South African Rand: Reasons for Hope

- Written by: Gary Howes

- ZAR rebounds

- Unrest eases, but lingering risks seen

- Ramaphosa could consolidate power

- Although global picture now less supportive

Above: File image of Jacob Zuma © GCIS, Government of South Africa.

- GBP/ZAR reference rates at publication:

- Spot: 19.86

- Bank transfer rates (indicative guide): 19.16-19.30

- Transfer specialist rates (indicative): 19.68-19.72

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The South African Rand has recovered sharply over recent days as it shed that domestic risk premium built up last week amidst the civil disorder that swept much of the country.

Investors have proven eager to look through the near-term noise surrounding the currency and instead focus on any potential positive outcomes that might arise from a week that shook global investor confidence in the South African economy's future.

John Meyer, Head of Research at SP Angel, the adviser and broker, says the military clampdown on widespread violence and the resultant political restructuring will likely lead to a new order in South Africa.

"We feel the widespread violence in South Africa must surely lead to a new and better political order in South Africa," says Meyer.

The Rand fell sharply after it became clear last week that widespread looting and disruption would not just impact short-term economic activity, but also potentially South Africa's overall attraction to investors.

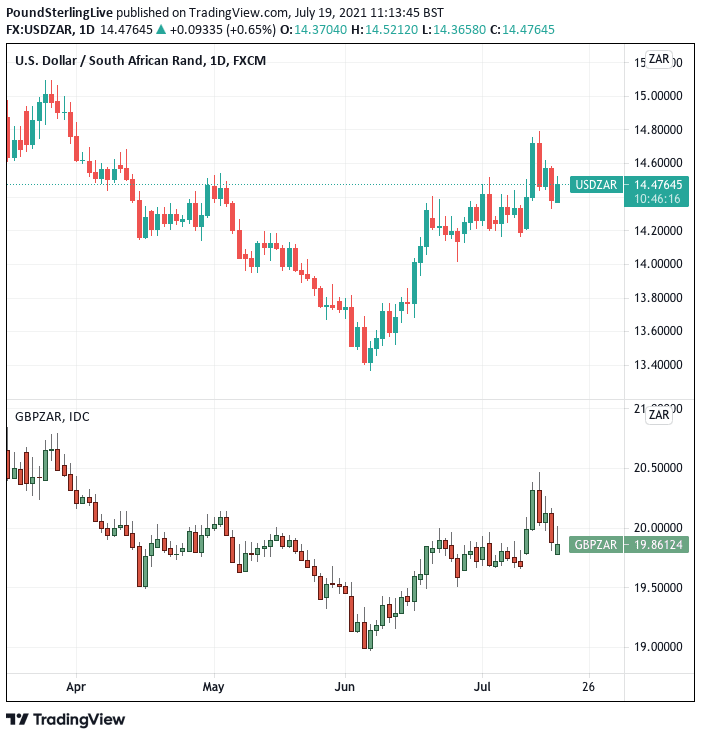

The Pound-to-Rand exchange rate spiked to 20.46 amidst the deterioration in investor sentiment towards the currency, but has since pared those gains to 19.86.

Bargain hunting was also evident in the headline Dollar-to-Rand exchange rate which went as high as 14.78 last week before fading back to 14.46 where it is found at the time of writing.

Although some calm has been restored, South Africans remain nervous that the civil disorder that marred the country last week makes a comeback, particularly given the appearance of ex-President Jacob Zuma in court on July 19.

Local news outlets report that messages circulating on WhatsApp and social media are advocating for further mayhem this week, particularly in the KwaZulu-Natal province which has born the brunt of the chaos.

However, with authorities alert to the threats it remains to be seen just how disruptive any fresh attempts to stoke disorder are.

"In the short run, the imprisonment of former president Zuma is likely to imply headline risk as well as real economic risk. Pro-Zuma protests may linger and become wide-spread enough to hurt retail sales and consumer confidence in a lasting manner," says Nimrod Mevorach, an analyst with Credit Suisse.

But, over the longer-term Credit Suisse are optimistic that the domestic situation could ultimately evolve into one that is more supportive of the Rand going forward.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Over the longer-run, this development is likely to help president Ramaphosa consolidate his power within the ANC party. Therefore, it improves the chances for market-friendly reforms in the future," says Mevorach.

The ascension of Ramaphosa to the Presidency was seen to be a market-friendly outcome as investors betting that he would bring about the required reforms to put the economy back onto a more stable footing.

However, internal politics within the ANZ have meant these reforms have been slow to take root as the President navigates various factions.

Ramaphosa could yet use the recent disruption to stamp his authority on the party and proceed with a more business-friendly and pro-growth agenda.

SP Angel's Meyer says if President Ramaphosa is able to clean up corruption in the ANC and restore confidence then South Africa may, once again, become a great nation.

"If not, then we fear South Africa may need to suffer a state of emergency and effective military rule for longer," he adds.

But for foreign exchange analysts at Credit Suisse, the return to calm on the civil front means the market will start trading the Rand according to more familiar themes.

Notably, global risk sentiment and Dollar movements.

The Rand was softer at the start of the new week amidst a global stock market and commodity sell-off, driven by concerns that the spreading Delta variant of Covid-19 would negatively impact the economic recovery.

This puts Emerging Market assets like the Rand on the backfoot.

"Markets seem to be grappling with the fear that the virus isn’t going away despite widespread vaccinations in the major economies. New and more resilient mutations might be a perpetual phenomenon that wreaks havoc, especially in developing countries, ultimately keeping a lid on the recovery," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

The Dollar is meanwhile advancing in this environment, on account of its traditional safe-haven status.

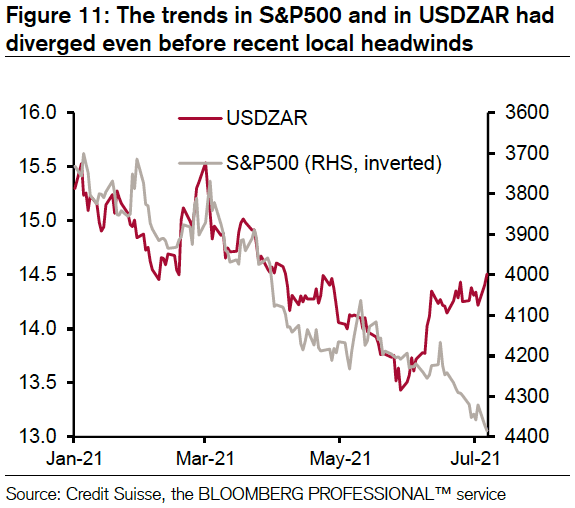

"Our view is that the direction of the USD against the rest of the global currency complex matters more for USDZAR than local developments at this point," says Mevorach.

Credit Suisse have said in a regular currency briefing out last week that they are lowering their Rand forecast targets.

For the USD/ZAR they now target a range of between 14.40 and 14.95, this is down from a previously held forecast range of between 13.60 and 14.40.

"The global landscape has changed into one in which investors are not rushing to sell the USD against EM currencies as they did in Q2," says Mevorach.

Furthermore there could yet be some persistent weakness ahead, linked to the developments seen over the past week in South Africa.

The violence and chaos triggered a breakdown in the Rand that ultimately meant the 14.40 area in USD/ZAR – which was the top-end of Credit Suisse's previous range – was breached in a sustainable way.

"By contrast, earlier in July, investors showed appetite to sell USDZAR when this level was breached. This suggest that our previous target range is too optimistic and that the 14.40 level might serve as a short-term support if current protests subside," says Mevorach.