Summers: A Fed Pivot Would be Disastrously Premature

Lawrence Summers, former U.S. Secretary of the Treasury, former director of the U.S. National Economic Council and former Chief Economist for the World Bank, says the Federal Reserve cannot pull back on its inflation-fighting quest.

File image of Lawrence Summers, image © IMF.

As the Fed prepares to meet, there is a growing chorus - both among political figures and economists - that the Fed should pause very soon for fear they will throw the economy into recession, given the lagged response of monetary policy.

I believe this advice is badly misguided.

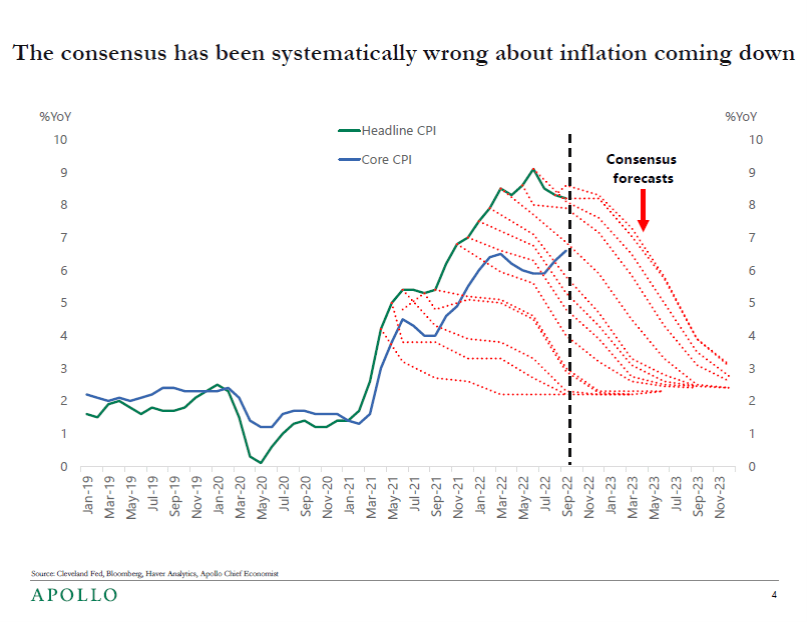

It comes from a consensus of economists who have a track record, since COVID, of being dismally wrong on inflation.

It is usually wiser to worry about things that have happened before, rather than those that which has never occurred.

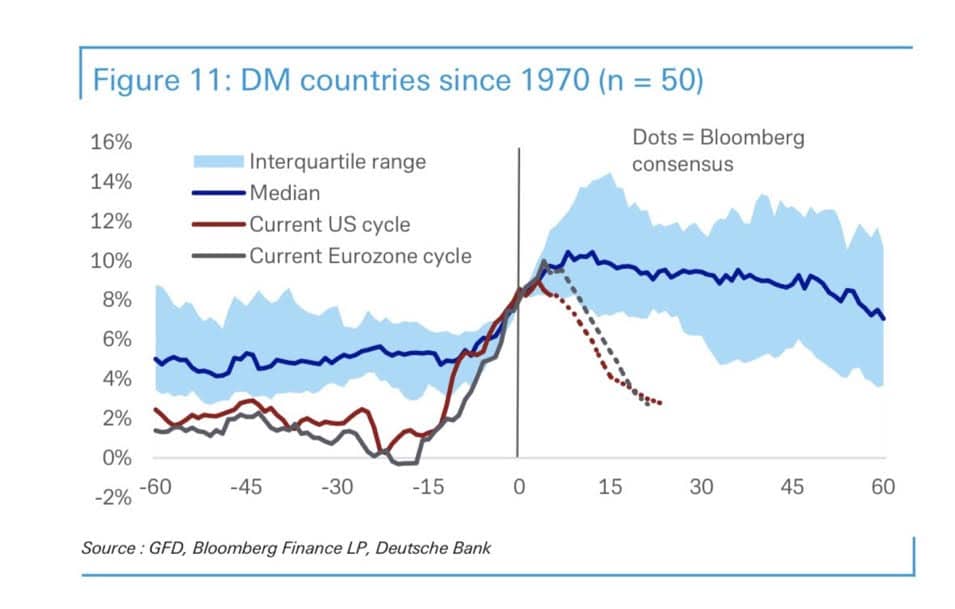

The Federal Reserve paused too soon because of recession fears many times between 1966 & 1981. Are there any cases where it kept fighting too long causing an excessive recession?

The symptom of excess tightening would be one if inflation was brought down sustainably below the Fed's 2% target.

Does anyone really believe that raising rates beyond 4% will bring core inflation from well above 6% down below 2%? Why?

Or is the argument, “Never mind inflation...Make sure we don’t have a recession.”

Those with this view need to explain how visibly abandoning the 2% target will play out.

The only previous time we dedicated monetary policy dominantly to avoiding recession was the disastrous 1966 - 1981 period.

History suggests that once generated, high inflation is very hard to stop. The vast majority of efforts to stop inflation have failed in industrial countries.

Finally, it is important to recall that expectations have remained anchored because the Federal Reserve has been moving.

If the Fed stops moving expectations may increase.

If the Federal Reserve doesn’t carry through on the market’s current expectation that rates will approach 5%, markets and others will see it as an easing.

On balance, especially given its past errors, the Federal Reserve should stay on the current course and then evaluate things.