Retail Sales Surge as Pent-up Savings are Put to Use

- Written by: Gary Howes

Image © Adobe Stock

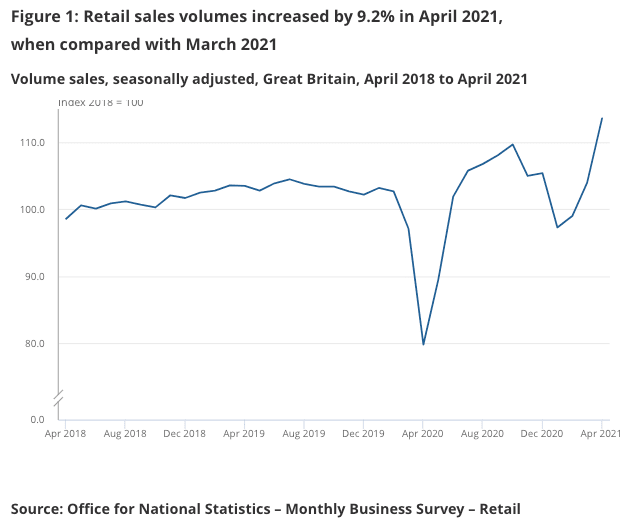

UK retail sales rose sharply in April and were in fact higher than pre-pandemic levels according to new data that suggests the involuntary savings acquired by consumers during months of lockdown are being put to work.

Retail sales rose 9.2% month-on-month in April says the ONS, which is ahead of the 4.5% consensus expectation and an increase in the 5.1% reported for March.

Retail sales rose 42.4% year-on-year in April, ahead of expectations for 36.8% and a sizeable leap on the 7.2% reported for March.

The large annual figure owes itself to a 'base effect' given the observation that a year ago retail sales fell off a cliff as UK lockdowns took hold.

Nevertheless, the beat on expectations is positive for Sterling which went higher against the Euro, Dollar and other currencies in the wake of the data release.

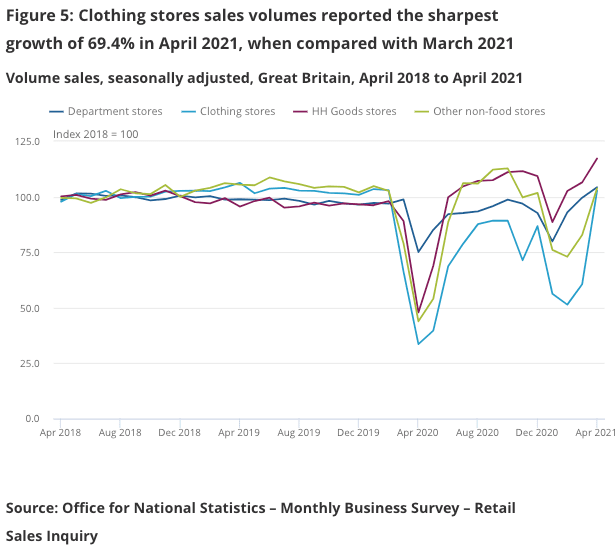

The ONS says the boost to the retail sales figures reflects the effect of the easing of coronavirus restrictions including the re-opening of all non-essential retail from 12 April in England and Wales and from 26 April in Scotland.

The data underpins an expectation amongst economists that the UK is currently experiencing a once-in-a-generation economic rebound as the country moves beyond the crippling effects of lockdown.

"Britain’s high street has come out swinging, and then some. Analysts had been expecting a big April; what they got was a blockbuster," says Ulas Akincilar, Head of Trading at INFINOX.

"Sentiment is strong and the spike in spending cannot be dismissed as a novelty. All of which is likely to put sterling and the UK markets back onto the front foot after a volatile week," he adds.

The data shows non-food stores provided the largest contribution to the monthly growth in April 2021 sales volumes, aided by strong increases of 69.4% and 25.3% in clothing stores and other non-food stores respectively.

A key point made by the ONS is that sales volumes were 10.6% higher than February 2020, before the impact of the coronavirus pandemic.

This is arguably a more important comparison than with sales volumes in April 2020 owing to the distorting 'base effect' of the first lockdown.

That sales are higher than they were in pre-lockdown February 2020 suggests pent-up savings are being put to use.

It is these pent-up savings that economists have said could super-charge the economic rebound.

The ONS says all retail sectors reported a fall in their proportions of online sales as physical stores re-opened during the month; as a consequence, the total proportion of sales online decreased to 30.0% in April 2021, down from 34.7% in March 2021.

"The obituaries written about the high street now look a little premature," says Akincilar.

Total retail sales levels for both the amount spent and quantity bought were meanwhile up 9.9% and 10.6% respectively compared with their pre-coronavirus pandemic February 2020 levels, again confirming some genuine pent-up demand is being released.

Looking ahead, "timely evidence suggests that retail sales might rise even further in May, as consumers continue to complete purchases that they delayed during the lockdown," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

According to the Bank of England's regular CHAPS survey, credit and debit card payments were just 3% below their February 2020 level in the seven days to May 13, improving on the 7% average shortfall in April.

However, looking forward by a few months Pantheon Macroeconomics are not confident the pace of recovery can be sustained.

Tombs notes Springboard’s measure of footfall at retail locations in the week ending May 15 and saw it was just 72% of its level in the same week of 2019, suggesting that bricks-and-mortar retailers have lost out permanently to online competitors.

In addition, Pantheon Macroeconomics continue to think that the recovery in households’ spending will stall as it approaches its pre-Covid level later this year.

"The winding-up of the furlough scheme at the end of September likely will trigger a renewed fall in employment, while rising inflation will push down real wages. In addition, the planned withdrawal of the £20 per week uplift to Universal Credit at the end of September will reduce households’ aggregate disposable income by 0.3%," says Tombs.

In addition, the final grant to self-employed people will be paid in the third quarter according to the government.

"A sharp decline in housing market activity in Q4, once the threshold for stamp duty has returned to £125K at the end of September, also likely will hit demand for big-ticket household goods. Accordingly, we think retail sales will be significantly lower in Q4 than in Q2," says Tombs.