Pound Sterling "Catchup" Could Extend against Euro and Dollar Following Bank of England says Analyst

- GBP goes higher following Bank of England event

- Gains can extend says TD Securities

- Short-term gilt yields rise above 0% once more

Above: File image of Bank of England Governor Andrew Bailey. Image © Pound Sterling Live, Still Courtesy of Bloomberg TV.

- GBP/EUR spot: 1.1085 | GBP/USD spot: 1.3126

- GBP/EUR bank rates: 1.0875 | GBP/USD bank rates: 1.2858

- GBP/EUR specialist rates: 1.1030 | GBP/USD specialist rates: 1.3000

Find out more about specialist rates here

The British Pound received a notable lift in the wake of the release of the Bank of England's statement on monetary policy, and further upside over coming days is possible according to a number of analysts we follow.

"The BoE’s more constructive tone could see sterling close some of its performance gap vs its G10 peers going forward. This could see GBP/USD catch up with some of its rivals while we also see tactical downside risks for EUR/GBP," says Jacqui Douglas, Chief European Macro Strategist at TD Securities.

The Pound rallied after the Bank of England's Monetary Policy Committee delivered an unanimous vote to keep interest rates unchanged at 0.1% and quantitative easing unchanged at £750BN: that no members of the committee vote to expand support came as the first pro-Sterling surprise for markets.

But there was certainly a glass half full stance on the economy in other areas too, with the Bank saying the downturn had not been as severe as was predicted back in May when they released their last set of economic forecasts.

Annual GDP growth for 2020 was upgraded to -9.5% from -14% in May, but the 2021 forecast was downgraded from +15% to +9%. The Bank therefore expects UK GDP to return to fourth quarter 2019 levels by the end of the year which is a more optimistic prediction than that held by economists at the UK's major financial institutions.

"We think the rosier tone that emerged from the Bank's forecasts may have allowed some differentiation to creep in at the margin. While we have serious doubts about the UK economy's ability to fulfil these lofty expectations, they appear to be giving Sterling a boost — at least for now," says Douglas.

The Pound-to-Euro exchange rate rose to a high of 1.1128, having opened the day at 1.1055 and the Pound-to-Dollar exchange rate rose to a high at 1.3185, having opened the day at 1.3124.

Above: The Pound rallied in the wake of the Bank's release of its monetary policy statement on the morning of August 06

"Looking forward, we see some scope for this tailwind to continue," says Douglas.

Markets have walked away from the August BoE event with the conclusion that another boost to quantitative easing before the year is out is not as likely as it once was, while an interest rate cut to 0% or below 0% is particularly unlikely before the year turns.

The net result of this new view was to raise the yield paid on short-term government bonds, which is significant in that the yields on 2-year bonds had actually fallen to below zero, and in doing so created a significant disincentive for international investors to buy them.

The importance to Sterling of international capital inflows driven by investors looking for yield cannot be over exaggerated, therefore any developments that lift bond yields will ultimately prove supportive of Sterling.

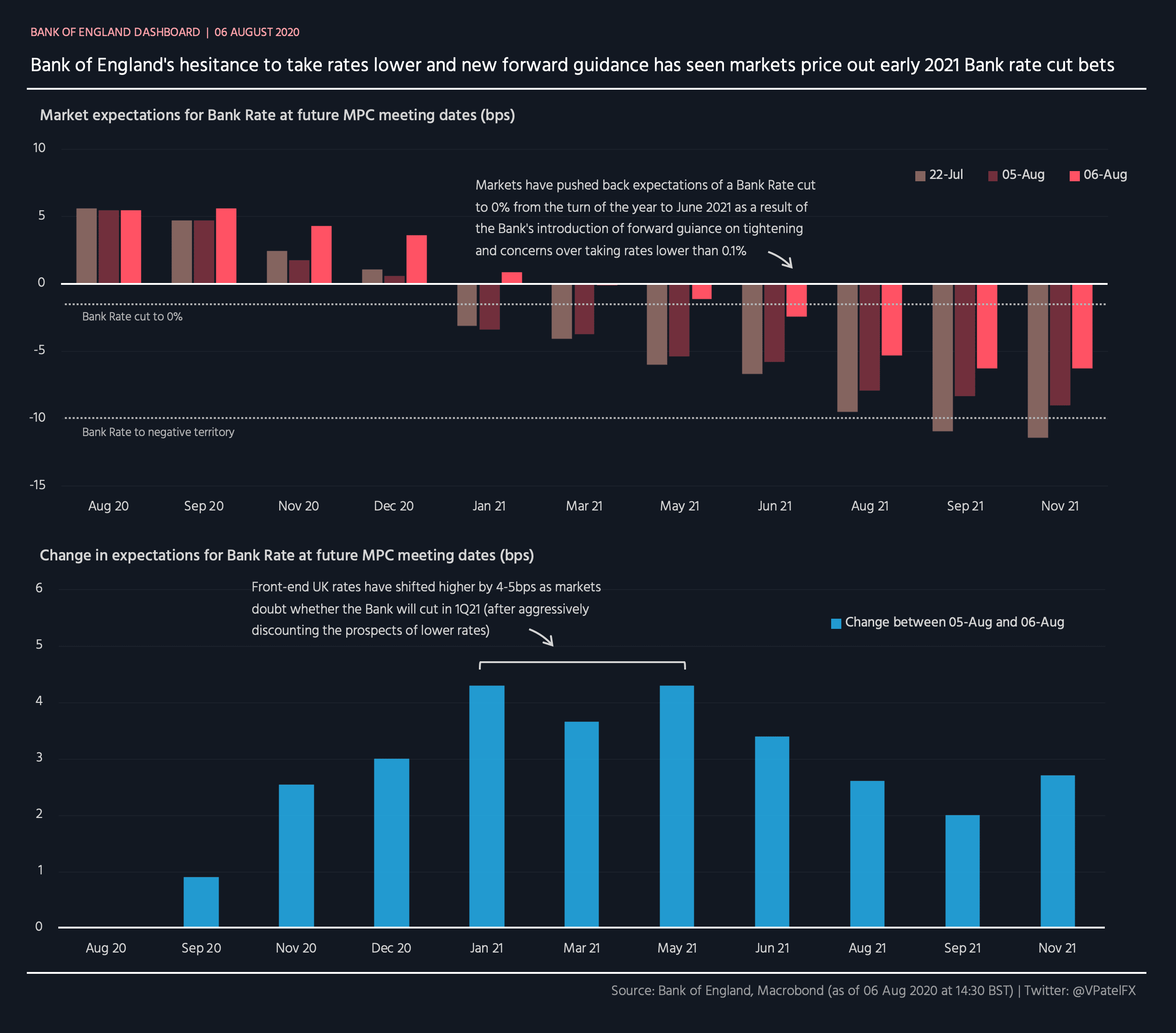

"Bank of England's resistance against negative rates & new tightening guidance has pushed expectations of Bank Rate cut back to summer 2021 (from turn of the year ahead of Aug meeting). Today's BoE comms perceived as a relatively hawkish tilt," says Viraj Patel, FX & Global Macro Strategist at Arkera.

"Hesitance to take rates lower has seen front-end of UK rates curve shift 4-5bps higher and out of negative territory. Bets for a 10bps rate cut in 2020 taken off the table," adds Patel.

There have been numerous factors behind Sterling exchange rate performance over recent months, namely: 1) Brexit trade negotiations, 2) Bank of England policy decisions, 3) Global market trends and 4) Covid-19 pandemic trends.

We note driver 4 to have faded in importance, while a broadly steady global equity market place has meant driver 3 remains supportive.

Factor 1 remains the big outstanding hurdle which will likely make itself increasingly felt in the autumn. Factor 2 - Bank of England policy - has after the August policy event has meanwhile gone from a headwind to a supportive backwind we fell, and it therefore leaves Sterling better supported over the short-term horizon.

"We think EURGBP could begin to trade with a more corrective tone over a tactical timeframe. With its upside from the recent EU recovery package now looking fully priced, we think the euro is looking a little stretched vs the rest of the G10 complex," says Douglas.

"Sterling climbed to five-month peaks after the Bank of England left monetary policy unchanged and dialed down its economic gloom," says Joe Manimbo, Senior Market Analyst at Western Union. "The bank striking a more optimistic tone can allow for further near-term gains for Sterling, keeping 2020 highs within reach."

A number of economists we follow do however retain a cautious stance on the economy, believing the Bank of England to be too optimistic on the outlook and as a result there will be a requirement to cut interest rates further and expand quantitaitve easing. Indeed, the Bank itself noted on Thursday that "the risks to the outlook for GDP are judged to be skewed to the downside”.

The Bank would only have to consider cutting rates or raising interest rates if incoming data between now and the November meeting disappoint, which tells us that the coming months should see foreign exchange markets place heightened attention on data releases and therefore Brexit trade negotiations won't be the only game in town for Sterling.

"Uncertainty on the course of the pandemic with its effects and on the post-Brexit trade agreement with the EU remain negative factors for the British economy in the next few months. Sterling is therefore at risk of depreciate in the event of disappointing data or negative news on the front of negotiations with the EU," says economist Asmara Jamaleh at Intessa Sanpaolo.

Samuel Tombs, Senior UK Economist at Pantheon Macroeconomics says the Bank will expand its quantitative easing programme by £50BN in November as data will disappoint and the labour market is looking particularly vulnerable to deterioration.

"We think this meeting likely will turn out to be a missed opportunity for the MPC to have done more to support the economy. Most households have seen little benefit yet from the Committee’s actions. While QE has contributed to the recoery in asset prices, mortgage rates have held steady, despite the 65bp decline in Bank Rate and the TFSME. The recovery in consumers’ spending could have been reinforced today by targeted action to get borrowing costs down, such as enhancing the TFSME. Ultimately, we expect the MPC to announce more QE in November—we’re pencilling in £50B of purchases over the following three months—and to make the TFSME more generous, in response to GDP growth falling short of its expectations in Q3," says Tombs.

Kallum Pickering, Senior Economist at Berenberg Bank says the Bank released "over optimistic" forecasts that were "verging on unrealistic".

"The BoE’s overly optimistic updated economic projections leave the door wide open for more monetary stimulus later this year," says Pickering. "Relative to the obvious challenges ahead linked to the COVID-19 pandemic, highlighted by the recent re-imposition of modest containment measures in major parts of the UK, the V-shaped recovery that the BoE continues to project seems unlikely, to put it mildly."

Berenberg expects the Bank to announce an additional £100BN in asset purchases for 2021 at the upcoming November Monetary Policy Report, although this could be delayed until early 2021.

The outlook for Sterling therefore looks to be positive in the near-term, i.e. over coming days and potentially the next couple of weeks, however this view could be challenged by disappointing data in September and October. Readers must also be aware that October really is the make or break month for EU-UK trade negotiators and we would expect Sterling to decline as market anxieties begin to rise once more as negotiators maintain an uncompromising tone until the final minute, which will be at a summit of EU leaders and Prime Minister Boris Johnson where the final deal will be agreed.