Dollar Shows Contempt for Doubters after PMI Data Lifts Yields

- Written by: Gary Howes

- New highs for U.S. PMIs lift USD into weekend.

- USD index rises from lows, aided by EUR/USD.

- EUR falls after ECB says is watching EZ yields.

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.4154

- Bank transfers (indicative guide): 1.3753-1.3850

- Money transfer specialist rates (indicative): 1.3916-1.4050

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Dollar was set to end the week in contemptuous defiance of its doubters on Friday as exchange rates rose alongside U.S. government bond yields following a volley of economic surprises and some late-in-the-day declines for European currencies.

Dollars were bought and most other currencies sold ahead of the weekend, leading to intraday gains for the greenback over all except the Canadian Dollar and a handful of emerging market currencies including the South African Rand.

Gains broadened and built further after IHS Markit said its purchasing managers’ index for the U.S. services sector had risen from an upwardly-revised 64.7 in April to a record high of 70.1 in May as more of the economy reopened, leading activity and output from the sector to soar.

Meanwhile, the equivalent survey of the U.S. manufacturing sector also advanced to a new record high of 61.5 in May from 60.5 the prior month, with both lending weight to the view that the world’s largest economy likely shifted into a higher gear this quarter.

"The latest flash PMIs reinforce our view that the economy will continue to grow at a faster pace in the US than in the euro-zone in the next few years. This feeds into our forecast that long-dated yields will rise more rapidly in the former than in the latter and that the euro will fall back against the US dollar," says Simona Gambarini at Capital Economics.

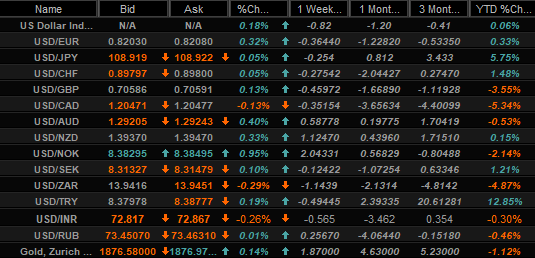

Above: U.S. Dollar exchange rate quotes and performances over various time frames. Source: Netdania Markets.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

A strengthening U.S. recovery is ultimately a boon for economies elsewhere in the world also as well as their currencies, although on Friday and in the immediate aftermath of the release American government bond yields rose and appeared to incentivise yet another flash-in-the-pan bid for the Dollar.

“The narrative that housing is booming just won’t die, even though sales peaked back in October last year and applications for mortgages to finance house purchase dropped by 19% between January and April. Sales are following mortgage applications in the usual way,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

The bond market and U.S. Dollar’s suitors overlooked on Friday other data from the National Association of Realtors which showed sales falling from 6.01 million units in March to 5.85 million in April, reflecting a tentative reversal of earlier strength in the housing market.

Pantheon’s Shepherdson says U.S. home sales are likely to fall further and to as low as around 5.2 million in the coming months, citing mortgage application data which has a positive correlation with the overall trend in sales but is a leading indicator of the latter.

Above: U.S. Dollar Index shown at 15-minute intervals alongside 10-year bond yield.

“We continue to expect the USD to remain soft while US yields remain contained and note that while the DXY is holding close to the late February low on the day, a close here for the index on the week would be the lowest for the DXY since early 2018,” says Shaun Osborne, chief FX strategist at Scotiabank.

The Dollar was stronger on a widespread basis ahead of the weekend although also against the European single currency, most notably, with a -0.29% decline there playing a leading role in lifting the ICE Dollar Index off of what was close to its lowest level for more than three years.

Europe’s single currency, which accounts for 57% of the ICE Dollar index, had faltered some time before the U.S. data was out and around the time European Central Bank (ECB) President Christine Lagarde spoke in a press conference following a meeting of the Eurogroup.

“ECB President Lagarde came to shake things up a little. She struck a dovish tone, saying she spotted the latest yield increases and that the ECB is closely monitoring it,” says Mathias Van der Jeugt, head of research at KBC in Brussels.

Above: U.S. Dollar Index shown at daily intervals alongside Euro-Dollar rate.

In addition to noting recent increases in European bond yields, Lagarde said it remains too early to consider “medium to long term questions” in what was a possible reference to recent speculation in some parts suggesting the ECB might soon be minded to begin tapering its coronavirus-inspired quantitative easing programme.

The ECB’s Pandemic Emergency Purchase Programme buys European government bonds each week to keep pressure on yields and maintain favourable financing conditions for governments, with a total allocation of €1.85 trillion.

The ECB still buys €20bn per month under its original QE programme, which has neither a total allocation nor an implied end date, although analysts say the €1.85 trillion would expire around April or May 2022 if the bank maintains the recent pace of weekly purchases.

“Her comments caused a knee-jerk downleg in German yields, with the curve bull flattening 2 to 2.4 bps at the middle and long end. Long U.S. yields lose about 1 bp, EUR/USD slipped below 1.22 to 1.219,” KBC’s Van der Jeugt says in a note on Friday.

It’s a tapering off of purchases under the latter PEPP programme to a reduced weekly pace which parts of the analyst community have suggested could be announced in June.

Any such tapering would prolong the ECB’s extraordinary support for Eurozone economies and its enhanced presence in the bond market, but at the same time be viewed by the market as an expression of confidence in the Eurozone economy, which this week took tentative steps out of ‘lockdown’ in many parts.