Pound-to-Euro Exchange Rate Forecast to Consolidate into the Weekend

Image © SlayStorm, Adobe Stock

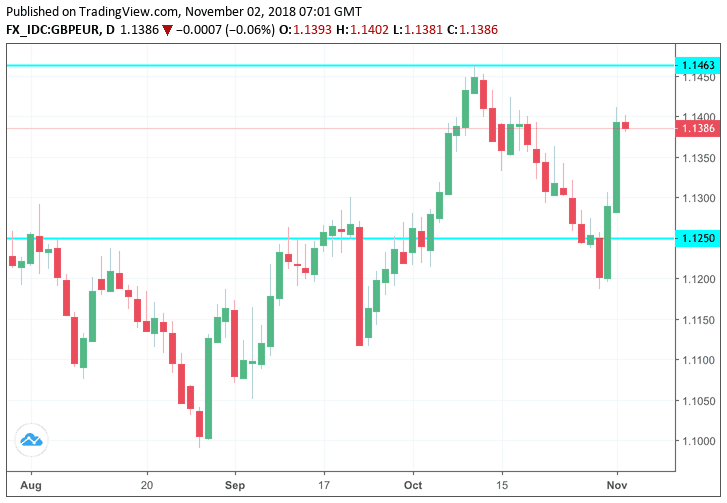

- Sterling consolidates vs. Euro ahead of 1.1460 resistance

- Forecast to enter holding pattern near-term

- Bank of England provides critical insurance against major slump

It's been a good 48 hours for those needing a stronger British Pound with which to buy Euros as the U.K. currency staged a sizeable recovery amidst positive rumours concerning Brexit negotiations while the Bank of England messaged that it would more likely raise interest rates in 2019 than not.

The Pound-to-Euro exchange rate rose over 1.0% on the day; moves of this scale are rare, the last one being on August 29 and provides some supportive impetus behind Sterling.

Paul Gamble, a Group Managing Partner and Co-Founder of MBMG Group says the moves are justified as the Pound remains cheap. "The difference between a soft Brexit and a 'no deal' Brexit is far more marginal than most of the scare stories that you read out there," Gamble tells Bloomberg TV.

"Brexit doesn't make that much difference to the U.K. economy so when we see the Pound dipping to the levels it did this week we buy it," adds Gamble.

The question is whether or not the rally can extend beyond current levels near 1.14 at deliver the October highs near 1.1460 again.

While we are of the belief that while the near-term outlook has improved, the chances of a massive advance above and beyond 1.1450 remains limited for the time being.

Above: Sterling almost undoes a month of losses in just 48 hours. Image (C) Pound Sterling Live, TradingView.

The 1.1460 area represents the October high and we see strong selling interest around this level and therefore many traders are likely to bail out of Sterling in the approach to these levels and book profit.

Taking a step back, we are able to note the Pound appears to be caught trading within a range markets are comfortable holding until that concrete resolution to Brexit negotiations is delivered.

Analyst Karen Jones with Commerzbank in London says she believes the Pound's recent strong rally against the Euro has neutralised the outlook for the pair; she has no strong conviction on where it might move next. Ahead of the strong recovery in Sterling she had been biased towards more Euro strength.

Jones says attention has reverted to the 1.1460 / 1.15 band which represents the highs from May. "We have no strong opinion here," says Jones on the immediate outlook for GBP/EUR.

We believe the conditions for sideways movement and consolidation are now in place.

We would expect Sterling strength to fade near the October highs located at around 1.1450 and revert back towards the middle of the range located at 1.1250.

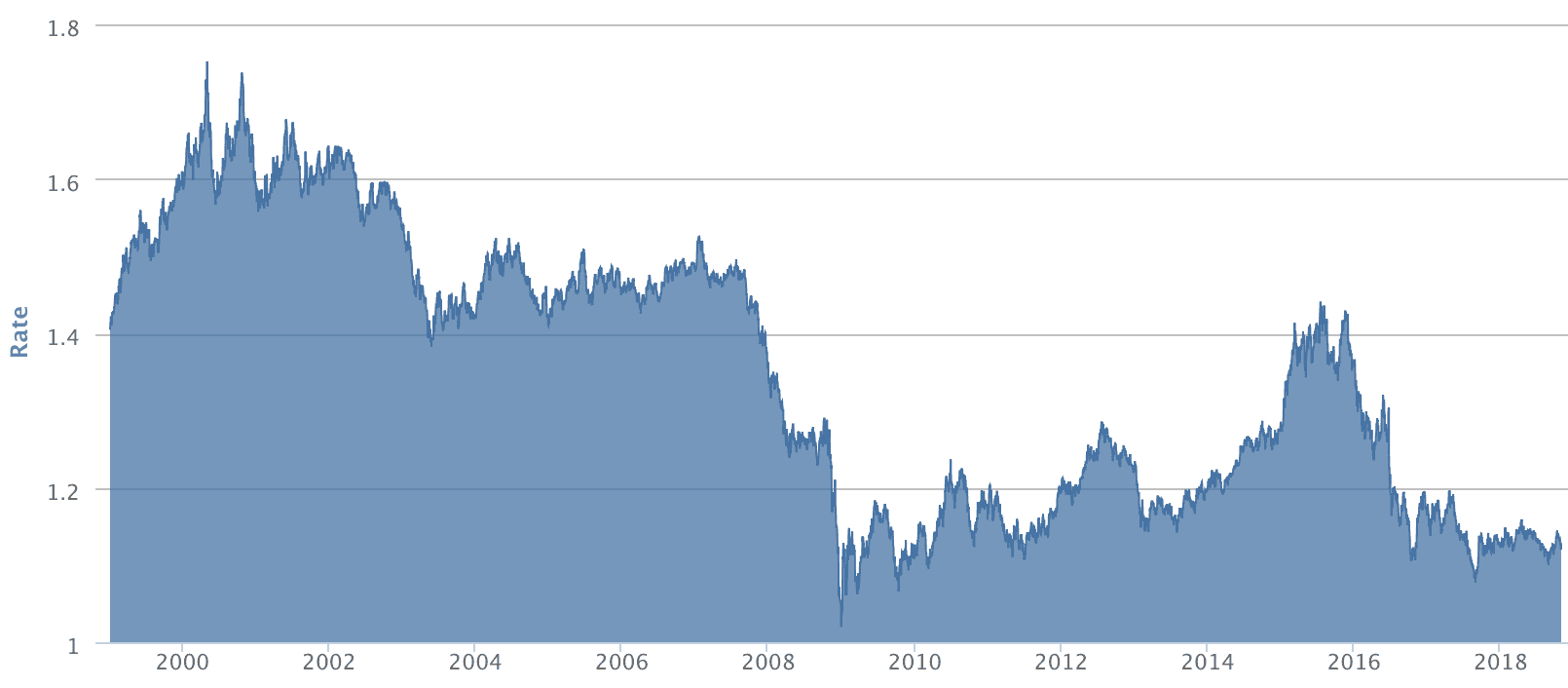

1.1250 is widely considered to be a long-term fulcrum for the exchange rate as a study of charts suggests the pair has gyrated around this point for months now. It is a point of equilibrium in the current regime and therefore those watching this exchange rate should expect moves either side to ultimately be short-lived.

The big trends that lie ahead will most likely start when the status of the future relationship is known, and judging by ongoing headlines, this could come as early as November 21.

"Until there is unequivocal confirmation that that the UK will avoid a hard Brexit next year, the outlook for the Pound will remain decidedly grey," says Jane Foley, a foreign exchange strategist with Rabobank in London.

Rabobank forecast EUR/GBP will trade around 0.86 at the start of Brexit, this gives a Pound-to-Euro exchange rate of 1.1628.

"This assumes that a deal will be done and passed by the UK parliament, though plenty of uncertainty is still likely to be kicked beyond the Brexit start data," says Foley.

On the event of a hard Brexit, Rabobank see a risk that EUR/GBP will head towards parity.

Above: Sterling-Euro continues to grind along near historic lows. Image (C) Pound Sterling Live, Bank of England.

Advertisement

Bank-beating GBP/EUR exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Bank of England Provides Insurance Against a Weaker Pound

Pound Sterling caught a bid on Thursday, November 01 after the Bank of England kept interest rates unchanged but communicated it stood ready to raise interest rates if the economy outperformed on a Brexit deal being sought.

Crucially, the Bank is also committed to raising interest rates if need be in the event of a 'no deal' disruptive Brexit outcome and we believe the Bank now stands as an important piece of insurance against a huge drop in the Pound going forward.

The Bank says it cannot predict exactly how the economy will react to such an outcome, but if Sterling needed defending in order to contain inflation it would not shy away from raising interest rates.

“Since the nature of EU withdrawal is not known at present, and its impact on the balance of demand, supply and the exchange rate cannot be determined in advance, the monetary policy response will not be automatic and could be in either direction,” said Bank of England Governor Mark Carney.

Therefore markets see the potential for interest rate rises in 2019 as having broadly increased, and this is on margin bullish for the Pound.

"He also suggested that a no-deal Brexit could possibly drive higher inflation, by triggering a supply-side shock that warrants higher interest rates. The GBP rallied and gilts slid," says Sue Trinh, a foreign exchange strategist at RBC Capital Markets.

We see the Bank of England as being a supportive narrative for Sterling longer-term.

Advertisement

Bank-beating GBP/EUR exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here