RBA Decision is "Australian Dollar" Supportive Near-term: GBP/AUD Pulls Back from Resistance

- Written by: Gary Howes

- RBA hikes 25bp

- In line with expectations

- AUD receives a boost

- But, gains might be short-lived

- As RBA terminal rate to be set low

Image © Newtown Grafitti, Reproduced under CC Licensing.

The Pound to Australian Dollar exchange rate (GBP/AUD) retreated from recent highs after the Reserve Bank of Australia (RBA) raised interest rates by 25 basis points and, crucially, indicated it was not ready to end the hiking cycle.

The RBA raised Australia's basic rate of lending to a decade high of 3.10% as said, "inflation in Australia is too high" and it "expects to increase interest rates further over the period ahead."

The Australian Dollar was higher against all its G10 peers in response to the developments with markets judging the central bank might be on course to raise rates further than previously envisioned.

"The Australian dollar flickered up from 0.6715 to 0.6735 in response to the 25bp cash rate hike which was fully expected by economists but only about 80% priced into money markets. The statement maintained the line that the RBA 'expects to increase interest rates further over the period ahead', which is Australian Dollar-supportive," says Sean Callow, Senior Currency Strategist at Westpac.

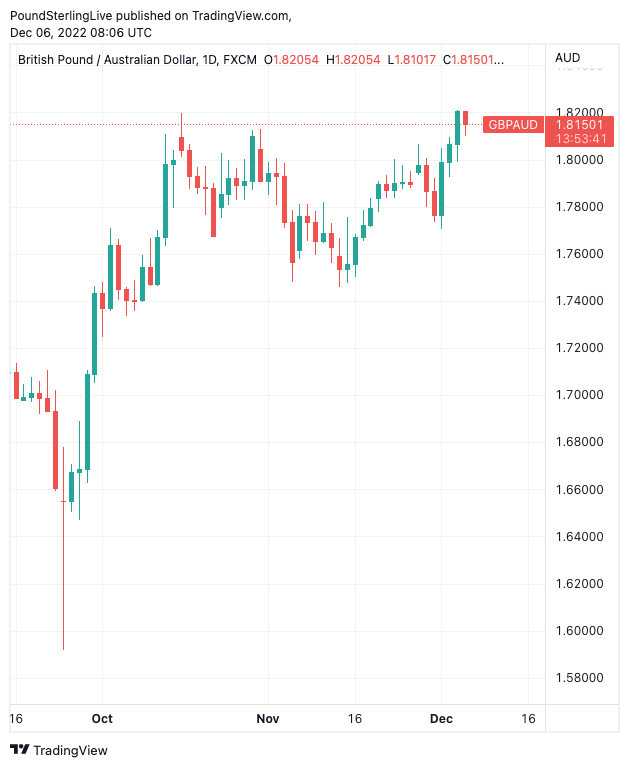

The GBP/AUD exchange rate had meanwhile rallied to 1.82 for the second day in succession but promptly fell in the wake of the decision and is quoted at 1.8144 at the time of writing.

This takes AUD transfer rates on a typical bank account to approximately 1.7643, cash and holiday money rates at competitive providers to around 1.7834, and rates at competitive transfer providers are seen quoting nearer to 1.8088.

Above: GBP/AUD at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

The Australian Dollar's reaction to the RBA decision suggests GBP/AUD will continue to struggle at the resistance band identified in Pound Sterling Live's GBP/AUD week ahead forecast. However, the trend does still appear to be higher and an eventual break can therefore still not be discounted.

The RBA decision comes at a time of general Aussie Dollar weakness, linked to a view that the RBA will be one of the first major central banks in the G10 to end its hiking cycle.

This risks leaving Australia's base interest rate well below those of the U.S., UK and New Zealand, which will in turn pressure the Aussie.

"The Aussie which has been underperforming in recent weeks and in fact is #9 in the G10 since 3 October, the eve of the RBA’s unexpected reversion to 25bp steps. The Kiwi is easily #1 in this time, backed by a hawkish RBNZ," says Callow.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

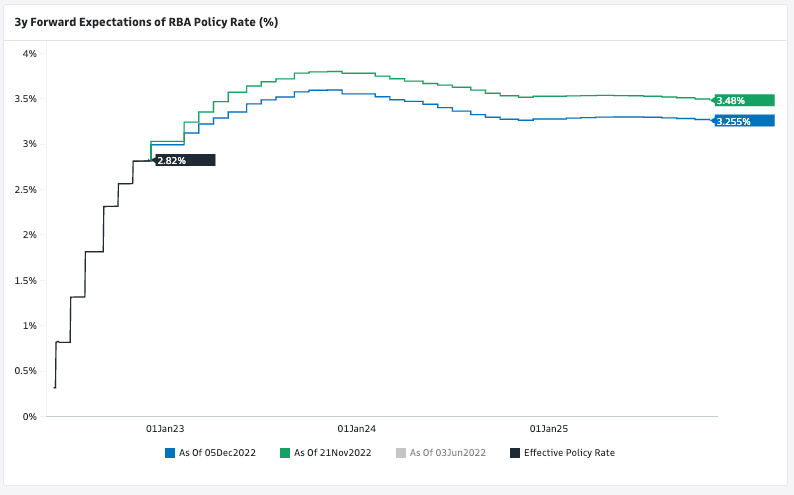

Money market pricing suggests investors now see the RBA cash rate peaking around 3.65% in the fourth quarter of 2023, well below a 5.00% peak in the Federal Reserve funds rate, the 5.35% priced for the RBNZ and 4.63% expected of the Bank of England.

ING Bank expects another 50bp of further tightening in 2023, "implications for AUD are limited, however, and we see downside risks as Chinese sentiment falters," says Francesco Pesole, FX Strategist at ING.

The RBA said it will maintain a policy of setting interest rates according to the incoming data, denying the market any formal forward guidance.

Nevertheless, for foreign exchange markets, there is little to suggest a significant repricing higher in Australian interest rates.

Francesco Pesole, FX Strategist says AUD will likely trade in a "contained" manner with global risk sentiment likely to hold a grip on near-term price action. "Especially market sentiment on China. It does appear that optimism related to easier Covid restrictions in China is quickly evaporating, and AUD may soon end at the bottom of the G10 scorecard," says Pesole.

Above: RBA rate hike expectations as implied by money market pricing. Image courtesy of Goldman Sachs.

Economists at ANZ say Australia's cash rate target will rise to 3.85% by May 2023.

"While each move from here will be data dependent, we think the key numbers such as CPI and wages will leave the RBA with little option but to tighten further," says David Plank, Head of ANZ Economics.

"We think inflation and wages growth will prove to be too high for the RBA to stop hiking anytime soon," he adds.

Although ANZ's expectation for 3.85% is higher than current market expectations, it is only marginally higher, and does therefore not represent the kind of upshift in rate expectations required to set the Aussie alight.

Commonwealth Bank of Australia (CBA) now expects the cash rate to peak at 3.35% in February 2023, which is substantially below market expectations.

The reason to expect one more rate hike of 25bp rests with the scale and pace of recent hikes.

"RBA have delivered a massive amount of tightening in a short space of time. The RBA's 5bp interest rate hike today means that they have taken the cash rate up by a whopping 300bp between 4 May and 6 December–(eight meetings over seven months). And as Governor Lowe noted in his post-meeting Statement 'there has been a substantial cumulative increase in interest rates since May'," says Gareth Aird, Head of Australian Economics at CBA.

What's more, CBA anticipates the RBA will be prepared to cut to the tune of 50bp by the fourth quarter of 2023. (CBA announced following the rate hike that their variable interest rate mortgage products would increase by 0.25% p.a.)

Whether these cuts occur in isolation or in tandem with other central banks would be a key factor in the Australian Dollar's performance in 2023 as cutting in isolation would likely place significant downward pressure on the currency. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Regarding the near-term outlook, the focus for the Australian currency will now likely turn to central bank decisions in the UK, U.S. and Eurozone.

But it will be China's evolving policy response to rising Covid cases that will potentially top the list of concerns.

"With the RBA meeting now past, AUD will take its cue from developments in China," says Joseph Capurso, a foreign exchange strategist with CBA.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes