Dollar Steadies Ahead of Fed Minutes but Writing Already On the Wall

- Written by: James Skinner

- USD up from near 2021 lows as stocks, bonds fall

- Market eyes Fed minutes for clues on QE tapering

- But USD susceptible to disappointment & fresh losses

- As Europe reopens, other central banks start to move

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.4154

- Bank transfers (indicative guide): 1.3759-1.3858

- Money transfer specialist rates (indicative): 1.3935-1.4055

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Dollar bounced on Wednesday, leading the Pound, Euro and other currencies to soften following strong gains earlier in the week and as investors looked ahead to the release of minutes from the April policy meeting of the Federal Reserve.

Dollars were bought back against all major counterparts in the mid-week session following days of declines that had lifted other currencies back toward multi-year highs while leaving the Dollar index within arm’s reach of multi-year lows last seen in January.

The Dollar had declined while other currencies rose earlier in the week when Europe took tentative steps to relax restrictions on activity and reopen supposedly non-essential parts of economies, although those moves were interrupted on Wednesday by renewed increases in U.S. government bond yields.

These may have been at least partly responsible for the declines seen in global stock markets, given that losses were steepest in North America where the yield rally was most observable and stock-bond correlations have been most positive of late, with all of the latest price action coming as investors and analysts eye the release of Federal Reserve (Fed) minutes at 19:00 London time.

“Analysts will dig around for hints that a rising number of Fed members are growing uncomfortable with the potential for inflation to continue rising to uncomfortable levels, or perhaps hints that the Fed’s purchases of Mortgage Backed Securities would be the first in line for a reduction in the rate of purchases, considering that the US housing market is on fire,” says Steen Jakobsen, chief investment officer at Saxo Bank.

Minutes are important for the greenback because some in the Dollar bullish corner of the market are looking for the Fed to begin tapering its $120bn per month quantitative easing programme as soon as year-end, and so may be sensitive to anything which suggests they’ve been mistaken.

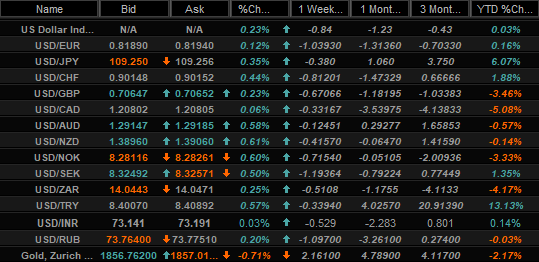

Above: U.S. Dollar quotes and performance over selected intervals. Source: Netdania Markets.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

For a tapering to happen in a manner consistent with guidance already given by the bank, a preemptive announcement would need to be made some months before and with only a handful of policy meetings left to go before then the Fed would have to begin indicating that such a thing is becoming likely relatively soon.

“The minutes are probably less relevant than usual given that the meeting pre-dated the surprising employment and inflation data releases for last month. But we will be looking out for any signs that Fed officials were already starting to worry about the prospect of higher inflation,” says Andrew Hunter at Capital Economics.

The Fed has said previously that it would notify the market “well in advance” of any decision to actually begin the process, so for any tapering to occur at year-end this notice might need to be given sometime around September, which isn’t all that far off.

Including the meeting taking place between September 21 and 22, there’s a total of three policy decisions to come from the Fed between now and then, although the bank has said as recently as April that it wants to see “substantial progress” toward its full employment and average-inflation objectives before this happens.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

"We think the minutes will keep the guidance on QE vague and dovish - the recovery has progressed 'more quickly than generally expected' but the economy is a 'long way' from the Fed’s goals, and it will take 'some time' for 'substantial further progress' to be achieved," says Kevin Cummins, chief U.S. economist at Natwest Markets.

There probably isn’t much chance of the Fed indulging the market at any point soon, although this doesn’t mean that some in the market aren’t hoping it might or that investors won’t be going through minutes of the April meeting with fine toothed comb this Wednesday, with potential implications for the Pound and Euro.

They likely will be, and the Dollar’s widespread corrective bounce ahead of the event is testament of the uncertainty that exists around the subject of Fed policy, and the apprehension felt by some investors whenever it resurfaces to the top of the agenda.

“We expect EUR and GBP will take their direction from USD’s reaction to the FOMC minutes, with local data calendars light over the next 24 hours,” says Kim Mundy, a strategist at Commonwealth Bank of Australia.

“Some other central banks are discussing tapering, or have begun to taper asset purchases. This divergence can weigh on USD,” adds Mundy.

Above: Pound-Dollar rate shown at daily intervals alongside U.S. Dollar Index.

Not all see an eventual decision by the Fed to begin winding down its crisis-inspired policy programmes as a Dollar-positive development however, and have instead flagged events at other central banks as posing a challenge to the greenback.

This is in part because since the summer of 2020 the Fed’s approach to interest rates and quantitative easing tools used to attain its inflation target has been different to in the past, and also different to other central banks including the Bank of England (BoE) and European Central Bank (ECB).

“By the end of Q3 we should know what a Fed taper will look like. This does not have to be a hawkish event; a wind-down of purchases lasting through next year will constitute an explicit form of calendar guidance that helps keep front-end yields under control,” says George Saravelos, global head of FX research at Deutsche Bank.

“The shape of the US yield curve continues to point to a weaker dollar,” says Saravelos.

Since summer 2020 the Fed has been working to an average inflation targeting strategy where it seeks to compensate for past periods in which price growth has been below its 2% target with a period of time where inflation is allowed to rise above the target without drawing interest rate rises.

Above: Euro-Dollar rate shown at daily intervals alongside U.S. Dollar Index.

The Fed’s policy bent is now such that there’s a genuine possibility if-not probability the ECB could end up tapering its Pandemic Emergency Purchase Programme before the Fed actually lifts a finger, which would have been unthinkable just a short time ago.

“The ECB policy meeting on 10th June will be important in setting out QE plans beyond Q2. A decision by the ECB to step back from the “significantly higher pace” of QE purchases in Q2 would help to lift the euro further,” says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

The ECB was already barely matching the Fed each month with its bond purchases even after announcing a “significantly higher” weekly pace of purchases for the second quarter, although there's been speculation of late that it could announce such a reduction in June.

This would be more than just a symbolic boost for the Euro, given the impact it could have on government bond yields across the continent, though notably in Germany.

“In contrast to treasuries the euro has shown greater sensitivity to movements in European yields. There is a strong non-linearity in the relationship between FX and interest rate differentials with the EUR turning very responsive to bund yields when they cross zero,” Deutsche Bank’s Saravelos says.

“Positive bund yields and a potential ECB taper provide asymmetric risks for the euro and will further highlight monetary policy divergence compared to a delayed Fed taper,” says Saravelos.