Australian Dollar Forecasts Cut at Westpac; GBP/AUD Seen Lower

- Written by: James Skinner

- AUD/USD still in with a shot at 0.80, Westpac forecasts

- Citing commodity rally, global recovery & RBA's outlook

- AUD recovery seen tipping GBP/AUD lower by year-end

Image © Adobe Images

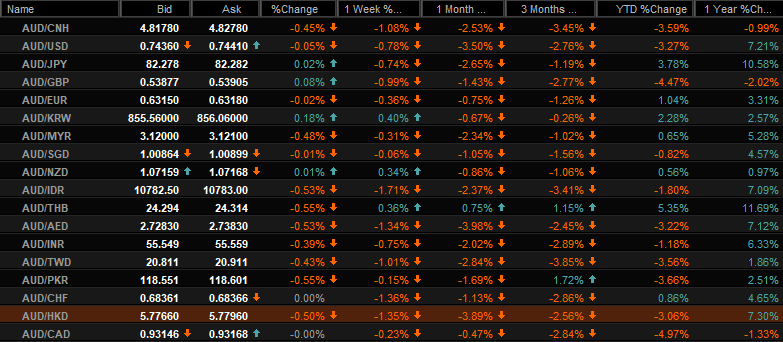

- GBP/AUD reference rates at publication:

- Spot: 1.8596

- Bank transfer rates (indicative guide): 1.7945-1.8075

- Money transfer specialist rates (indicative): 1.8430-1.8466

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Australian Dollar has taken a cold shower in recent months, one made longer by the Federal Reserve’s shake up of the market in June, but newly downgraded Westpac forecasts are holding out for an antipodean comeback that is expected to push GBP/AUD lower before year-end.

Few other currencies have fallen from favour like the Aussie in the weeks since the Fed shocked the U.S. Dollar back into life when indicating that its inflation and employment targets could be met earlier and interest rates be raised sooner than was previously guided for.

Australia’s Dollar has fallen against around half its major currency counterparts since then while ceding ground to all but one component of the Reserve Bank of Australia’s (RBA) trade-weighted index, which measures the antipodean currency against currencies of Australia’s largest trade partners.

“The Australian dollar has been making heavy going of it, trading in a broad range between US74.5¢ and 78¢ over recent weeks. For now, currency markets have been largely overlooking the elevated level of commodity prices. That is likely to change,” says Bill Evans, chief economist at Westpac.

Above: Quotes and performances for constituents of RBA’s Australian Dollar trade weighted index. Source: Netdania Markets.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Neither the huge and mostly enduring percentage gains in industrial commodity prices, nor a favourable shift in the RBA’s monetary policy stance have mattered much for the Aussie since the middle of June, a period in which the U.S. Dollar has been the winner among major currencies.

But the Westpac Economics team sees this changing over the coming months after anticipating that some other central banks will look to catch up with the U.S. Federal Reserve and that investors will give greater recognition to higher commodity prices and the macroeconomic tailwind they provide Australia.

“The unfolding global recovery, increased vaccinations, and the burgeoning current account surpluses will be supportive of the AUD, sending it up to US80¢ and above as we move into 2022,” Evans says when unveiling new forecasts for Australian Dollar exchange rates.

“We now believe that the conditions necessary for the Reserve Bank to begin raising the cash rate will be achieved by the end of 2022, setting the scene for the first increase to 0.25% from 0.1% in the March quarter 2023,” Evans adds.

The bank downgraded its forecasts for the Australian Dollar in its July market outlook but still envisages scope for the main Aussie exchange rate AUD/USD to return to the 0.80 level that was briefly seen for the first time in three years during February.

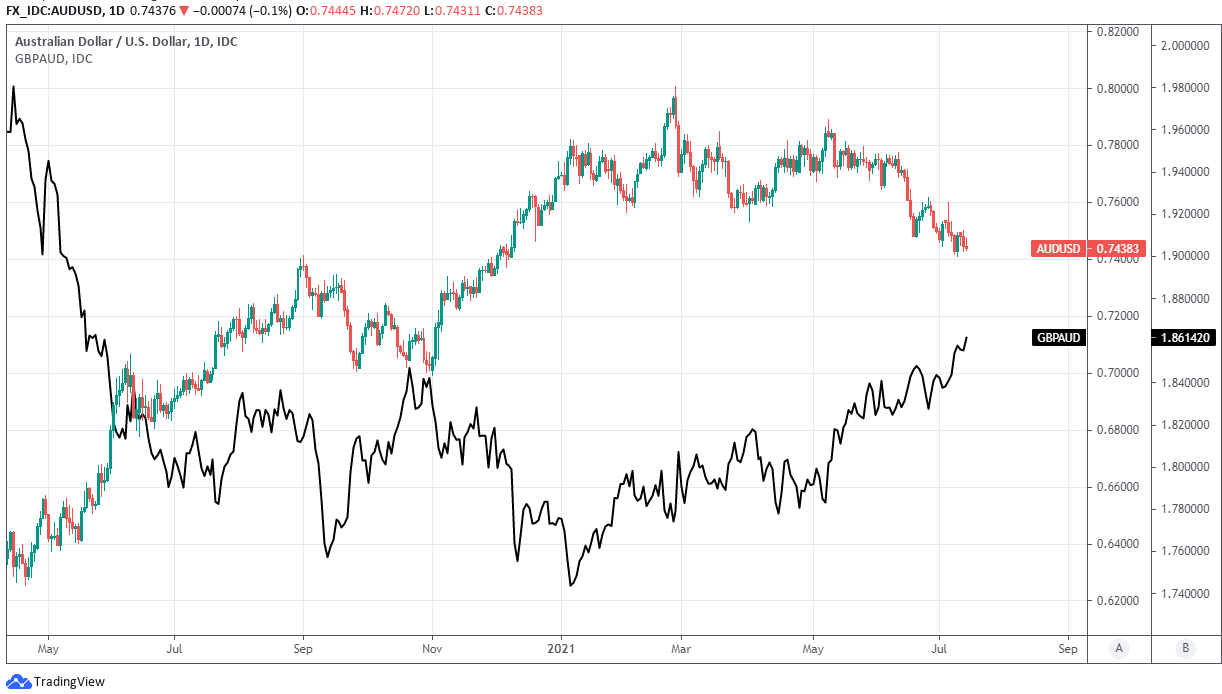

AUD/USD shown at daily intervals alongside Pound-Australian Dollar rate.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

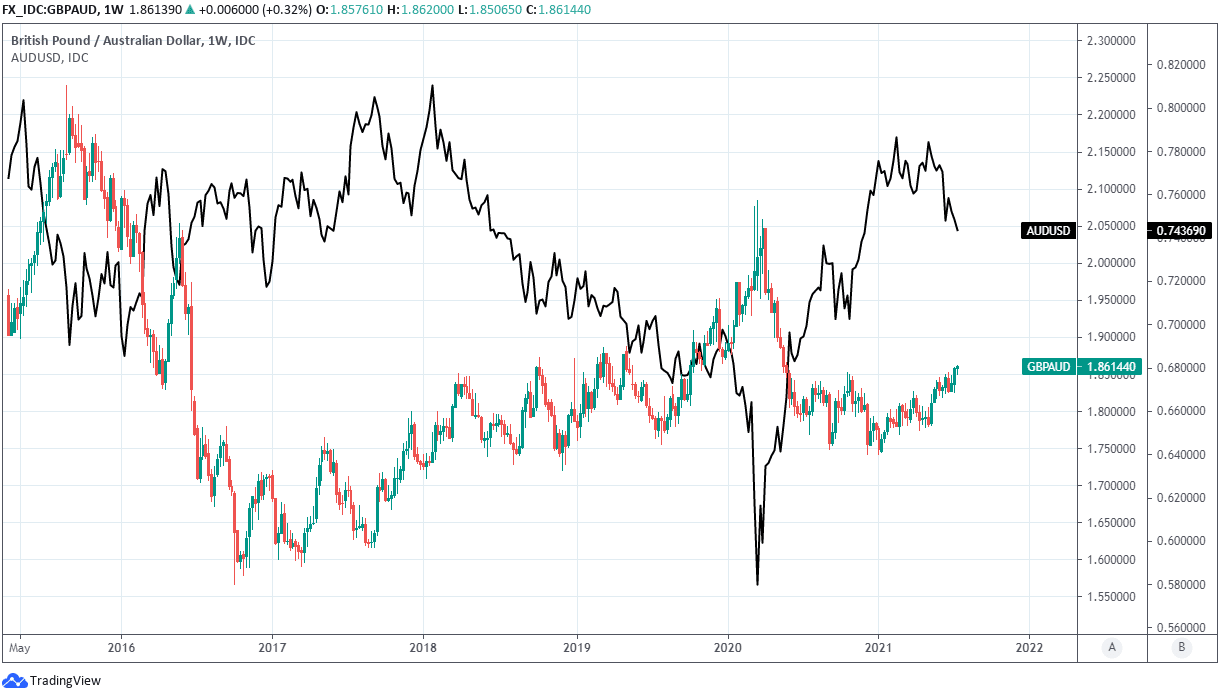

New AUD/USD forecasts imply a 7.1% increase from Wednesday’s trading level around 0.7435 and is more than anything else the reason the bank anticipates a second-half 2021 reversal lower in the Pound-to-Australian Dollar rate, which always closely reflects the comparative performance of AUD/USD and the main Sterling exchange rate GBP/USD.

“Sterling is still anticipated to lift to around USD1.45 in mid-to-late 2022; finally, having the benefit of momentum, policy and sentiment,” Evans says of the GBP/USD pair.

Westpac’s new forecasts now look for AUD/USD to rise from near 2021 lows around 0.7440 mid-week to 0.78 by the end of September, reflecting a downgrade from 0.80 previously, before climbing to 0.80 by year-end.

The Pound-to-Australian Dollar rate is forecast to fall from 1.85 to 1.81 by the end of September, which is an upgrade from an earlier projection of 1.7857, although Sterling is still seen declining to the latter level before year-end. The Pound was previously expected to end 2021 at 1.7543.

The latter forecasts imply losses of between 2.2% and 5.2% respectively from Wednesday’s levels for Sterling.

Above: Pound-Australian Dollar rate shown at weekly intervals alongside AUD/USD.