Pound Bucked by Rumours Ahead of Key EU Brexit Summit

Above: Merkel and May meeting in Berlin to discuss a possible Brexit extension for the UK. Image (C) Gov.UK, Number 10 Downing Street.

- EU to demand UK be powerless member during year-long Brexit extension

- Cross-party merely a useful facade for both Labour and Conservatives

- Sterling faces protracted period of limbo

- Pound-to-Euro exchange rate @ 1.1562 today

- Pound-to-Dollar exchange rate @ 1.3049 today

Pound Sterling betrayed the nerves of wary currency traders it oscillated between gains and losses on Tuesday as markets kept an eye on UK Prime Minister's whistle-stop tour to two of the European Union's most influential states aimed at trying and secure a Brexit extension that would prevent the UK leaving the EU without a deal on Friday, April 12.

May is using meetings with Germany's Angela Merkel and France's Emmanuel Macron to ensure any delay offered is not too short and is not subject to humiliating conditions.

For the British Pound, the key risk we feel over coming hours is that the delay granted by leaders is a short one that serves little purpose other than aiding a 'no deal' exit in coming weeks.

May met France's Emmanuel Macron late on Tuesday, in what was certainly the more important of the day's two scheduled events.

Reports out on Friday, April 05 suggested Macron would be happy to see the UK exit without a deal as a long Brexit extension was seen as being detrimental to Europe and plans for further European integration, of which he has taken the role of standard bearer.

However, faced with a united agreement amongst other European leaders to avoid a 'no deal' it appears Macron has reluctantly conceded the UK should be allowed more time.

Ahead of May's visit Macron did set out strict conditions for any delay.

An aide to French President Emmanuel Macron told Reuters a delay that lasted a full year would be too long.

"In the scenario of an extended delay, one year would seem too long for us," said the aide, adding if Britain did delay its exit, it should not take part in EU budget talks or in choosing the next president of the EU executive and the other 27 member states should be able to review its "sincere cooperation".

Rumours of German Concession on Irish Backstop Prompt Bout of Sterling Volatility

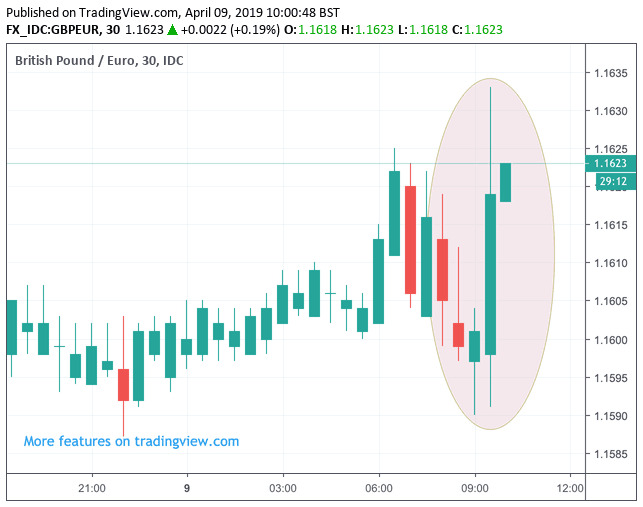

The British Pound saw a spike in volatility mid-morning as traders responded to rumours that Germany's Angela Merkel might look at offering the UK a time-limit on the Northern Irish backstop clause contained in the Brexit Withdrawal Agreement.

There was a notable pop in Sterling on reports of what would almost certainly be the one move the EU could make to finally end the Brexit impasse. The Irish backstop clause is widely-held to be the most significant single sticking point in the Withdrawal Agreement holding back its ratification in the EU parliament. Adding a timelimit to the clause would almost certainly see the deal pass the House of Commons, hence why Sterling spiked on the rumour.

"A leading Brexiteer tells me they have been advised that Angela Merkel is willing to put a five year time limit on the Northern Ireland backstop," says Nicholas Watt, Political Editor of BBC Newsnight.

The comments came after Watt was seeking the unidentified source's views on Andrea Leadsom’s comment earlier today that she hoped Angela Merkel would reopen the Withdrawal Agreement. Leadsom is the Leader of the House of Commons and earlier sparked what can be described as ridicule when she unexpectedly suggested she would like to see changes made to the Withdrawal Agreement.

"If Angela Merkel put a five year time limit on the NI backstop the Brexiteer told me his side would face a massive challenge. Difficult to reject that but would need assurances that ideas on new technology from the Malthouse Compromise would be at the heart of a replacement," adds Watt.

We find the notion that the Withdrawal Agreement can be tinkered with highly questionable, given the stead-fast assurances made right across the EU spectrum that it is not open for renegotiation.

Yet, there does seem to be something afoot, at least according to the foreign exchange market place.

While moves in Sterling following the rumour release wre not massive, there was nevertheless a discernible spike in volatility:

"Spike in GBP on reports Merkel willing to put a 5-year time limit on Irish backstop," says David Cheetham, Chief Market Analyst at XTB UK.

At the time of writing the Pound is up on the Euro with GBP/EUR quoted at 1.1622, having been as low as 1.1591 already today.

The GBP/USD exchange rate is quoted at 1.3114, having been as low as 1.3057 already today.

Markets appear to believe that a last-ditch move by the EU of the kind being rumoured could be exactly what is needed to get May's Brexit deal across the line, crucially the deal could pass with the Conservative party's backing.

This not only would such an outcome minimises Brexit uncertainty, but it would also likely stabilise the government, both optimal outcomes for Sterling we believe.

In true Brexit-rumour form, the rumour has quickly been denied by lower-ranking officials.

"The reports are without any foundation," a German government spokesman said in an e-mailed statement to Reuters on Tuesday. "The withdrawal agreement stands."

Further, when asked on the rumours, the EU's lead Brexit negotiator Michel Barnier says he was unaware of any such developments.

"Rumours, speculation, results and reactions surrounding the European Union's Brexit summit on Wednesday will all fuel GBP volatility, already evident in Tuesday's rumour that German Chancellor Angela Merkel suggested a five-year limit to the Irish backstop," says Richard Pace, an analyst on the Thomson Reuters currency desk. "Liquidity is poor with traders sitting on the sidelines, meaning GBP volatility could be easily exacerbated."

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

A Long Brexit Delay and Period of Limbo for Sterling Lies Ahead

If no changes to the Withdrawal Agreement are offered by Merkel, Pound Sterling almost certainly faces a period of extended limbo as the UK is expected to be offered lengthy Brexit extension that effecitvely leaves it a powerless EU member state.

The market expects a delay to be granted, and judging by the lack of volatility in Sterling it appears any delay is expected to be a long one.

The British Pound is seen consolidating against the Euro and U.S. Dollar as the clock counts down to the mid-week meeting of European Union leaders at which the decision to grant the UK another Brexit extension will be made.

According to reports out on Tuesday, the delay will however come with costs attached.

One report suggests the UK will have to field candidates in European elections but the country will effectively agree to yield no power in the EU at all, effectively making the elected representatives dummies.

European leaders will reportedly demand assurances that "Britain does not block or disrupt EU decisions during an extension period," according to Bruno Waterfield, Brussels Correspondent with the Times.

Overnight we have heard reports the Conservative party is already mobilising potential candidates for a European election in May.

Any assurances are expected to be made in a letter that commits the government to always to vote with the majority of other member states says Waterfield.

In short, the UK will become an EU member state without any decision-making powers.

The demands reflect European fears that Britain would look to frustrate the business of the European Union, with a tweet made by Conservative lawmaker Jacob Rees-Mogg last week giving flesh to these fears. Rees-Mogg said the UK "should be as difficult as possible" if it were to be caught up in a long extension.

Above: File photograph of Prime Minister Theresa May at a previous European Council summit. Image © European Union.

Furthermore, European leaders are expected to reiterate that the Withdrawal Agreement already struck with the EU will remain closed and no new UK leader will be able to negotiate on the deal, and a 'no deal' Brexit would be the price of of any move to breach the terms of the delay.

The EU are certainly putting the pressure on the UK: according to the EU's lead negotiator Michel Barnier, should a 'no deal' ever happen, no trade negotiations would take place until the matter of the Irish border was resolved and financial settlements were made.

Speaking in Dublin on Monday, Barnier said: "You have our full support, and I have said before the backstop is currently the only solution we have found to maintain the status-quo on the island of Ireland."

It appears the EU will look to push the backstop on any UK government, under any scenario.

From a currency perspective, the conditions for any substantial strength in Sterling are severely limited we believe.

The UK is fast become a powerless European province and a year of further uncertainty will likely weigh heavily on business investment and consumer confidence.

A period of political stalemate will likely draw investor attention back to UK economic fundamentals, and here the story might be unsupportive with chronic uncertainty and withdrawn investments restricting growth.

There are also likely to be significant implications for UK domestic politics as an extension that leaves the UK as an effective supplicant European state would likely result in a groundswell of support of anti-establishment parties, only exacerbating the movement that lead to the Brexit vote in the first place.

More immediately, Prime Minister Theresa May's standing in the Conservative party will almost certainly become untenable as we expect MPs in her own party to withdraw their support in protest.

The chance of a general election are elevated, and the uncertainty posed by another vote would be another negative likely to weigh on the currency.

May to Beg European Leaders for Extension

UK Prime Minister Theresa May will today fly out and plead with Europe's most influential leaders to grant her wish of a Brexit delay to June 30, with meetings with French and German leaders due to take place ahead of Wednesday's crunch EU summit.

It is the meeting with France's Emmanuel Macron that we believe will be critical.

Reports have been circulating that France, Belgium and Spain see too much danger to the EU's integrity in offering a long extension to the UK, and the three countries are reportedly keen to only offer a short, two week extension that would allow both sides to prepare for a 'no deal'.

A diplomatic cable seen by the Guardian reveals France's ambassador secured the support of Spanish and Belgian colleagues in arguing that there should only be, at most, a short article 50 extension to avoid an instant financial crisis, saying: “we could probably extend for a couple of weeks to prepare ourselves in the markets.”

For Sterling, there is a risk that Macron is uncompromising.

However, we know Germany's Angela Merkel is eager to avoid a 'no deal' Brexit at all costs and therefore France's position is unlikely to be win out.

Instead, expect a compromise that would see the UK granted a long extension with humiliating costs that ensure the UK effectively becomes a powerless member state for a period of one year.

We would expect Sterling to be supported on any such decision as it ensures the UK will avoid a 'no deal' Brexit come Friday, the day the UK is officially supposed to exit the EU.

However, as mentioned earlier, the prospect of months of limbo would significantly limit the Pound's upside potential, therefore expectations for a large rally in the Pound on a long extension would be unfounded.

Cross-Party Talks Continue, Don't Expect a Breakthrough

May will have to present EU leaders evidence that the Brexit extension she is asking for is made on the basis that she has a plan to finally push through a deal.

The condition on any Brexit extension is that it must come with credible reasoning.

May will almost certainly point to ongoing cross-party talks between the Conservatives and Labour, which are expected to continue today.

No doubt, a consensus Brexit deal, that could command a majority in the House of Commons would break the deadlock and potentially usher in a period of appreciation in the value of the British Pound.

That said, expectations for deal remain optimistic as both sides have a red line they are not willing to cross: a customs union. Labour want want, the Conservatives don't.

We don't see this bridge being crossed.

As mentioned however, both sides have something to gain from engaging in talks.

The government use the talks to show the EU they have a credible basis to request a Brexit extension and, they can share the blame for a 'no deal' with the opposition should it ever happen.

Labour, meanwhile are observing the damage the talks are inflicting on the Conservative party.

"On the matter of cross-party talks. Surely it's better for Labour to drag it out rather than cutting May a deal. Force Tories to contest EU elections, sit back & wait for Tory party/govt to implode. ‘Maximum chaos’ strategy and one that could bring Corbyn the General Election he so craves," says Beth Rigby, Sky's Deputy Political Editor.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement