Bank of England: August 2022 Interest Rate Rise Now Likely says Deutsche Bank

- Written by: Gary Howes

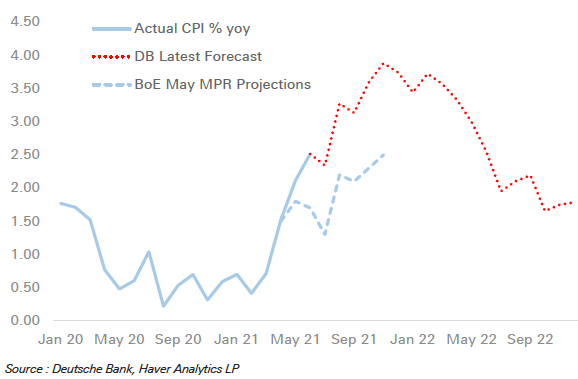

- Inflation at 4.0% likely

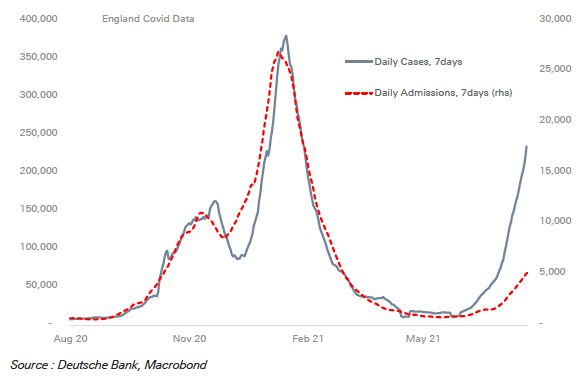

- UK reaching herd immunity

- But GDP growth to disappoint

The Bank of England's August 06 policy decision will be an important one for Pound Sterling and financial markets as it will likely provide a template on how the Bank intends to whittle down its balance sheet and raise interest rates once more.

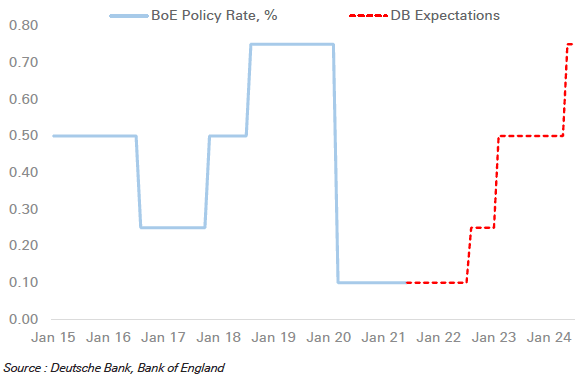

Any hints that a rate rise might occur in the first half of 2022 would be an outcome consistent with the more 'hawkish' end of market expectations and would therefore likely trigger gains in the Pound.

But such a rush into a rate hike is unlikely shows new analysis from Deutsche Bank.

In a new research briefing they warn that while UK inflation might hit 4.0% in coming months, the economy won't grow as fast as the Bank of England expects, therefore making a lift off in interest rates in August 2022 a more likely outcome.

Above: CPI inflation on course for 4.0% says Deutsche Bank

This is nevertheless earlier than had previously been expected as Deutsche Bank's previous lift-off target was 2023.

"The strength of the UK’s recovery has been stronger than we anticipated coming into 2021," says Sanjay Raja, Senior Economist at Deutsche Bank. "The labour market has outperformed, and any rise in unemployment we now think will be modest."

According to Raja, the UK's improved economic outlook is driven by the "extraordinary" success of the country's vaccine rollout that has allowed for all previous restrictions to be lifted even in the midst of rising cases.

The government's confidence in the vaccines has paid off as hospitalisations and deaths have been significantly curtailed even as cases rise.

"Deaths from Covid have sunk considerably over the current wave, with 92% of adults showing signs of Covid antibodies. To be sure, the UK is moving ever closer to herd immunity," says Raja.

This view will be backed up by data showing cases in the UK have started to fall rapidly over the course of the past week.

The improvement in the health outlook has implications for the Bank of England's forward guidance and this could well prove to be a source of bullishness on the Pound on August 06.

"With the economy now fully open and vaccine effectiveness proving its mettle, the balance of risks around the health outlook lean towards some removal of emergency pandemic policy support over the next year," says Raja.

In terms of the inflation debate, "we think Bank expectations may be underestimating the scale of inflationary pressures – both in terms of peak and persistence," says Raja.

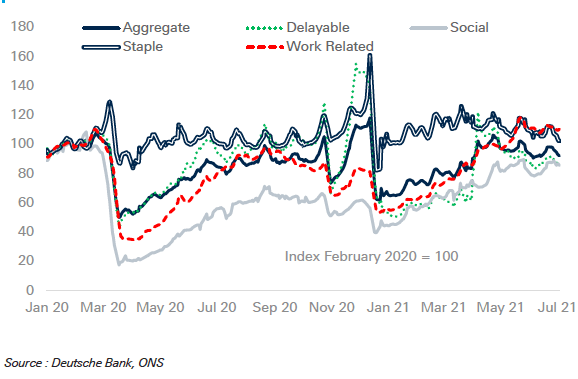

Above: Card spending data from the Bank of England's CHAPS system shows a slowdown in spending despite restrictions easing. Image courtesy of Deutsche Bank.

UK inflation has shot above the Bank's 2.0% inflation target already and Deutsche Bank economists expect the headline rate to hit nearly 4.0% before 2021 is out; a view that aligns with that of Andy Haldane, the Bank's arch-hawk who has since departed Threadneedle Street.

This is a whopping 1.5% above the Bank's projections published in May and has been a source of much debate amongst various members of the Bank's Monetary Policy Committee over recent weeks.

"While we expect much of the jump in core inflation to be transitory, we also see some excess price pressures remaining for a little longer than highlighted in the Bank’s May MPR," says Raja.

"We see some lingering price pressures in the services basket, as a result of strengthening wage dynamics," he adds.

But despite all the positives in the health situation and hot inflation levels the Bank won't rush into raising interest rates, argues Raja.

This is largely because although inflation will bust the Bank's forecasts growth data won't.

Deutsche Bank observe the recent slowdown in economic growth rates, which could mean the UK economy recovers to pre pandemic levels a full quarter after the Bank's current forecasts suggest.

"With domestic growth already slowing, the fiscal outlook tightening, and Brexit/Covid lowering the UK's near-term potential growth outlook, the Bank of England won't have to do very much to keep inflation in check, with the UK's neutral rate likely to be lower coming out of the pandemic," says Raja.

He adds that any policy tightening needs to be only "limited" and "gradual" over the forecast horizon to return the economy to equilibrium.

Deutsche Bank now expect the MPC to initiate lift-off from the current Policy Rate of 0.1% in August 2022 with a 15bps rate hike, previously lift-off was expected in February 2023.

A 25bps rate hike is then seen in February 2023 and another in May 2024, taking the Bank Rate to 0.75% by 2024.

But bad news for savers is this will likely be the peak of the hiking cycle says Deutsche Bank as this level is closer to the UK's "lower neutral rate".

This is the interest rate suitable for an economy that is at full employment and is experiencing stable inflation, in other words it is the rate at which monetary policy is neither contractionary nor expansionary.