Pound / Indian Ruppee Rate Prone to Sizeable Breakout

© DragonImages, Adobe Stock

GBP/INR is showing a heightened potential for increased volatility in the week ahead both from chart setups and major Indian data releases.

Patterns form on price charts with unerring repetitiveness and chart analysts use them to forecast future price movements - one fairly common pattern, is the triangle.

Triangles form when a sideways range narrows, as illustrated by the example which has formed on the daily chart of GBP/INR after it started going sideways at the start of February.

There are different varieties of triangles but the one on GBP/INR appears to be a symmetrical triangle.

Symmetrical triangles have a roughly equal chance of breaking out in either direction, although some analysts assign a bias to the direction of the established trend, which in this case would suggest an upside bent.

The chart below is an example of a typical symmetrical triangle in an uptrend on XAU/USD which also shows how the height of the triangle ('H') is used as a tool by technical analysts to forecast the likely reach of the subsequent breakout.

(Image courtesy of IFC Markets)

In the case of GBP/INR we are a little less bullish simply becuase there is a major resistance level in the way of the breakout in the form of a major trendline drawn from the 2015 highs which runs flush with the upper border line of the triangle.

Large trendlines often act as barriers against the price because they attract short-term technical sellers seeking to profit from the expected pull-back, which has the effect of actually increasing supply around the trendline and increasing the chances of a pull-back.

It is not just the trendline which lies in the way of further upside growth but also the historic 2015 lows at 91.00.

Major lows and highs are often areas of support and resistance on charts where trends can also encounter increased volatility.

The GBP/INR triangle has now probably completed the requisite five composite waves (labelled a-e) and is, therefore, ripe for a breakout.

We forecast a possible breakout in either direction but would want to see confirmation first.

In the case of an upside breakout we would want to see the exchange rate break above the 91.15 level, just above the February 26 highs, to forecast an extension to a target at 92.20, at the level of the 200-week moving average (MA).

In the case of a downside break we would first like to see a move below the March 1 lows at 89.50 before forecasting a continuation down to a target at 89.10, at the level of the 50-day MA.

Major moving averages act as obstacles to the trend, as they are zones of liquidity where a greater-than-average volume of buying and selling takes place. This is due to many investors - both institutional and private - using MAs to make investment decisions.

There is also greater trading from short-term technical traders who often use MAs as places to fade the dominant trend and profit from the surrounding volatility.

Data and Events to Watch for the Rupee

An important release for the Rupee this week is February inflation data which is out at 12.00 GMT today (Monday 12) and is forecast to ease to 4.8% from 5.07% previously.

Lower inflation is generally negative for a currency because it suggests the central bank will have to lower interest rates to stimulate spending, and lower interest rates attract less foreign capital inflows, which are drawn by the return on offer.

The balance of trade is also out at the same time and is expected to show a narrowing of the deficit in february to -14.3bn from -16.3 bn previously.

A narrower trade deficit is usually associated with a stronger local currency as it infers falling demand for foreign imports denominated in foreign currencies and increasing demand for exports and the host currency.

Industrial and Manufacturing Production are also released at 12.00 on Monday.

The current account balance for Q4 is released at 12.00 on Tuesday and is a broader balance of payments metric which can impact on the currency in the same way as the balance of trade (which is a subcomponent of the current account), although the impact is extremely variable.

The other significant release is that of wholesale price inflation on Wednesday at 12.00, which is an influencer of consumer price inflation.

Data and Events to Watch for the Pound

The main event for the Pound in the week ahead is probably the Chancellors’ Spring Statement, this is a new initiative brought in by Philip Hammond to provide an update on the economic and fiscal outlook.

No changes to the budget are expected and the statement is only scheduled to last 15-20mins, according to media reports, which is only a rump compared to the Autumn statement.

Budget's do not often move currencies so the Pound may not react, however, alongside the statement are revised forecasts from the Office of Budgetary Responsibility (OBR) which if substantially altered may impact on growth prospects and therefore Sterling.

The OBR has, on balance, been overly pessimistic in the past, generally undershooting with its forecasts and leading some commentators to expect it to revise up its forecasts on Tuesday.

"It is always difficult to predict other institutions’ forecasts. However in terms of the Spring Statement, we would expect the GDP growth projections to be a little more upbeat," says Ryan Djajasaputra, analyst at Investec.

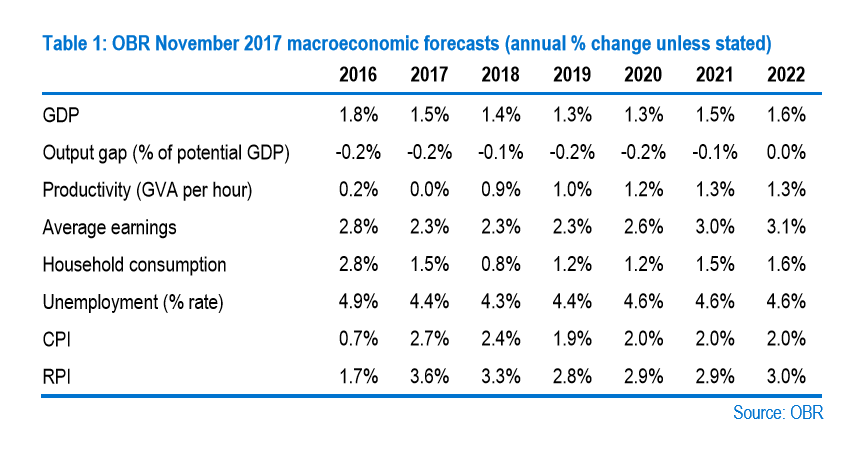

The OBR's most recent forecasts are contained in the table below.

For the sake of context, Investec's own house forecasts is for GDP growth of 1.7% in each year.

The other main event is the Bank of England's (BOE) Financial Policy Committee (FPC) meeting on Monday (statement published Friday 16) to discuss possible changes to capital buffers, introduced after the financial crisis under the Basel 3 regulatory framework.

The focus will be on whether the BOE reviews the size of the "Counter Cyclical Capital Buffer" (CCYB), a piece of regulation which guards against excessive bank-lending during upturns and excessive parsimony during downturns - thus the "counter-cyclical" sobriquet.

In November it was raised to 1%, with the FPC also indicating that it could be increased further in H1 2018 - so there is a possibility of a change at the meeting.

Again, this is unlikely to hit FX markets in any major way, and even if it does the impact may be difficult to gauge beforehand.

The CCYB impacts on the supply of credit, and therefore on inflation and growth, which in turn influence currency value, and it will probably form a part of the bigger picture that currency analysts consider in relation to their forecasts.

Generally increases in the supply of credit are seen as inflationary and likely to increase interest rates, which in turn leads to capital accumulation and a stronger currency.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.