British Pound in a "Rather Precarious Position" this June as it Loses Safe-Haven Appeal

- Written by: James Skinner

- Pound a sell say J.P. Morgan

- Losing a safe-haven allure in relation to Eurozone political flare-ups

- Fraught month ahead for the Pound

Image © SlayStorm, Adobe Stock

Pound Sterling is said to be "in a precarious position" this June by strategists at J.P. Morgan citing Brexit negotiations which are approaching another pivotal moment ensuring the UK currency has now lost its safe-haven allure.

UK government debt - also known as gilts - have over recent years provided a safe harbour to investors during times of uncertainty, particularly for Europeans during the Eurozone debt crisis years that pushed the single currency close to its deathbed. The demand for gilts from Europeans in turn pushes up demand for the Pound.

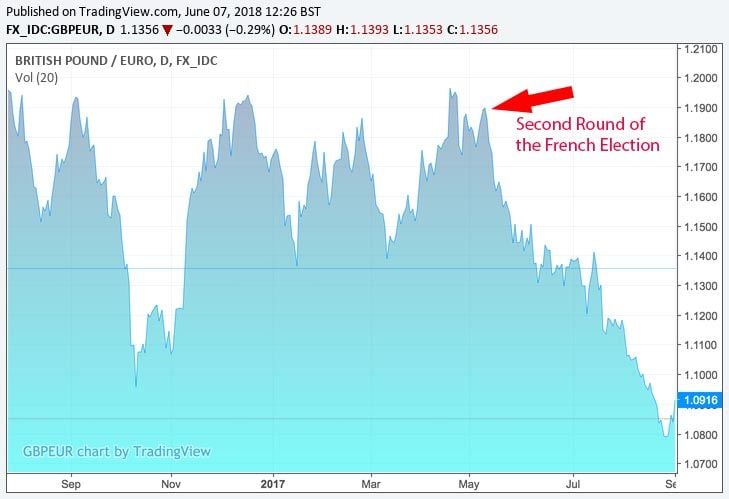

Safe-haven demand has even been noted in the post-Brexit vote era with the Pound-to-Euro exchange rate rising back up to 1.20 in the approach to elections in the Netherlands and France in 2017.

Above: Sterling showed a safe-haven characteristic in the run-up to event risk in the Eurozone in 2017, falling once the risks had passed. Does it still embody that safe-haven appeal?

However, price action during the recent Italian political crisis has left some strategists thinking the Pound may have lost its allure as a financial mooring during times of stress. And the UK's own developing political crisis has prompted the J.P. Morgan team to advocate that clients bet against the British currency.

“The rather precarious position of GBP is well illustrated by the collapse in the normally positive correlation between EUR/GBP and EUR/USD as the Euro first fell and the Italy crisis then broke. The realised correlation is virtually the most negative in the last 20 years, which surely demonstrates that GBP can’t be regarded as a EUR safe-haven for a post-Brexit world,” says Paul Meggyesi, vice president of currencies and commodities at J.P. Morgan.

The Euro-to-Dollar rate fell by close to 250 points between the final week of May and early June, as concerns over the new Italian government’s commitment to the Euro grew.

But the Euro-to-Pound exchange rate rate proved much more resilient after declining by less than 100 points, suggesting investors were much less willing to park funds under the wing of the Bank of England than they might have been just a few years or even months ago.

This price behaviour came ahead of a crucial month for the UK government and Pound Sterling, with Prime Minister Theresa May facing a series of votes in the House of Commons on Tuesday 12, June over whether to approve 15 “Brexit wrecking” amendments inserted into the EU Withdrawal Bill by the House of Lords.

“It is certainly possible that political turmoil in Europe may in some sense ameliorate the independent economic fall-out to the UK from Brexit and so warrant a smaller Brexit risk premium than the 15% or so that is currently priced,” says Meggyesi. “But the ongoing lack of clarity about what Brexit actually entails together with the intervening underperformance of the UK economy and confusion surrounding BoE policy will likely dissuade investors from wanting to own this.”

J.P Morgan’s Meggyesi says that, rather than attracting safe-haven flows due to renewed political uncertainty in Europe, the Pound is likely to face itself under increasing pressure against other so called safe havens in June because of the current UK political situation.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

If the PM loses the aforementioned votes the UK will be required by law to remain a member of the EU single market and customs union and the House of Commons will have the power to send government back to the negotiating table if MPs are not happy with the final arrangements negotiated by Theresa May.

Such an outcome could reduce the prospect of a so called hard Brexit, where the UK leaves the EU in March 2019 without any arrangements for future trade in place, but may also dramatically raise the prospect of a challenge to PM May’s leadership.

That latter consequence would heighten the risk of another general election being called and, according to some, raise the prospect of a Labour Party government which would also be a negative development for Pound Sterling.

And if the Prime Minister somehow wins the votes in the House of Commons then it will mean the UK remains on course to exit the EU and its institutions, including the single market and customs union. And it’s a potential exit from the single market and customs union that pushed Sterling into a double digit loss against the Euro after the 2016 referendum in the first place.

“The lack of any real progress in the Brexit talks since the March EU council is troubling, especially the lack of convergence between the UK and EU on how to deal with the Irish border, and this impasse will come into much sharper relief in the lead-up to the next EU council meeting on June 28-29. Politically this promises to be quite a fraught month for GBP,” Meggyesi writes, in a recent note to clients.

Failure to present a Northern Irish border solution that is agreeable to EU leaders at the end of June could mean trade talks are sidelined until the October summit that has always been seen as the final deadline for all agreements to be reached.

This would also heighten the risk of a so called hard Brexit because the final withdrawal deal, and anything agreed that covers the future relationship, will have to be ratified in all of the parliaments across the EU before the March 2019 Brexit date. That is a process that could take months and underlines the importance of resolving the key issues ahead of October.

“Despite partial evidence that UK growth may be creeping higher after coming to a near standstill in 1Q, we increase our overall GBP short through a new cash position in GBP/JPY as we suspect the coming month could prove politically quite fraught in the UK,” Meggyesi concludes.

Meggyesi and the J.P. Morgan team have recommended that clients bet on a fall in the Pound-to-Japanese-Yen exchange rate during the coming weeks. They advocate entering a “short” trade at or around 146.05, with a stop loss at 148.97.

This comes on top of another short trade from May 04 where the bank is betting against the Pound-to-Swiss-Franc exchange rate. The J.P. Morgan team entered the trade at 1.3519 and have since made a 2.58% profit. They have also lowered their “stop loss” to 1.3350, which will lock in some of their profit regardless of what happens during the weeks ahead.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.