Euro-to-Dollar Rate Week Ahead Forecast: More Upside Anticipated After Pair Breaks Out Of Range

Image © European Central Bank

- EUR/USD has broken out of Q3 range and trendline

- Various signals pointing to more upside

- Dollar to take cue from retail sales; Euro from industrial production

The Euro-U.S. Dollar rate starts the week trading at 1.1468, after rising 0.64% from the previous week’s close.

The Euro outperformed the Dollar as a result of easing trade war risks due to progress made in negotiations between the U.S. and China.

Gains also came from a weaker U.S. Dollar, pushed down by comments from Federal Reserve (Fed) Chairman Powell about U.S. debt being too high as well as the continued government shutdown due to the standoff over the border wall.

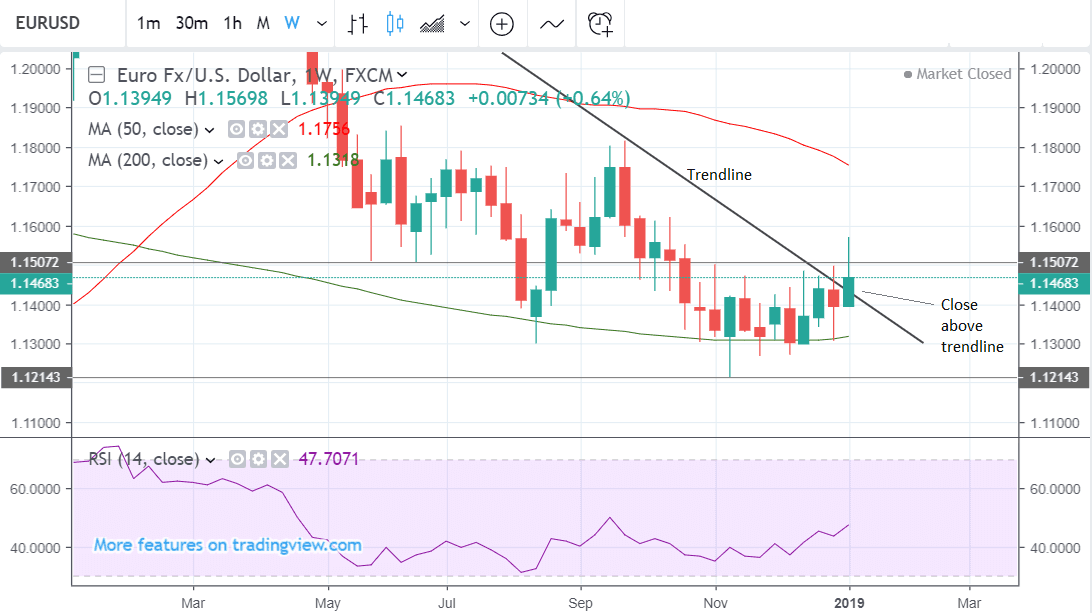

EUR/USD has broken above a major trendline on a closing basis on the weekly chart, which is a strong bullish indicator for the pair, and biases the charts to indicating more upside in the week ahead.

The pair has maintained its perch above the 200-week moving average (MA) and formed a ‘key reversal’ weekly candlestick which is also a sign a reversal may be underway.

EUR/USD appears to be breaking out of the range it was in during Q3 which roughly spanned the space between 1.12 and 1.15.

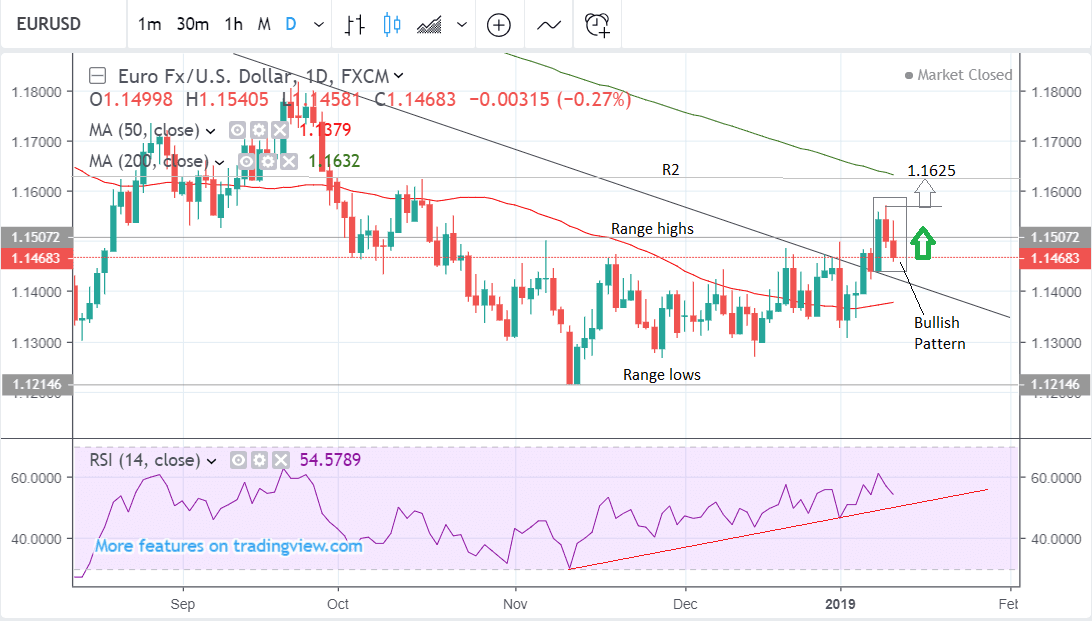

Last week saw a strong move higher in which the exchange rate broke above the 1.1525 key line in the sand, which we mentioned as necessary in order to confirm a breakout and new uptrend. This then saw the pair move up towards the next upside target at circa 1.1625.

The short-term uptrend is now established and expected to extend higher, given the principle that ‘trends have a tendency to extend’. It will probably rise all the way up to its target. A break above the existing 1.1570 highs would help confirm such a move.

The pair has also formed a short-term high-probability bullish pattern composed of the last three days price action. This is highlighted by the rectangular pattern drawn on the daily chart.

The pattern forms when a long, strong, up-candle, is followed by a pull-back over two days during which the market forms two shorter, red, down-candles. The pattern signals that there is a 60% chance the next day (Monday 14 in this case) will be an up-day too, which basically means the open will be lower than the close.

Finally, the RSI momentum indicator in the bottom panel of both charts is showing strong bullish conviction. It is trading at the same level as it did when the exchange rate was between the 1.16s and 1.18s back in September. This may suggest ‘pent-up’ unexpressed upside which could come out in the week ahead.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Euro: What to Watch

Be aware that the Euro appears to have been tracking the fortunes of China's Renminbi of late. The single-currency rallied in the week prior on news that the U.S. and China were making progress towards settling their ongoing trade dispute.

Should markets maintain optimism on the matter the Euro could well appreciate further.

The rise in the Euro however comes despite some dire data which suggests Italy and Germany both sunk into recession in the final quarter of 2018.

We wonder if the Euro is defying gravity, and are wary of a bigger move lower if data remains resolutely poor.

One of the most important releases for the Euro in the week ahead is industrial production out on Monday at 10.00 GMT, as this will provide another up-to-date assessment of the state of the Eurozone economy.

The consensus expectation is for industrial production to have fallen by -1.3% in November compared to October when it rose 0.2%. Compared to a year ago it is expected to have fallen by -2.1%.

“Data in the coming days will probably continue to paint a bleak picture, with investors eyeing Monday’s industrial production numbers for the euro bloc and Tuesday’s 2018 GDP estimate for Germany,” says Raffi Boyadjian, an analyst at broker XM.com. “Industrial output is forecast to have contracted by 1.0% month-on-month in November, more than reversing the prior 0.2% gain.”

Germany is expected to show a slower 1.5% growth in 2018 - down from the 2.2% in 2017, when it is released at 7.00 on Tuesday, according to consensus expectations.

Mario Draghi, the president of the European Central Bank (ECB) is set to give a speech on Monday at 15.00, which could also impact on the Euro given mixed data recently. Data out last week showed that although retail sales showed a resilient 0.6% rise in November and Unemployment fell to 8.0%, “other economic figures were mostly consistent with a generally subdued Eurozone growth trend” and the Eurozone is “flirting with recession.” Says Wells Fargo, which cited German data as particularly poor.

“The decline in German output in particular raised the specter of whether the Eurozone economy is on the verge of falling into recession. In our view there appears to be enough solidity in the consumer sector, and momentum in the overall economy, to avoid a recession at this time. That said, we do expect the period of subdued Eurozone economic activity to persist further and, as a result, see a slower return to zero interest rates than previously expected by the European Central Bank,” says a note from investment bank Wells Fargo.

Their analysis suggests a weaker or flatlining Euro in the short-term.

The U.S. Dollar: What to Watch

The U.S. Dollar has struggled in 2019 with an improvement in global investor appetite appearing to be a large driver of the weakness.

Should this optimism characterise market trade over coming days then the trend lower in the U.S. Dollar could extend.

The domestic backdrop remains challenging for the U.S. unit as political uncertainty drags on thanks to the ongoing partial government shutdown while the Federal Reserve grows increasingly cautious about the outlook, with the Fed Chairman Powell most recently highlighting the size of the U.S. debt as a major risk factor.

On the 'hard data' front, probably the most important release for the U.S Dollar will be retail sales for December, due out on Wednesday at 13.30 GMT. This is forecast to show a 0.2% rise month-on-month, the same as the growth it showed in the previous month.

Consumer spending is a major contributor to overall growth in the U.S. economy so retail sales will be important for gauging how well the economy is holding up, especially amidst qualms it may be slowing down.

“Despite recent worries of slower domestic growth, the consumer sector looks poised to post another solid quarter to end the year,” say Wells Fargo who foresee a positive print for December in an economic note covering the coming week. “Control group sales, a proxy for personal consumption expenditures (PCE), were up 0.9%. This was the strongest monthly increase for 2018 so far, and points to another strong print for PCE in Q4.”

If retail sales remain strong they will help support the U.S. Dollar, if lower-than-expected, they will add to fears about the slowdown in the economy, and probably weaken the Dollar.

The other major release for the Dollar may well be regional manufacturing data from New York and Philadelphia, which is out on Tuesday and Thursday respectively at 13.30. This is because the market is still reeling from the sharp drop in the ISM manufacturing index registered last week and will want confirmation from the regional indicators.

“After last month’s shock plunge in the ISM manufacturing PMI, the New York Fed’s Empire State manufacturing index and the Philadelphia Fed’s own manufacturing barometer will be watched more closely than usual for potential signs the US economy could be headed for a sharp slowdown. Consensus estimates for January though, are for both indices to rise slightly.” Says Raffi Boyadjian, an analyst at XM.com.

The Philly Fed index is forecast to come out at 10 from 9.1 previously and NY is forecast to rise to 11.25 from 10.90.

Another key barometer of the economy is U.S. industrial production, out on Friday at 13.30. This is forecast to show a slower 0.2% rise in December, from 0.6% in November. Again a lower-than-expected print would shake market assumptions about the U.S. economy and vice-versa for a stronger reading.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here