Pound-Australian Dollar Forecast: Charts Advocate for More Downside Short-Term, but Strategists Favour Sterling this Month

- GBP/AUD tipped lower on technical studies

- But seasonality favours gains

- GBP/AUD at 1.96-1.98 possible

Image © Robyn Mac, Adobe Stock

- GBP/AUD spot at time of writing: 1.9483

- Bank transfer rates (indicative range): 1.8797-1.8934

- FX specialist transfer rates (indicative range): 1.9020-1.9304 >> more information

Pound Sterling starts the new week softer against the Australian Dollar and technical studies suggest further short-term losses are likely, however we are wary of betting against GBP/AUD noting that seasonality tends to favour Sterling over its Australian counterpart in May.

The Aussie Dollar's advance against the Pound on Monday - GBP/AUD is quoted 0.20% lower at 1.9478 - is curious given the decidedly dour tone to global stock markets: typically we would associate falls in Asian and European markets with Australian underperformance.

The Australian currency is however falling against the U.S. Dollar and Yen, confirming that the general rule-of-thumb that the Aussie is a 'risk on' currency (i.e. rises when markets rise), is broadly intact and we wonder if GBP/AUD will soon follow suit.

Global sentiment is deteriorating on Monday as investors consider the dire state of the global economy as well as rising tensions between China and the U.S. over the origins of covid-19.

"Rising tensions between the U.S. and China over the coronavirus are supportive of both USD and JPY. We expect USD to remain supported this week," says Kim Mundy, a foreign exchange strategist at Commonwealth Bank of Australia.

Despite the softer market backdrop, the short-term technical setup for the Pound-to-Australian Dollar exchange rate (GBP/AUD) suggests the Aussie could yet still hold the upper hand over coming days.

"The downside prevails as long as 1.9838 is resistance," says Trading Central, a technical analysis provider.

Currently the pair is quoted at 1.9467, suggesting the Pound would need to put in more convincing gains if a positive technical outlook is to develop based on this particular analysis.

Trading Central notes momentum studies are broadly negative while the MACD is below its signal line and negative. "The configuration is negative. Moreover, the pair is trading under both its 20 and 50 MAs, respectively at 1.9788 and 1.9784," says a note out Monday.

The 1.9838 level is seen as a pivot: below this level further declines are expected, but a break above this point invalidates the GBP/AUD downside thesis and would advocate for gains.

While technical studies favour the Aussie Dollar against the Pound, we would caution that one major institutional analyst is tipping the Australian currency for weakness over coming weeks.

"We see the recent strength in the Australian Dollar as unjustified and likely to be tested in the weeks ahead. We would therefore sell the Australian Dollar at current levels," says Robert Rennie, Head of Financial Market Strategy at Westpac.

Studies by Westpac suggest the Aussie Dollar tends to underperform in May, which is a month that tends to display high levels of seasonality.

Pound Sterling stabilised against the Aussie and other commodity currencies at the start of May following a sell-off that took the Pound-Australian Dollar rate 8% lower from the March-April peak-to-trough.

April was characterised by a widespread recovery of risk assets including the Aussie Dollar and stock markets, but an old investor adage says to "sell in May and go away," which if repeated in 2020 could result in widespread Aussie Dollar losses

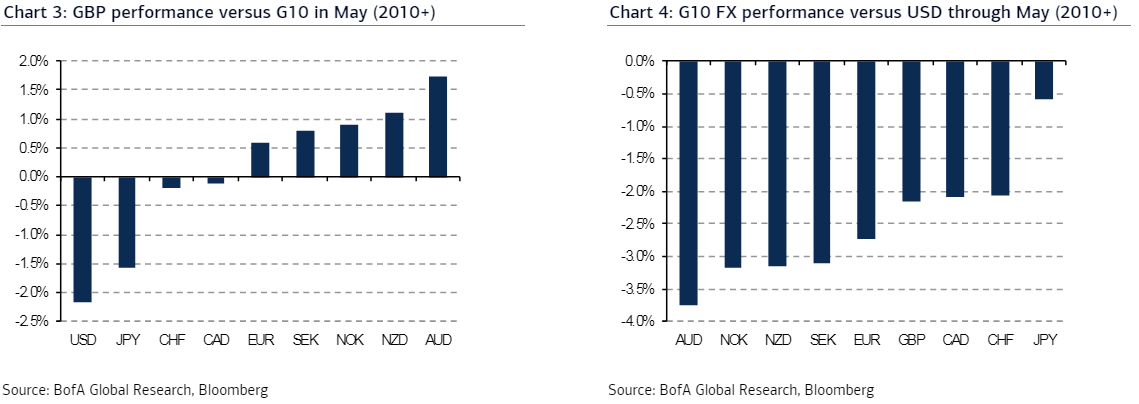

"We find that all G10 currencies broadly underperform through the month. As Chart 4 highlights, the consistency in the under-performance reveals two findings: a) AUD, NOK and other high beta currencies weaken the most; b) EUR under-performs more than GBP. This pattern of FX performance strongly suggests that May is a risk-off month," says Kamal Sharma, a strategist at BofA Global Research. "FX volatility (using the JPM VXY index as a proxy) rises on average and has done so particularly in the last couple of years."

But for Westpac it is not simply seasonality that makes GBP/AUD an attractive prospect for gains over coming weeks.

"The RBA and BoE are pursuing very expansionary monetary policy and fiscal support is substantial, especially in Australia. Australia’s C/A position is much more supportive and Australia’s much lower Covid-19 case count should mean a quicker restarting of economic activity in Australia. These factors should ensure AUD remains well above March lows but given our baseline view on global risk appetite, we see AUD softening to GBP 0.5050/0.5100 or AUD 1.96-1.98 multi-week," says Sean Callow, a foreign exchange strategist at Westpac.