UK GDP Forecasts Cut at Bank of America, Timing is Everything When it Comes to Brexit Transition

Analysts at Bank of America Merrill Lynch have cut their forecasts for the UK’s economy saying a combination of interest rate rises, Brexit uncertainty and subdued consumer confidence will weigh.

UK economic productivity is weak, and is expected to remain weak argues Robert Wood, UK Economist at Bank of America Merrill Lynch who argues this will translate into a long-term growth rate for the economy of between 1-1.5%.

This is below assumptions for trend growth of 2% at the Bank of England.

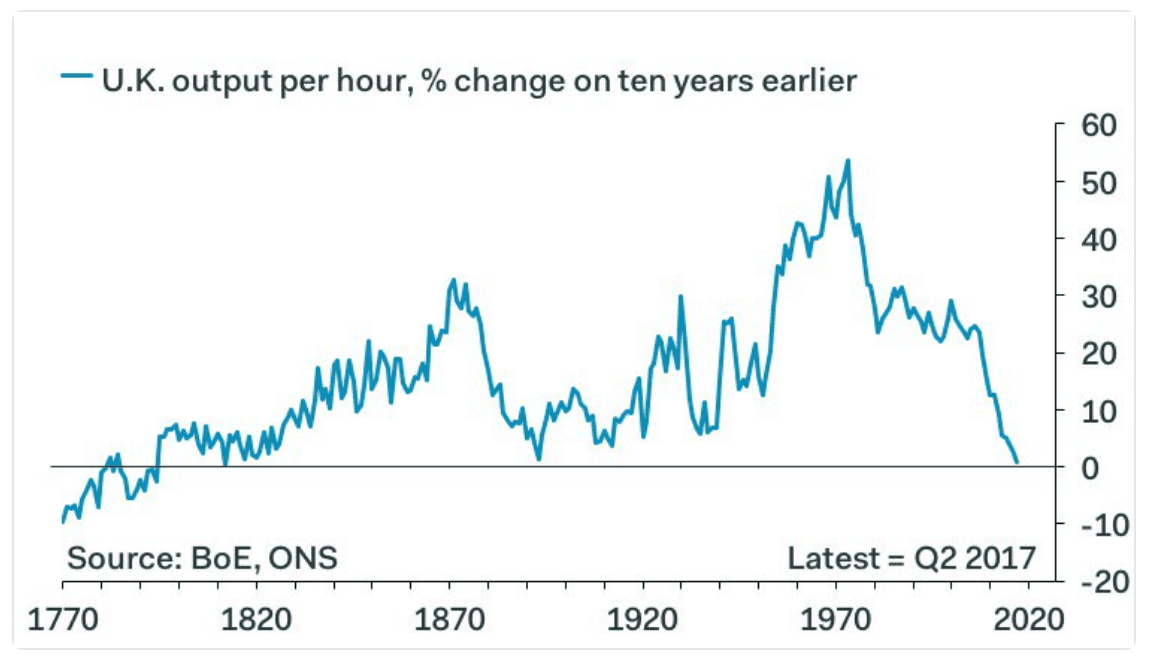

As per latest Bank of England data, the productivity of the UK worker is simply stuck in a rut, and if you are not being more productive, do you deserve a pay rise? Of course note. As such, if there is one chart that should catch your attention today it is this:

As noted by Samuel Tombs at Pantheon Economics, “simply staggering - productivity (output per hour) in Q2 just 0.9% higher than a decade ago, the worst result for 200 years.”

The Bank of England reckons the UK will soon start becoming a more productive country, which will in turn raise inflation which must in turn be tempered with an interest rate rise.

As such the Bank of England’s communicated intent to raise interest rates from record lows in the near future is the wrong decision argues Wood as weak trend growth means real wages will not rise at traditional rates after inflation drops back, which will deliver a weak growth outlook.

And the UK’s love affair with debt - both public and private - presents a significant constraint on future UK growth.

“We do not believe households have finished deleveraging. They loaded up on credit after the negative, in our view, Brexit shock. There may be a misperceptions gap,” says Wood.

Growth Forecasts Cut

In a note to clients dated October 6, Bank of America announce they have cut their 2018 growth forecast to 1.0% from 1.2%.

The decision rests on three reasons:

- the BoE say they will hike rates to keep growth weak. BofA track 0.2% qoq 3Q GDP growth. Leading indicators point to no 4Q improvement;

- Households have more adjustment to make to weak income. That will keep consumption subdued;

- falling construction orders, output, weak business expectations, and some easing of investment intentions suggest investment will remain under pressure in the near-term. We assume growth of 0.2% qoq until 2Q 2018, delaying the growth pick-up we had previously assumed started in 1Q.

Brexit will however play a key role in the eventual shape of UK growth with Wood arguing the transition deal could prove to be a potential upside.

The main bull case, in Bank of America’s view, is the possibility that a deep Brexit transition deal is agreed soon.

“We expect a transition deal to be agreed in the end, but the longer it takes the less valuable it will be, in our view. We cannot be confident about when a deal will come, especially with political events coming thick and fast,” says Wood.

How firms react is another unknown: if transition came with a clear hard Brexit path in the long-run, would it help?

Inflation to Drop Rapidly

Bank of America meanwhile expect inflation to drop back to the BoE's 2% target in May and end 2018 at 1.8%, though they warn these forecasts are very sensitive to Sterling moves.

“We see plenty of evidence that Sterling effects have passed through to consumer prices quickly, meaning there is less to come,” says Wood.

BofA say underlying inflation pressures remain very subdued in, so once the effects of Sterling’s deep fall in 2016 fade, “there is little prospect of above target inflation. This is one reason we do not expect the BoE to follow a November hike with another hike next year.”