'Return to Normal' Boosts the UK Economy, But Economy to Shrink in 2nd Quarter say Economists

- Written by: Gary Howes

Image © Adobe Images

The UK economy grew again in February as the services sector continued its recovery from Covid, but the war in Ukraine and surging inflation are likely to slow growth rates over coming months.

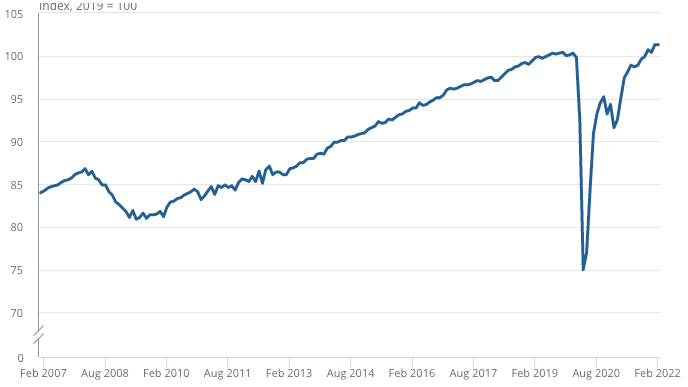

UK GDP grew 1% in the three months to February says the ONS, a figure that beats analyst expectations for a reading 0.9% but represents a slight slowdown on January's figure of 1.1%.

The month-on-month change from January to February was 0.1%, which was weaker than the 0.3% the market was looking for and lower than the previous month's 0.8% reading.

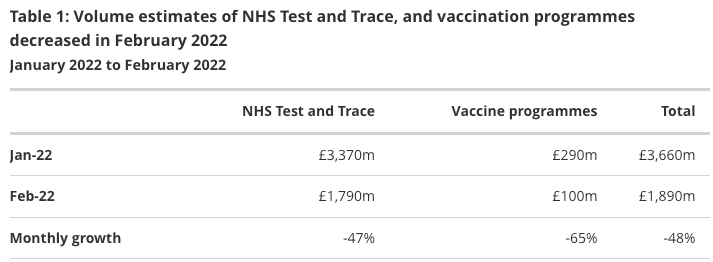

The figure would have been higher were it not for the ending of the government's Test and Trace programme, shows data from the ONS.

The year-on-year figure for February stands at 9.5%, in line with the forecast but again slightly lower than the upwardly revised 10.5% reported in January.

This means monthly GDP is 1.5% above its pre-coronavirus (Covid-19) pandemic level (February 2020).

Above: Monthly index, January 2007 to February 2022, UK. "UK monthly GDP is estimated to have grown by 0.1% in February 2022, and is now 1.5% above its pre-coronavirus pandemic level (February 2020)" - ONS.

Encouragingly, services grew by 0.2% and was the main contributor to February's growth in GDP.

But the outlook remains challenged by surging inflation which has been turbo-charged by the war in Ukraine that commenced at the end of February.

Therefore the data misses much of the subsequent negative effects posed by the war.

"It’s little wonder the economy overall is showing signs of stalling from its remarkable pandemic recovery, given the sense of foreboding which arose from mid-February as troops amassed on the Ukraine border and then the commodity shock unleashed by the invasion hit sentiment," says Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

Streeter says economic growth over the coming months will require a shift upwards in overall productivity levels but with the labour crunch intensifying, borrowing costs rising and business investment flagging that is proving elusive.

Nevertheless, the rebound from Covid continues to offer the UK economy some support with the ONS saying services sector growth in February was mainly driven by tourism-related industries with increases in both travel agency, tour operator and other reservation service and related activities.

Output in consumer-facing services grew by 0.7% in February 2022, following 2.0% growth in January, revised up from 1.7%.

Services is now 2.1% above its pre-coronavirus level, while construction is 1.1% above and production is 1.9% below.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The ONS does however point to the scope for further post-Covid recovery in the services sector as consumer-facing services are still 5.2% below their pre-coronavirus levels, which compares with all other services which are 4.0% above.

Accommodation and food service activities grew by 8.6% in February 2022 and was the main contributor to February’s growth in services.

Within this sector, the ONS says the main driver was accommodation, which grew by 23%. This partly reflected a bounce back following weakness in both January and December because of the impact of the Omicron variant of coronavirus.

There was strength seen in hotels and camping grounds.

The ending of the NHS Test and Trace and Covid-19 vaccination programme meanwhile detracted 1.1 percentage points from GDP growth in February 2022, confirming the government's response to the pandemic has provided a substantial impact on the UK economy over the course of the pandemic.

"The winding down of the UK's booster vaccine and Covid-19 test campaigns weighed on growth in February and will continue to do so for the next few months," says James Smith, Developed Markets Economist at ING Bank.

Smith says if health spending hadn't risen through the pandemic, monthly GDP would be over 1% lower.

Looking ahead, ING expects 'the cost of living crisis' to begin to show through in some of the consumer spending categories.

Consumer confidence has fallen considerably in recent months says Smith and the second quarter's additional bank holiday will artificially depress quarterly GDP to some degree.

"Putting that together, we expect first-quarter GDP to come in at roughly 1% before turning negative in the second quarter. We expect a small contraction of -0.2/-0.3%, though for now, the jury’s out on whether that evolves into a technical recession," says Smith.

A recession would require an additional fall in GDP in the third quarter.

Capital Economics says there is now an increased risk of a contraction in GDP in the coming months as the squeeze on household real incomes intensifies.

"The pace of the recovery was already going to slow once the post-Omicron bounce faded and the squeeze on household real incomes intensified. But we hadn’t expected it to slow so much so soon," says Ruth Gregory, Senior UK Economist at Capital Economics.

She expects the economy may have grown by 1.0% in the first quarter as a whole, down from a previous estimate of 1.1%, and the risks to a 0.2% growth forecast for the second quarter is "tilted to the downside".

Looking ahead, economists at Pantheon Macroeconomics forecast GDP likely to fall by about 0.3% quarter-on-quarter in the second quarter.

"The end of free Covid-19 testing in April and widespread vaccinations in the summer points to a further sharp decline in output in the health sector. In addition, past experience suggests that June’s extra public holiday, to mark the Queen’s Platinum Jubilee, will subtract about 0.4% from the level of Q2 GDP," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

A sharp decline in real disposable incomes at UK households in the second quarter is anticipated to bring the recovery in real expenditure to a stand-still.

"Given this weak near-term outlook for GDP growth, we continue to think that the MPC will stop increasing Bank Rate after raising it to 1.0% next month," says Tombs.