US Recession Likely in 2021 warn Scandinavian Economists, and Corporate Debt will be to Blame

© Paolese, Adobe Stock

A group of Scandanavian economists pinpoint corporate debt as being the likely catalyst of the next US recession.

The current global expansion is the strongest in a decade; thanks largely in part to the help provided to the global economy by central banks who have provided ample cash to fuel growth.

But, the ultra-loose monetary conditions which helped us out of the great recession could be sowing the seed of the next downturn says economists with Nordic lender DNB Markets who have looked into the crystal ball to ascertain where future risks lie for investors. In fact, DNB Markets foresee a greater than 50% chance of a moderate recession in 2021.

The recent volatility in US stock markets has coincided with a spike in borrowing costs, and this is no coincidence - in it lie the clues to what might cause the next recession. Normally shares are not as sensitive to borrowing costs at this point in any economic growth cycle when they are still relatively low and just off a historically low floor.

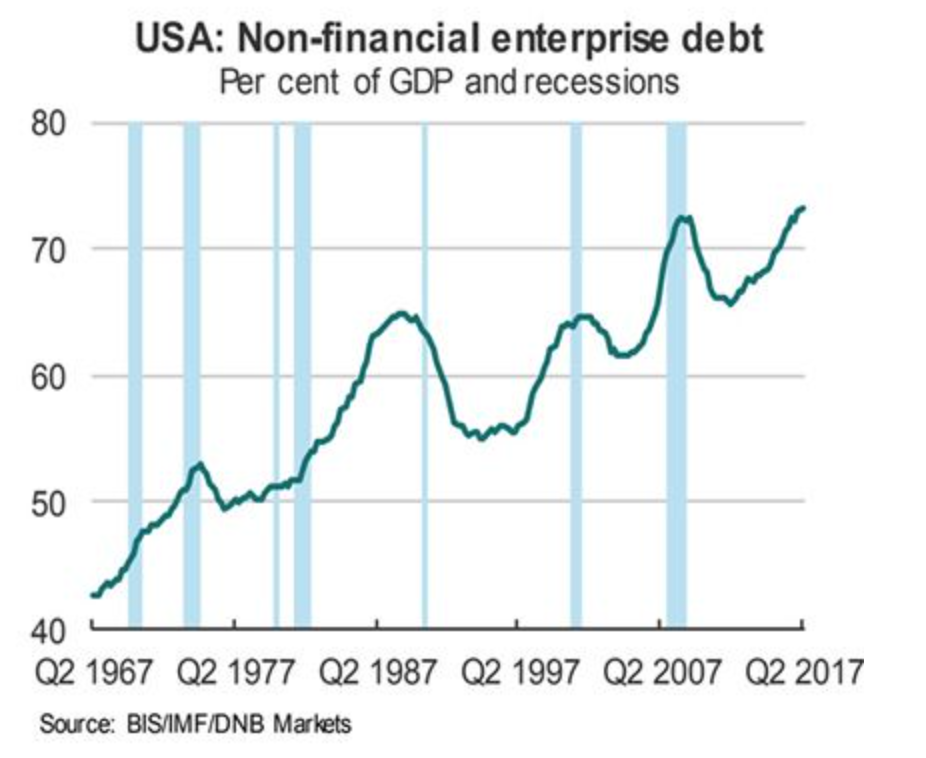

The reason for the abnormal reaction of the stock market is the rising level of corporate debt in the US, which Haugland and other commentators now see as reaching dangerously unsustainable levels. Furthermore, the impact of the recession sparked in the US will be felt across the global economy which is expected to chill.

The rising corporate debt burden has been a side effect of the easy monetary policy conditions in force since the financial crisis which has brought borrowing costs to historic lows and led to borrowing binges by corporations unable to turn down the buffet of cheap funding on offer.

"Benign financial conditions have led to historically high corporate debt in the US, which means that there is farther to fall," says Haugland.

The flow of cheap money is destined to end as ever decreasing unemployment, which has already fallen to 43-year lows in the US, forces up wages, and this, in turn, pushes up inflation, and finally interest rates.

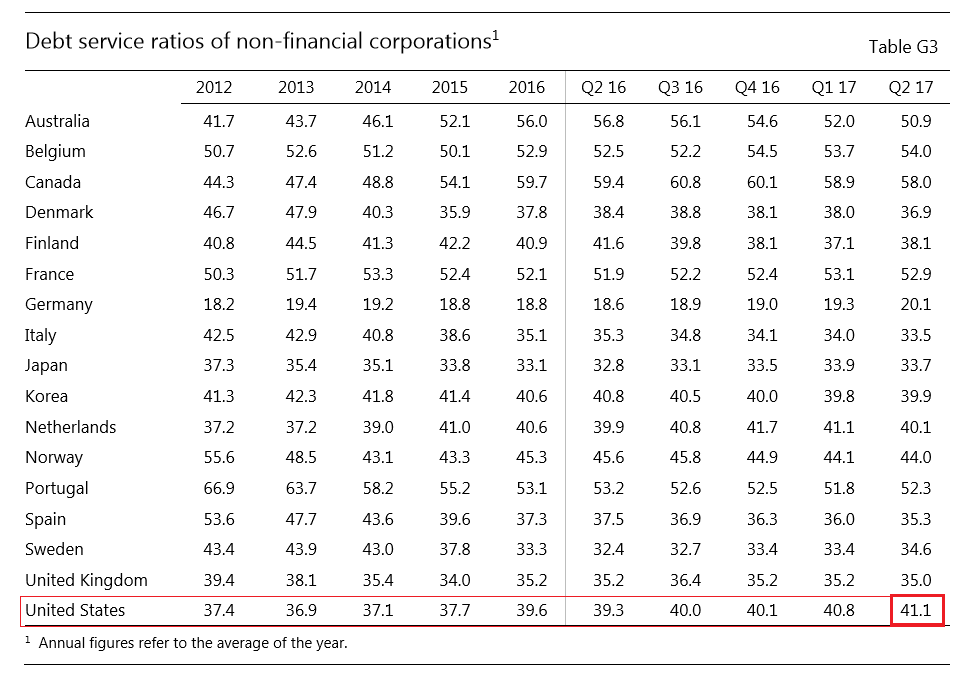

With an average of 41.1% of US corporate profits are already going simply to service their debts (a figure known as the debt service ratio or DSR), even at the currently extremely low rates of interest, a rise in line with Federal Reserve estimates of three or possibly four more hikes in 2018, would increase that debt burden substantially.

Whilst US companies do not have the highest DSR in the world, as shown in the table produced by the Bank of Internation Settlements (BIS) below, they are still comparatively high and interest rates are rising more quickly in the US than most countries.

If this picture of corporate indebtedness jars with the more commonly held perception of corporates enjoying burgeoning profits, which are squirreled away in hidden cash piles offshore, it is because the perception is a distortion of the savage reality of the widening inequality of the US corporate chicken run.

The top 1.0% of corporations - the Apples, Amazons, and Googles of the world - increasingly own a greater portion of the pie with estimates showing they now own over 50% of the corporate cash pile leaving the other 99.0% with little more than debt.

"Cash and investments held by S&P Global Ratings' universe of rated U.S. nonfinancial corporate issuers rose by 10% to $1.9 trillion in 2016 as the rich get richer: The top 1% control more than half of this cash pile," says Danske bank private banking investment advisor Tautvydas Marciulaitis.

"But rising debt, now at a collective $5.1 trillion for the 99%, is a concern: Adjusted leverage for both investment-grade and speculative-grade issuers is near decade highs and, conversely, the cash-to-debt ratio near decade lows," he adds.

But what about the promised backflow of repatriated cash due to the government's new tax reforms? Won't they help bring down the debt burden?

Yes, but there is also a risk they will be used in share buy-backs instead, says Marciulaitis.

Don't say you Weren't Warned

Of note, the IMF too flag up similar concerns in their January 2018 World Economic Outlook update where they point out the quality of corporate debt is something that could threaten the global expansion as it increasingly becomes an issue:

"Financial conditions remain easy into the medium term, with a protracted period of very low interest rates and low expected volatility in asset prices, vulnerabilities could accumulate as yield-seeking investors increase exposure to lower-rated corporate and sovereign borrowers and less credit-worthy households."

Recall, the quality of mortgage debt was the driver behind the 2008 crash where poor quality mortgages were simply defaulted on which in turned sparked a spiral of financial collapses.

"The share of companies with low investment-grade ratings in advanced economy bond indices has increased significantly in recent years," warn the IMF.

Yet regardless of what companies decide to spend their repatriated earnings on, the problem is likely to be bigger than these modest inflows can solve, and once large companies start to feel the pinch one of the first things they will reign in investment, which will negatively impact on growth.

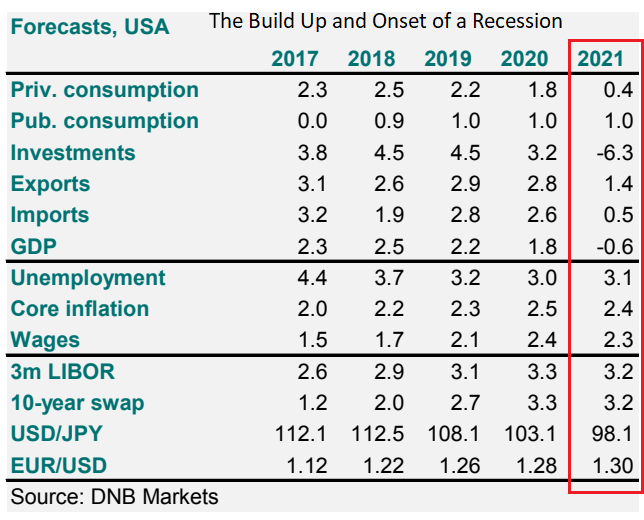

"In light of the high debt level in the business sector, we predict that the recession will primarily be driven by a steep decline in corporate investments. We have developed a possible scenario in which growth in investment slows down in 2020 and falls steeply throughout 2021. Investments are expected to decline by 8 percent from 2020 to 2021," says DNB economist Knut A. Magnussen.

US GDP is forecast to steadily slow over coming years with a -0.6% due to be recorded in 2021 when the recession takes hold.

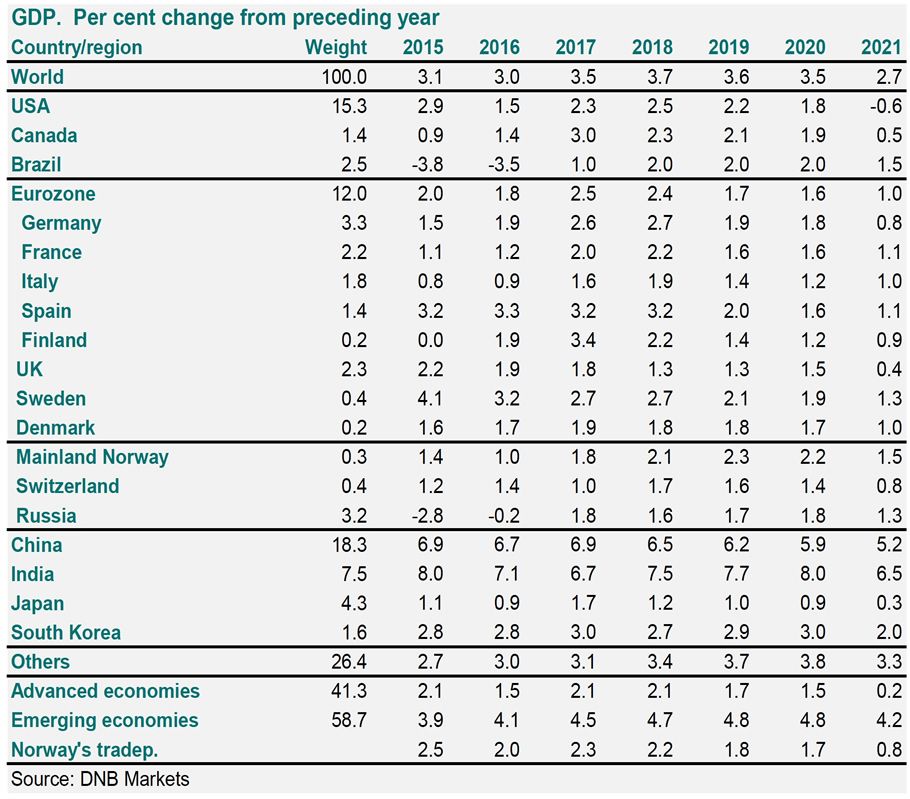

It is also worth noting that other countries will not be immune to the global slowdown as the developed world often tends to track the US economic cycle.

"We expect the next three years to be at least as good for the global economy as a whole. Growth in emerging economies, which accounted for three fourths of global growth last year, has the potential to accelerate further," says Haugland.

However, the contagion effect of a US recession - sparked by unsustainable corporate debt - is seen impacting global growth, particularly that of the Eurozone:

"When the recession will come, what will trigger it and how strong it will be are very uncertain. The timing of a US recession makes a big difference for its impact on the world economy. If it is imminent, the eurozone in particular, where economic recovery has come the shortest, will have few remedies in the form of monetary policy stimuli."

Haugland says the ripple effects will spread to other countries and pull global economic growth down by one percentage point to 2.5 per cent in 2021.

"The increase in credit spreads is likely to spread quickly to other countries and make it harder and costlier to take out new and renew existing loans. Lower US imports will eventually be reflected in

weaker export growth in other countries. Uncertainty about the future will thereafter make both businesses and households more cautious," says Haugland.