The Pound-to-Euro Rate in the Week Ahead: at A 'Make Or Break' Level

- GBP/EUR finding its feet at the bottom of a long-term range

- Week ahead could be pivotal from political, technical and data perspective

- Main event for the Pound will be Parliament's reception of May's Brexit white paper; for the Euro, trade data in top spot

Image © Savo Ilic, Adobe Stock

The Pound-to-euro exchange rate has reached a pivotal level on the charts at the bottom of its long-term range, which reflects the current heightened suspense over Brexit negotiations and the importance of the economic data scheduled for release in the week ahead.

Technical indicators favour a recovery back up towards the range highs but the lack of upside confirmation from actual price action so far - which as been rather tepid - means that a risk remains of a volatile breakdown cannot be ruled out too.

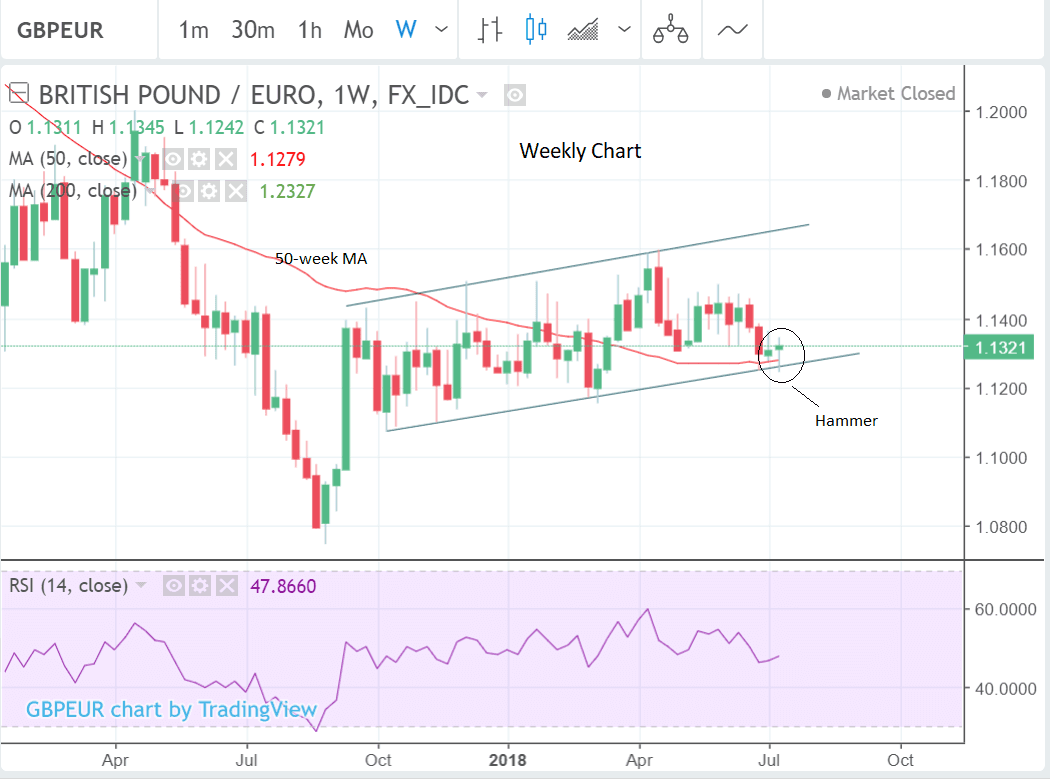

The weekly chart above - which gives us the longer-term picture - is showing the most compelling bullish signs, including a bullish hammer candlestick pattern last week and underpinning support from the 50-week MA.

These both bias the outlook to expecting more upside over coming weeks.

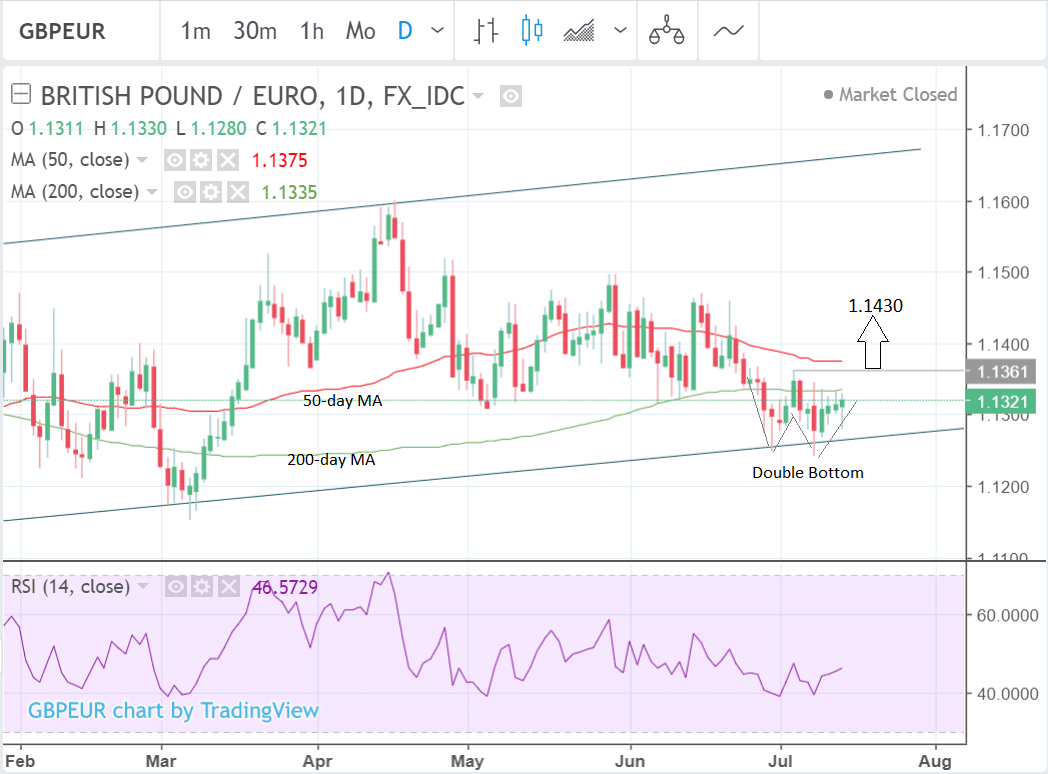

The daily chart - which gives us a shorter-term picture that could be relevant to the coming few days - is showing a double-bottom reversal pattern has formed at the lows. Double bottoms look like the letter 'W' and are reliable reversal patterns.

Confirmation comes from a break above the highs of the top of the pattern, also known as the neckline. In this case the neckline is at 1.1361 and a break above it would signal a move up to a target at 1.1430, conservatively, which is the golden ratio (0.618) of the height of the pattern extrapolated higher.

The lack of upside in price so far, however, and the fact the pair has been in a short-term downtrend since the April highs, also means we cannot yet discount the possibility of a continuation of that trend lower.

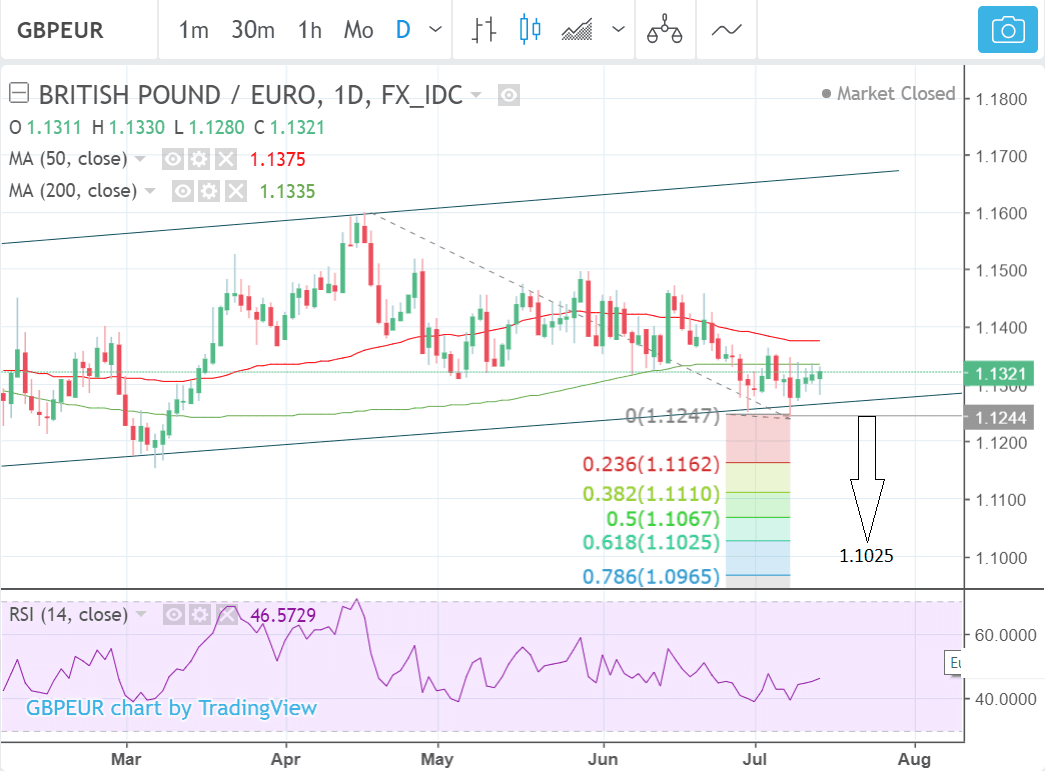

Although the bottom of the range sits at the lows, at around about 1.1250, if the exchange rate were to successfully pierce below the July 9 lows at 1.1242 it would probably confirm a breakdown from the the range entirely.

Such a move would probably herald a new very bearish phase and quite low price expectations. The usual technical method for calculating a target from a range breakdown is to take the height of the range and extend it lower by the golden ratio for a conservative estimate of the follow-through after the break.

The calculation gives a final target of 1.1025 for the pair.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

What to watch in the week ahead for the Pound

There is a considerable bundle of data and events in the week ahead for Sterling, which suggests it could be a highly volatile time for the currency.

On the political front there will be votes on amendments to the Trade and Customs Bill, which help form the basis of the government's new 'softer' Brexit proposal. These are expected to take place on Monday 16 and Tuesday 17.

They could be critical in gauging whether the plan has a likelihood of success and implementation.

"Another legislative showdown takes place in the UK House of Commons as the Trade and Customs Bills are voted on. Amendments to the bill have come from 'hard' Brexiteers (trying to undo the white paper) and Remainers (trying to bind the UK to a customs union). Some of these votes could come down to the wire, and have significant implications for Brexit negotiations," says Actionforex.com in their week ahead analysis.

Sterling may catch a bid if Brexit supporters in the Conservative party fail in their upcoming attempt to harden the UK government's plan on leaving the EU, as failure should increase the GBP-positive probability of a relatively soft Brexit.

We note a string of opinion polls out over recent days that shows support for the Convervatives has fallen below that of Labour with a good proportion of voters flocking back to UKIP having judged that May will not deliver the Brexit they desire.

This will remind Convervative lawmakers that bringing down the government will likely throw their party onto the opposition benches. It does also however offer the potential to sharpen the determination of Brexiteers who believe their electoral success will lie with delivering a clean 'hard' Brexit.

From a 'hard' data perspective the week has three major, potentially market moving, releases too: labour market data on Tuesday, CPI on Wednesday and retail sales on Thursday - all are at 9.30 UK time (8.30 GMT).

Their significance is further heightened by the fact that they may impact on the decision-making of the Bank of England (BOE) when it has its pivotal meeting in August. Because the probabilities of a hike or not, are so evenly balanced, next week's data could prove critical in swinging the vote one way or another.

Labour market data for May, is expected to show continued improvement with a 150K rise in employment on a three-month-on-three-month basis.

The more important wage data component of the release, which is more of an influence on inflation and therefore Bank of England decision-making, is expected to show only modest rises of 2.6% for headline and 2.8% (including bonuses).

Stronger wage rises are necessary to increase the chances of a rate hike and a disappointment could weigh heavily on Sterling.

CPI inflation data in June, out on Wednesday, is likely to show a rise due to the temporary influence of higher oil prices, however, if the main driver is in fact only fuel prices, it is unlikely to have much impact on the Bank of England who are more likely to look through inflation from temporary factors.

Therefore we believe the core CPI reading will be of more interest to the Bank of England as it shows the underlying inflationary pressures present in the economy.

Core CPI is forecast to read at 2.1% (month-on-month) while headline CPI is forecast to read at 0.2% month-on-month and 2.6% year-on-year.

"We suspect that CPI inflation edged up to 2.6% in June, owing to a rise in energy prices. But this should not mark the start of a sustained rise," says Andrew Wishart, UK economist at Capital Economics.

Retail sales for June are set for release on Thursday but the "evidence on strength," says Capital Economic's Wishart, "has been decidedly mixed."

On the one hand, the strong data in April and May will be a hard act to follow in June, yet on the other hand factors such as the good weather and the World Cup could support a rise.

"More sunshine, warm weather, and World Cup should be supportive. Our base case 0.4% forecast leaves a very strong trend for Q2 sales, and a solid hand-off to Q3," says TD securities in their note on data in the week ahead.

Markets are forecasting a reading of 0.4% on a month-on-month basis and 3.9% annualised.

What to watch in the week ahead for the Euro

The week ahead for the Euro promises to be fairly quiet as the main release is a revision of June CPI data which is unlikely to be markedly different from the initial estimate, and therefore unlikely to rock markets.

The other major releases for the Euro is the Trade Balance in May, which is forecast to show a rise in the surplus to 20.9bn from 16.3bn Euros previously, when it is released at 9.00 (GMT), on Monday the 16th.

The current account balance for May is released on Friday at 8.00. In April it stood at 26.2bn Euros and the high surplus is considered one of the reasons given by Euro-bulls for the currency to continue strengthening.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here