera and colleagues said in a Friday market commentary.

The Pound-Dollar rate’s setback came as a further surge in U.S. and global bond yields appeared to exacerbate widespread declines for stock markets, helping Dollar exchange rates to recover from prior losses in what was sometimes volatile trading.

Above: GBP/USD rate shown at daily intervals with 100-day moving-average and Fibonacci retracements of December rally indicating likely areas of technical support for Sterling.

- GBP/USD reference rates at publication:

Spot: 1.3537 - High street bank rates (indicative band): 1.3163-1.3258

- Payment specialist rates (indicative band): 1.3415-1.3470

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

“Recent market volatility may have dampened what otherwise should have been a great week for sterling. With unemployment falling to 4.1%, core CPI climbing to 4.2%, and Plan B restrictions set to be removed by the end of the month, little doubt remains about the prospect of another Bank of England hike in two weeks,” says Thomas Flury, an FX strategist at UBS Global Wealth Management.

“If a hike materialises, it should provide further upside to sterling —particularly against the euro and the Swiss franc—as long as risk sentiment does not spoil the party. Flash PMIs will be the main release for the UK next week, but with restrictions easing soon, any signal they may offer is likely to be discounted by investors,” Flury and colleagues wrote in a Friday research briefing.

While recent international market volatility could continue, posing a risk to Sterling in the process, the Pound to Dollar exchange rate’s losses could potentially be cushioned by the market’s perception that the Bank of England (BoE) is now highly likely to raise interest rates again next Thursday.

Last week’s revelation that inflation rose to 5.4% in December keeps alive the prospect of additional Sterling-supportive increases in Bank Rate this year.

Although with the UK economic calendar relatively quiet this week and another policy update set to come from the Federal Reserve on Wednesday, it may be U.S. monetary policy and market appetite for the greenback that exerts the greater sway on the Pound-Dollar rate this week.

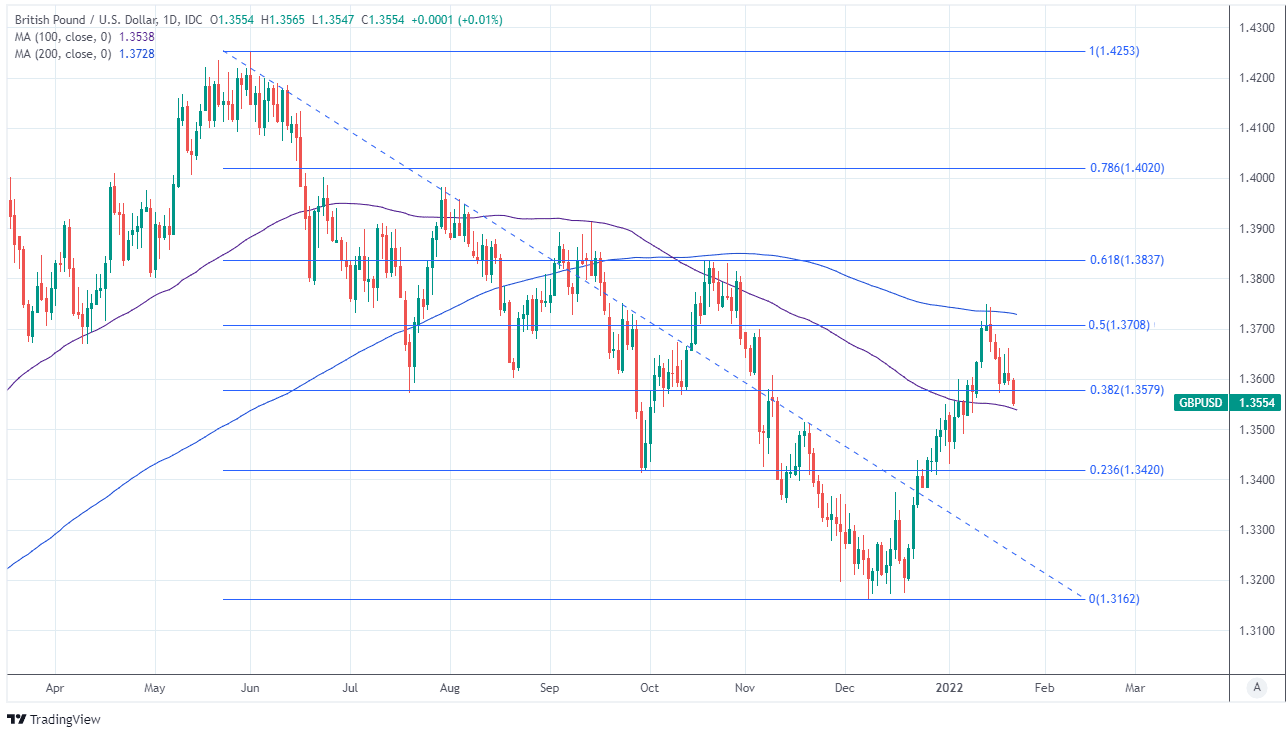

Above: GBP/USD shown at daily intervals with 100-day moving-average and Fibonacci retracements of June 2021 corrective decline indicating likely areas of technical resistance to any recovery by Sterling.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“Our team expects the Fed to announce the end of QE prematurely and signal a readiness to hike in March. Given that four hikes are already priced this year, the focus on the Fed balance sheet could see the pricing of the Fed terminal rate stall/marginally reverse and be mildly dollar negative,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

Wednesday’s Fed decision is the highlight of the week ahead and marks the bank’s first opportunity to address the December acceleration of inflation to a fresh multi-decade high of 7%, which some strategists see raising the risk of a decision by the Fed to further accelerate the winding down of a once $120BN per month quantitative easing programme ahead of a widely anticipated increase in the Fed Funds rate in March.

“Additionally, next week sees a heavy slate of US tech, financial and industrial 4Q earnings – leaving US equities in a vulnerable position as bond yields rise too. In terms of data, we’ll get our first look at 4Q21 US GDP data – expected near 5% QoQ annualised after soft December figures. More important will be the 4Q Employment Cost Index on Friday,” Turner and colleagues said on Friday.

Once beyond the Fed decision and Thursday’s initial estimate of final quarter U.S. GDP data market attention could turn quickly to Friday’s release of the Personal Consumption Expenditures price index for December, which is the Fed’s preferred gauge of inflation and was already at 5.7% in November.

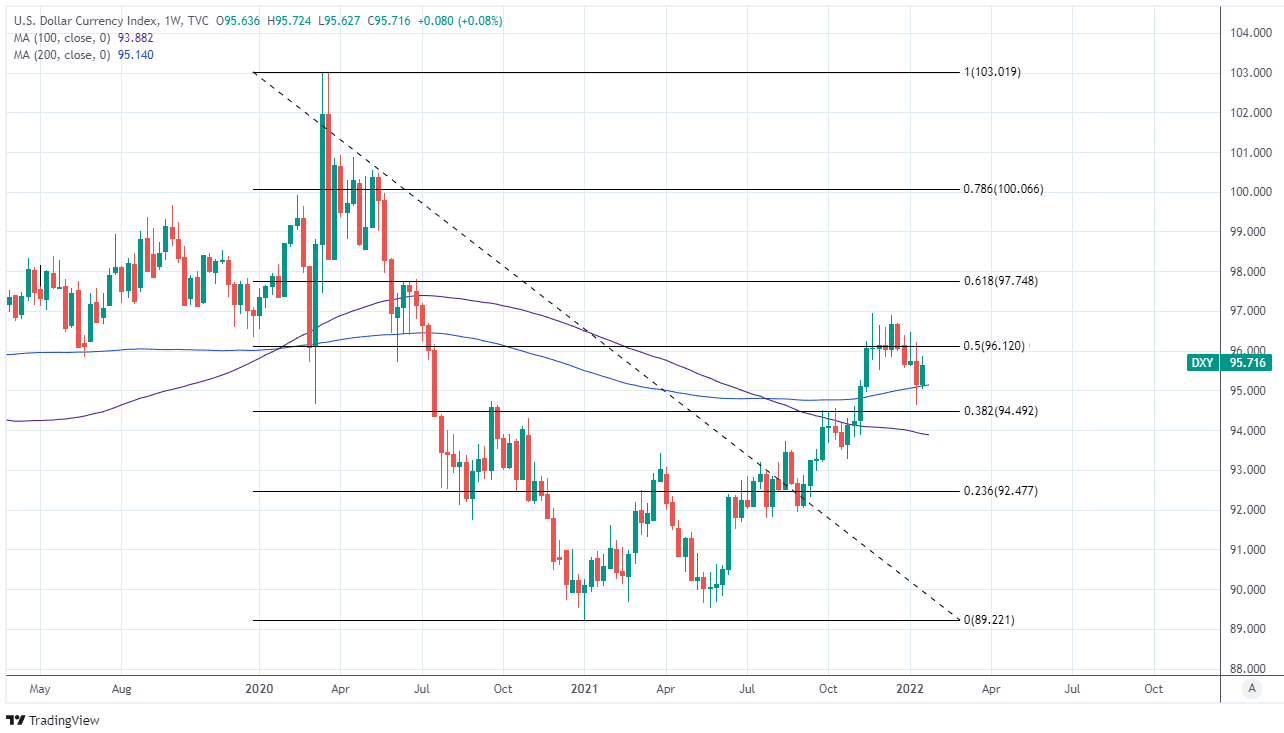

“The FOMC next week will likely be another important step to tightening commencing, probably in March. But the hurdle for a market reaction is high given recent moves in rates. The dollar therefore will likely be influenced more by equity market volatility,” says Lee Hardman, an analyst at MUFG.

Above: U.S. Dollar Index shown at weekly intervals.