Euro Bid on Prospect of Looming ECB Interest Rate Increase

- Written by: Gary Howes

Above: File image of Martins Kazaks, copyright Latvia State Chancellery.

Euro exchange rates are up in midweek trade, with speculation of an approaching interest rate rise at the European Central Bank possibly driving demand.

Martins Kazaks, ECB Governing Council member and head of Latvia's, central bank says a rate hike could come as soon as July.

The call rejuvenates ECB rate hike expectations and offers the Euro support in a foreign exchange market largely focussed on the differing monetary policy stances at the major central banks.

Kazaks said a rate increase is possible as soon as July as the ECB's commitment to a "gradual" approach to raising interest rates "doesn't mean a slow response".

He added the ECB doesn’t need to wait to see stronger wage growth before raising the Deposit Rate above -0.5%.

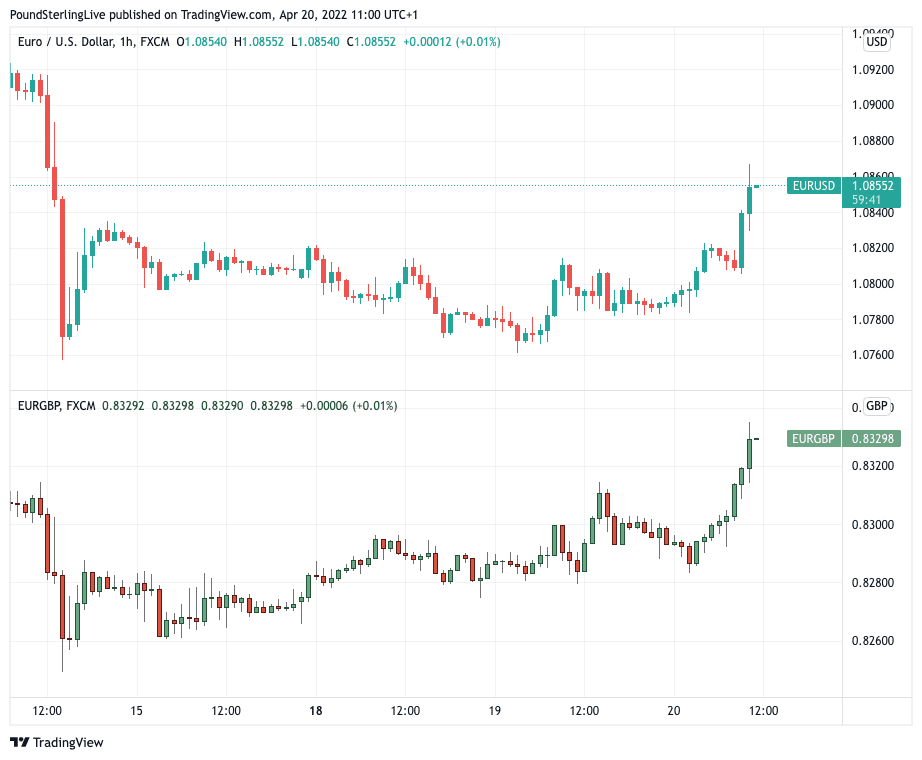

Above: EUR/USD (top) and EUR/GBP (bottom) showing a bid on April 20.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Currently the ECB is committed to ending quantitative easing in the third quarter, suggesting the ending of quantitative easing could fall close to, or at the same time as, a rate rise.

The Euro has been hindered by the ECB's slow journey towards raising interest rates for record lows, with markets anticipating some 65 basis points worth of hikes to be delivered in 2022 ahead of Kazak's statement.

Expectations will likely rise following these remarks and this is evident in the move higher in the Euro.

The Euro to Dollar exchange rate is higher by 0.60% at 1.0857, the Euro to Pound exchange rate is higher by 0.40% at 0.8330, giving a Pound-Euro rate of 1.20. (Set your FX rate alert here).

The Euro was lower in the wake of last week's ECB policy update which offered no hint that interest rate rises are imminent, ensuring the central bank remained in the slow lane in the global race to try and stave off surging inflation.

The ECB's guidance was largely unchanged on March's update and therefore disappointed against rising expectations that policy makers in Frankfurt would lay further ground for a 2022 rate hike.

"Inflation is naturally an ongoing concern, but the ECB did not signal an end to bond purchases and stated they would continue to buy assets even after they begin raising rates. The EUR moved lower suggesting that the ECB may be behind the curve," said Chris Wilgoss, Head of Global Markets Treasury, Crown Agents Bank.

The ECB said in a statement inflation has increased significantly and will remain high over the coming months, "mainly because of the sharp rise in energy costs" suggesting it was not yet overly concerned broader price pressures were emerging in the economy.

Kazak's comments will therefore raise questions as to whether a rethink at the central bank is already under way.

Further developments of this nature would naturally offer the Euro support.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes