Euro / Dollar Week Ahead Forecast: PBoC Bid Could Frustrate Sellers Below 1.08

- Written by: James Skinner

- EUR/USD under pressure from Fed & ECB divergence

- But PBoC bid could frustrate EUR sellers beneath 1.08

- In any effort to fend off unwanted strength in Renminbi

Image © European Commission Audiovisual Services

The Euro to Dollar exchange rate entered a holiday-shortened week close to its 2020 lows but could now find itself better supported if the People’s Bank of China (PBoC) comes to the aid of the European single currency in a bid to stymie further unwanted strength in the trade-weighted Renminbi.

Europe’s single currency came under significant pressure ahead of the holiday weekend from a strong U.S. Dollar that rallied further against many currencies on Thursday while the Euro itself also fell in the wake of the April European Central Bank (ECB) monetary policy decision.

Census Bureau data showed U.S. retail sales growing strongly in March, doing nothing to discourage the Federal Reserve (Fed) from raising interest rates in the aggressive manner that is increasingly anticipated by markets.

Meanwhile, last Thursday’s ECB monetary policy decision did nothing to alleviate perceptions in the market that Europe will likely lag far behind the U.S. when it comes to monetary policy normalisation this year and next.

“Whether you look at employment, whether you look at wages, whether you look at actually the general attributes and instruments of the monetary policy at the moment in the United States, our economies do not compare,” ECB President Christine Lagarde said last Thursday.

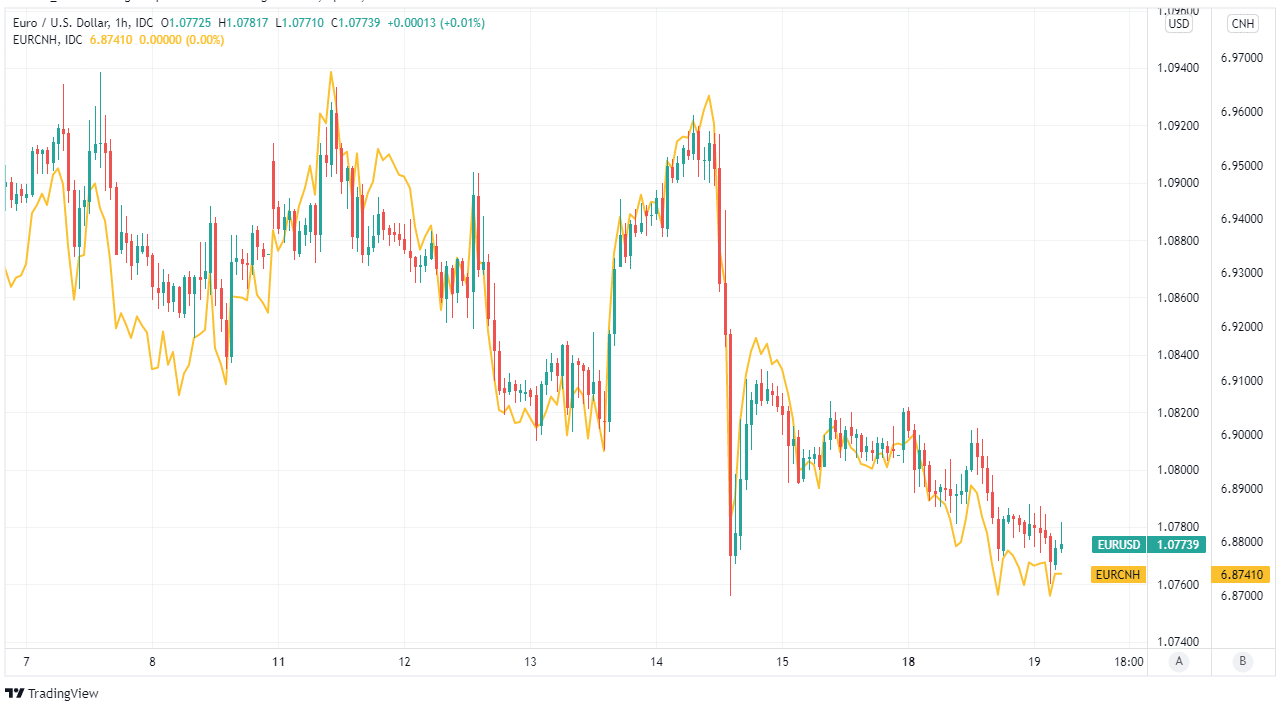

Above: Euro Dollar rate shown at hourly intervals alongside Euro-Renminbi rate. Click image for closer inspection.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

“If anything, I believe that this is likely to be accentuated by the fact that the euro area is probably going to be more exposed and will suffer more consequences as a result of the war by Russia against Ukraine,” President Lagarde told reporters in April’s press conference.

The ECB reiterated last week that its remaining quantitative easing programme, known as the Asset Purchases Programme, is likely to wound up at some stage in the third quarter of this year due to a mounting risk that above-target inflation rates will persist for too-long a period.

But the ECB also went to great lengths to impress upon markets last week that policymakers will be keeping all options open in relation to monetary policy instruments and especially interest rates throughout the remainder of the year.

This means there remains the possibility of the ECB electing to lift Europe’s interest rates from current levels, which have been at zero or below for years, and possibly even call time on the era of negative interest rates later in 2022.

“ECB President Lagarde said increases in interest rates could follow the end of asset purchases in Q3 2022 ‘anywhere between a week to several months’. We expect EUR/USD to consolidate near 1.0700 though it could test 1.0636 support this week,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia. (Set your rate alert here).

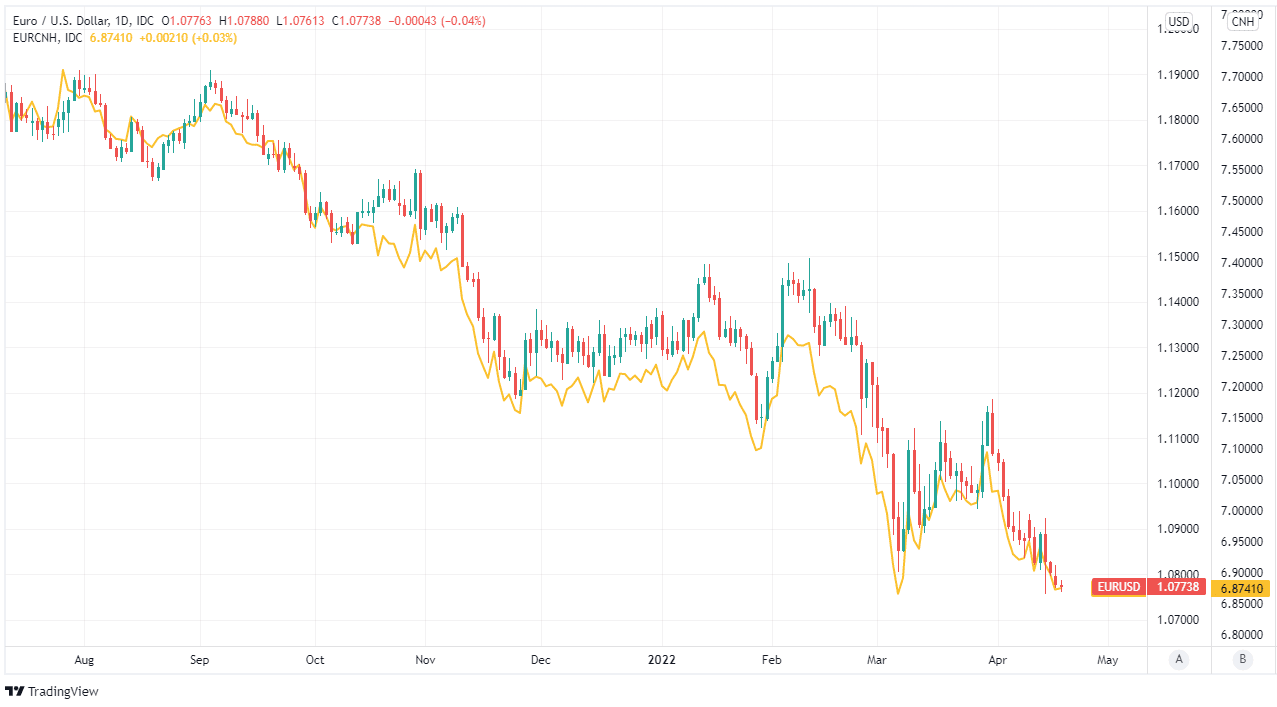

Above: Euro Dollar rate shown at daily intervals alongside Euro-Renminbi rate. Click image for closer inspection.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

While an end to the era of negative interest rates in Europe would likely be a highly supportive development for the Euro, this is far from assured as an outcome for the months ahead and pales in comparison as a policy stance when stood next to that of the Federal Reserve.

“The combination of no sense of ECB urgency, Fed comments, higher USD rates and higher energy prices all contributes to the move lower in EUR/USD. We still favour the downside on aspects primarily not related to monetary policy,” says Mikael Olai Milhøj, an analyst at Danske Bank.

That leaves the Euro vulnerable to ongoing strength in the Dollar and uncertainty about the outcome of this coming Sunday’s French presidential election, although there is also reason for thinking that further downside in EUR/USD may now be becoming increasingly limited.

This is after last Wednesday’s sharp but short-lived rally in EUR/USD came accompanied by a strong indication that this money flow arrived in Europe from Beijing and through the Euro-Renminbi or EUR/CNH pathway.

“The domestic demand remains weak which reflects the disruption due to frequent virus resurgence. The municipal city Shanghai started a full lockdown in early April. This is certainly the worst virus situation in China since the Wuhan lockdown,” says Hao Zhou, an analyst at Commerzbank.

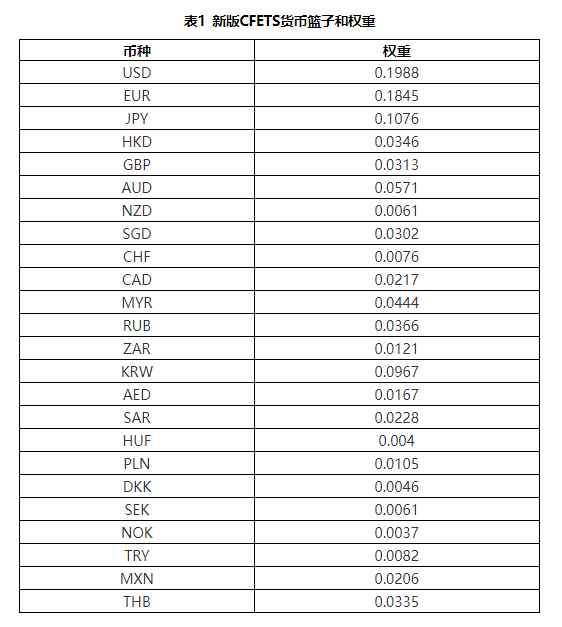

Above: 2022 weightings for China Foreign Exchange Trade System (CFETS) index. Click image for closer inspection.

To the extent that the Euro’s short-lived rally originated from the PBoC itself, it would be an indication of a desire in Beijing to fend off further unwanted strength in the managed-floating Renminbi, and potentially due to the ongoing economic slowdown in China.

This would involve taking the Euro-Dollar rate on its shoulders as Europe’s single currency is the second largest part of the trade-weighted Renminbi index, with an 18.4% weighting, and has recently been the largest contributor to a trade-weighted rally that has been ongoing since July 2020.

“This [Monday’s strong Q1 GDP print] feels like the prelude to a soft Q2 to be honest. The weaker consumer backdrop in China is a HUGE risk to the macro picture going forward,” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

A decline in the trade-weighted Renminbi has frequently been sought after by policymakers in Beijing throughout the currency’s almost two-year rally and is something that would likely have widespread implications for other currencies but most notably, the Euro, Dollar and Japanese Yen.

Euro-Dollar declines have pulled EUR/CNH almost five percent lower thus far in 2022 and -12% lower in the 12-months to Tuesday, lifting the trade-weighted Renminbi by 2.2% over the latter interval, and may now have elicited direct intervention from the PBoC.

The PBoC would be armed with the largest chest of foreign exchange reserves in the market and the most extensive network of bilateral currency swap lines if and when undertaking the above task, which could be enough to frustrate sellers of the Euro-Dollar rate in the days and weeks ahead.