Canadian Dollar Reacts to NAFTA Breakthrough, GBP/CAD Downtrend Ultiamtely Remains Intact

Image © kasto, Adobe Stock

- Canadian Dollar in positive reaction to NAFTA breakthrough

- But 'green shoots' of a potential GBP/CAD uptrend are sprouting

- Broader trend is still down

The Canadian Dollar reacted in positive fashion to news of a breakthrough in NAFTA negotiations between the US and Mexico on Monday, August 27.

According to reports, the United States and Mexico have reached agreement to revise key portions of the 24-year-old North American Free Trade Agreement.

The exact details of the agreement are unclear and an announcement by US President Donald Trump is expected over coming hours.

Reuters meanwhile report that in addition to the Mexico-US breakthrough, talks with Canada can be expected to begin immediately in the hopes of reaching a final agreement by Friday.

“We are now inviting the Canadians in as well and hope that we can reach a fair and successful conclusion with them as well,” an official told Reuters in an interview. “There are still issues with Canada but I think they could be resolved very quickly."

Optimism grew that a deal was possible over the weekend after US President Donald Trump tweeted “our relationship with Mexico is getting closer by the hour… a big Trade Agreement with Mexico could be happening soon!”

On Friday, Canadian Foreign Minister Chrystia Freeland said that Canada would be “happy” to rejoin the talks once the United States and Mexico had made progress on their specific issues.

“Once the bilateral issues get resolved, Canada will be joining the talks to work on both bilateral issues and our trilateral issues,” said Freeland.

For the Canadian Dollar, progress on NAFTA means one of its most pressing headaches could be about to ease.

"There is growing optimism that a US/Mexican agreement can be reached on NAFTA, which in turn would allow Canada to re-join talks and progress to be made overall," says Kit Juckes, a strategist with Société Générale.

Technicals Confirm Downtrend in GBP/CAD Remains Alive

Sterling trades lower against the Canadian Dollar at the start of the new week thanks to the news, with one GBP buying 1.6717 CAD, with the opening rate for the week being at 1.6728.

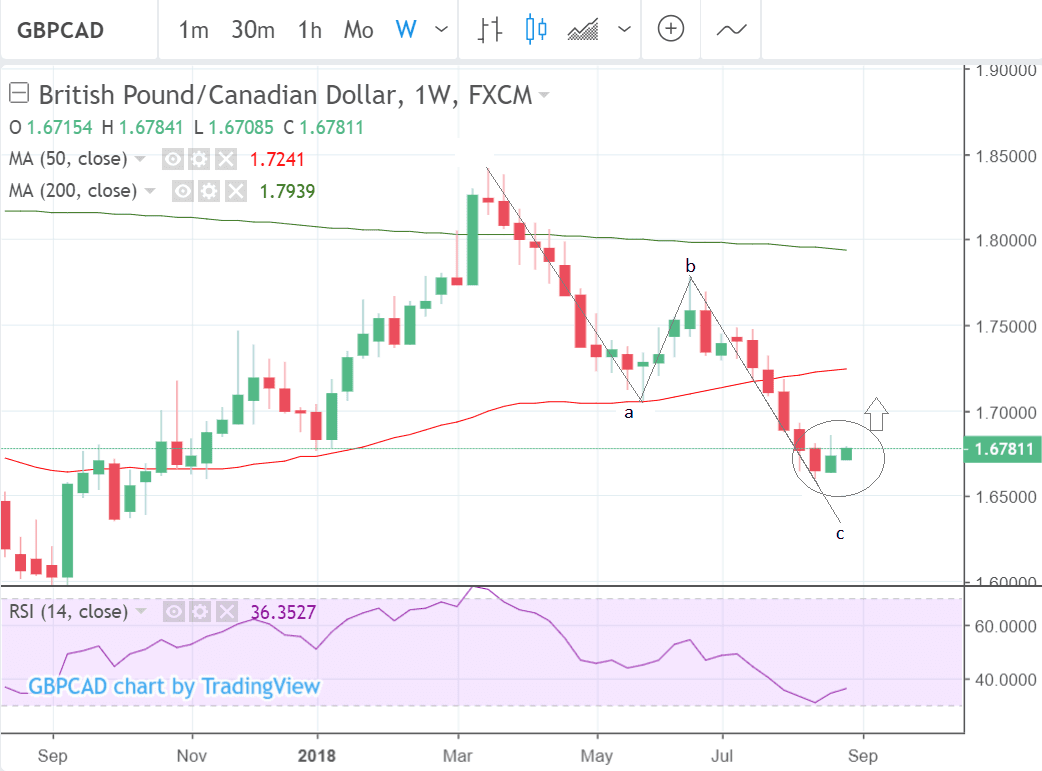

The exchange rate has been falling ever since the 1.84 March 2018 highs and is now trading in the 1.6780s after a decline of nearly 10% from its peak, confirming the existence of a broad-based downtrend.

The strong down-trend still looks intact overall, despite a nascent recovery starting in mid-August.

The move down from the March highs is showing symmetry and looks like a possible three-wave corrective pattern such as an abc correction.

These often 'a' and 'c' legs of similar proportions such that it is possible to forecast how long the final c-leg will be using the length of 'a' as a guide.

In this case you get a target down in the 1.64 region, which suggests the bear trend still has further to go.

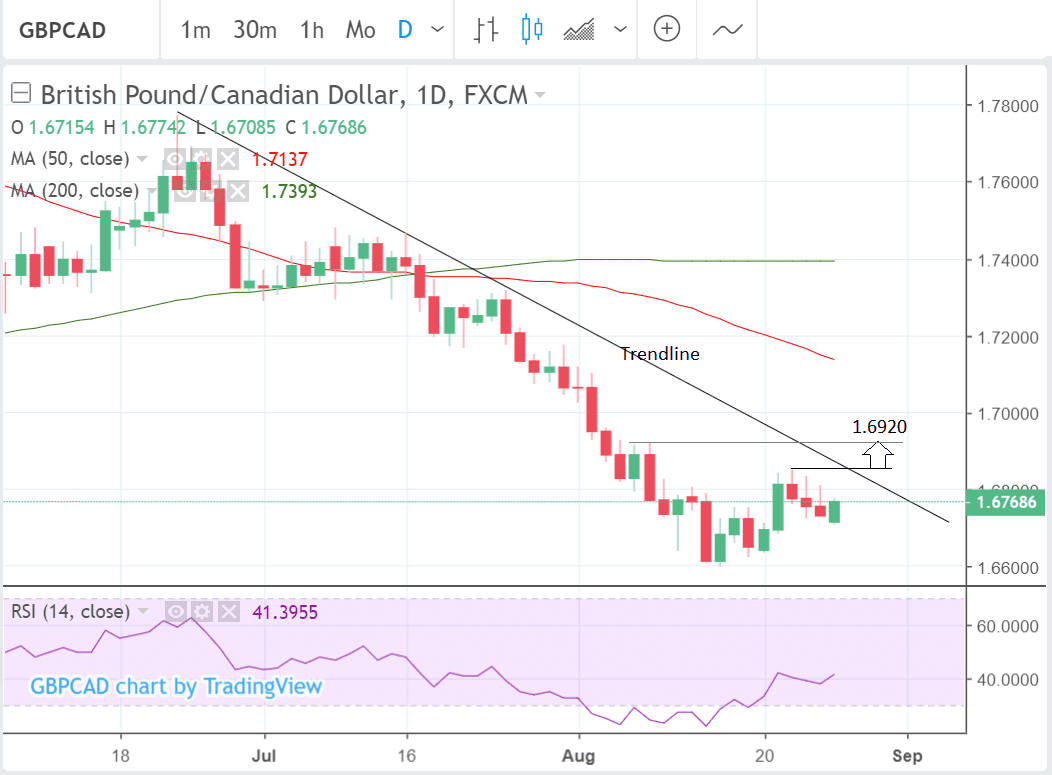

Yet recent activity has been bullish and the daily chart shows that the pair is fast approaching a trendline which could provide a 'make-or-break' level for the exchange rate, above which it would suggest a new trend higher was forming.

Indeed, we think that if the exchange rate broke above the 1.6852 highs, it would confirm the trendline breached and continue up to a target at 1.6920, and the early August highs.

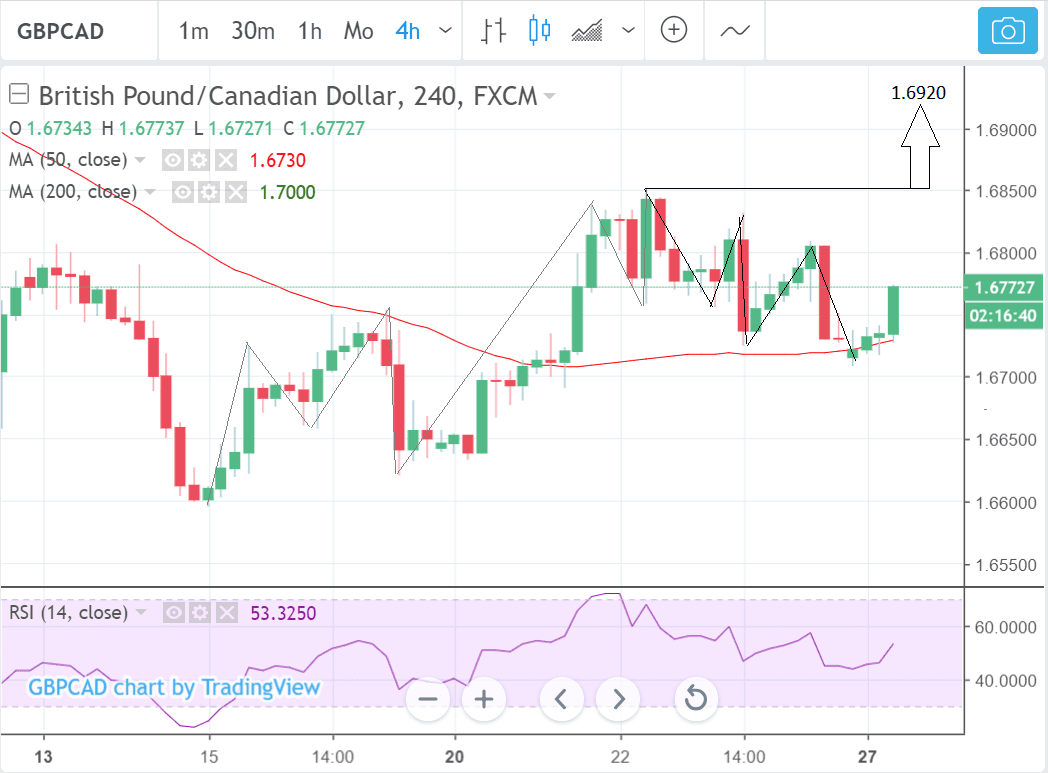

The four hour chart below shows how unclear the trend is. The rally up from the August 15 lows completed two higher highs and higher lows which is normally a sign of a new uptrend, but the same argument can also be made for the move down, which is showing two lower lows and lower highs.

This brings into question the overall direction of the short-term trend.

On balance, we think the bulls have the advantage as the initial move up had the greater momentum, and the last period has been especially bullish.

We think that a break above the 1.6852 highs would lead to an extension higher to 1.6920, in line with the forecast on the daily chart.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

GDP Data Dominates Canadian Dollar's Calendar

NAFTA negotiations aside, economic growth data dominates the CAD's agenda this week.

June GDP is forecast to show a 0.1% rise, from the 0.5% in May, when it is released at 13.30 B.S.T on Thursday, August 27.

Results for Q2 are also released at the same time.

"Q2 GDP is one of the most anticipated quarterly prints in some time, serving as an important input into the Sept 5 rate decision," says Elsa Lignos with RBC Capital Markets. "The BoC hiked almost a year ago after a strong Q2 GDP report (4.5% vs 3.0% in their July 2017 MPR) and a similar upside surprise would move pricing for September towards 50% (currently ~20%)."

The Pound - What to Watch

Brexit remains the overarching factor driving Sterling values at present with negotiations entering a key phase with markets becoming increasingly weary that the two sides remain too far apart to reach a deal.

After their meeting on Tuesday, August 21 UK Brexit Secretary Dominic Raab and EU chief negotiator Michel Barnier announced that with some key autumn deadlines fast approaching, negotiations will now be ongoing. Raab and Barnier will probably meet again on Tuesday, August 28, so we will be looking for any communications.

Latest developments see Prime Minister Theresa May preparing a "cabinet crisis summit" to prepare for a 'no deal' Brexit, amid fears that a cabinet row between 'Remainers' and 'Brexiteers' will stop Britain going it alone, and undermine her negotiating position with Brussels.

The Prime Minister's office has reportedly ordered cabinet ministers to clear their diaries for September 13 to work on a plan to pump fresh cash into critical areas not yet covered by disaster plans.

Only when markets are convinced that a 'no deal' Brexit will be avoided to we believe the conditions for a sustainable recovery in the Pound will emerge.

On the calendar, there are no stand-out events for the Pound in the week ahead so we comment on them chronologically.

The week for Sterling starts with the continued testimony of Bank of England (BOE) officials before the the Parliamentary treasury select committee on Tuesday, August 28. Any new information on where interest rates in the UK are headed over coming months could well move Sterling.

Few analysts realistically expect the BOE to raise interest rates until the outcome of Brexit is clarified and therefore the next possible move will likely come later in 2019, but there is always an outside chance officials may hint differently on Tuesday.

If it seems more likely interest rates will rise then the Pound will also rise because higher interest rates attract greater inflows of foreign capital, drawn by the promise of higher returns.

The next major release for the Pound is house price data from Nationwide, on Wednesday, at 07.00 B.S.T, which is forecast to shown a 0.1% rise in August from July and 2.6% compared to a year ago. This is unlikely to move Sterling unless it comes out widely different from expectations.

Thursday sees lending data out at 9.30, including BOE Consumer Credit in July, Net Lending to Individuals, Mortgage Lending and Mortgage Approvals also all for July. These may be significant as the gauge consumer's stomach for credit and therefore their ability to spend extra cash. Higher spending generally aids growth and is positive for Sterling.

Friday sees the release of Gfk Consumer Credit data for August, which is expected to come out negative at -10, when it is released at 12.01. This is important in a similar was as the BOE data above.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here