Pound / Euro Could Rise 9.0% Analyst Forecasts

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling could be on the cusp of a large surge in value against the Euro, according to an analyst at data and information provider Thomson Reuters.

Jeremy Boulton - a market analyst for Thomson Reuters' markets information platforms - says it is now "wise to hedge for big rise in sterling's value".

The call comes a day after a significant bump higher in the Pound that came on the back of no data or news, although the invisible hand of one or two central banks could have been at play.

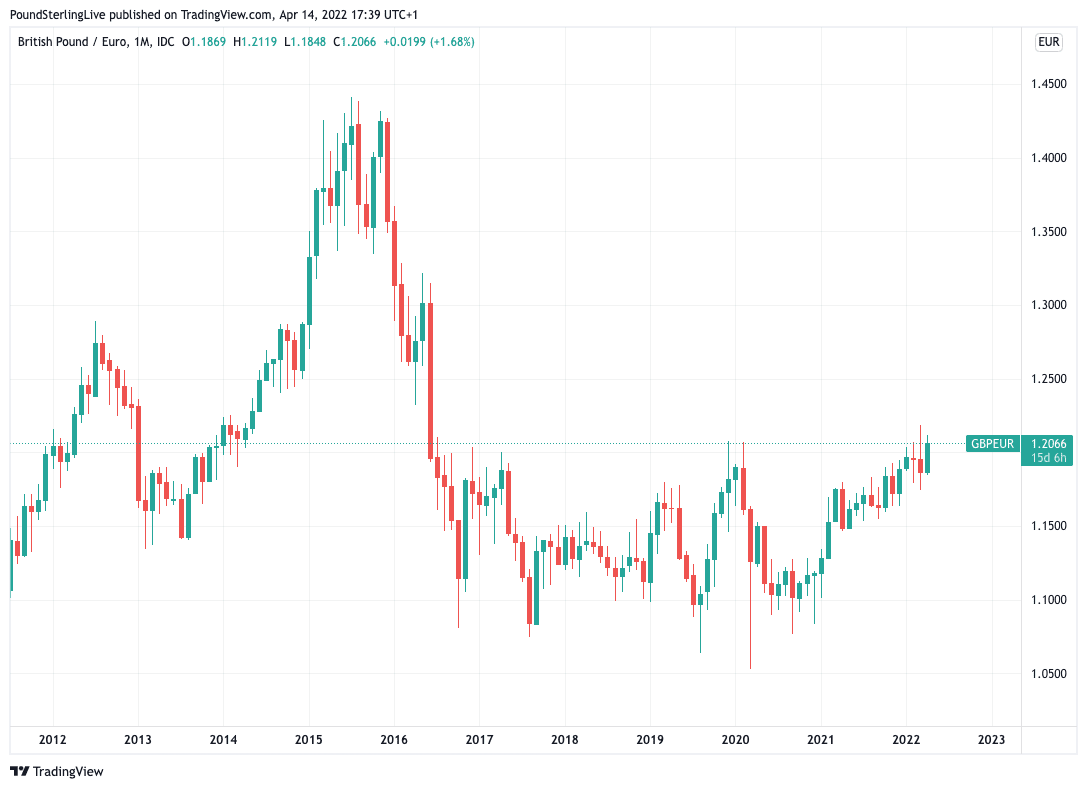

Boulton tells clients "the pound is on the brink of levels that have capped strength since the UK voted to leave the European Union in 2016."

The Pound to Euro exchange rate fell sharply in 2016 in the run up to, and following the result of, the UK's referendum on EU membership.

The low on October 07 2016 was at 1.0573.

Above: GBP/EUR at monthly intervals.

Boulton notes that sentiment towards Pound Sterling however remains subdued with market pricing betraying "little expectation" for a sizeable Sterling rise.

He notes traders are presently inclined to bet the pound falls versus dollar, while institutional analysts are eyeing GBP/USD around 1.34-1.35 over the course of the next year.

Option volatilities remain low, suggesting traders "anticipate little movement".

But, "an unexpected move that forces a big rethink and the necessary adjustment to hedging and speculative bets should go much further than a move traders are prepared for."

Boulton says the diverging paths for UK and euro zone monetary policy could support a rise in the GBP/EUR exchange rate, "and the long period that sterling has held close to a resistance point of major significance is a bullish sign".

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"A peak for sterling would usually be preceded by a brief test and rejection of resistance," says Boulton.

Boulton is now looking for the sizeable resistance levels above 1.21 to be tested and either rejected or broken.

"Should they break, GBP/EUR could rise 9 percent," says Boulton.

He says a GBP/EUR close over 1.2185 (61.8% Brexit drop) would target 1.2576, which would lift the pair above the 200-MMA at 1.2285 "that may result in much bigger gains". (Set your FX rate alert here).