Australian Dollar Outperforms after RBA Appears to Retain Rate Hike Bias

- Written by: James Skinner

Image © ArchivesACT, Reproduced under CC Licensing, Editorial, Non-Commercial

- AUD outperforms G10 rivals following RBA guidance surprise.

- RBA retains rate hike bias despite bets on shift to easing stance.

- RBC Capital Markets says sell the Pound-to-Aussie rate this week.

The Australian Dollar ouperformed rivals Tuesday after the Reserve Bank of Australia (RBA) took markets by surprise when it appeared to retain its bias to lift interest rates over the coming years.

It goes almost without saying the RBA held its interest rate at a record low of 1.5% again in February, citing below-target inflation and weak wage pressures that will leave price growth beneath the 2%-to-3% target band for a while yet.

The bank also noted increased risks to the global economy and said the U.S. trade war with China is having an adverse impact on some business investment decisions, before tweaking its forecasts for GDP growth a tad lower.

However, and on a more positive note, the RBA also said business investment and household income should pick up over the coming years and that this will support a recovery of wage growth and inflation.

The relatively upbeat tone on the economy took the market by surprise but the most notable part of the bank's statement was its apparent sanguine view of Australia's faltering housing market.

"With dwelling prices falling and consumer spending slowing, it's looking likely that the RBA will sit on the sidelines for a while yet. We think a rate cut would require a deterioration in the labour market and that is not what we or the RBA are expecting," says Kristina Clifton at Commonwealth Bank of Australia.

Some analysts had wondered if the Reserve Bank would drop its "tightening bias" at Tuesday's meeting given that inflation remains below target and the economy has slowed of late, which reduces the odds of a pick up in price pressures coming any time soon.

Furthermore, the global economy has very clearly slowed in recent months and activity levels in Australia's housing market have gone from bad to worse since the RBA's last meeting. This has seen financial markets becoming increasingly of the view that, sooner or later, the RBA will be forced to cut its interest rate to a fresh record low.

"Our reading of the statement is that the Bank remains of the view that the next move in interest rates is most likely up, but not for some time. We expect the RBA Governor to say words to this effect when he speaks on the “The Year Ahead” on Wednesday," says Felicity Emmett, an economist at Australia & New Zealand Banking Group (ANZ).

The RBA has held rates at 1.5% for more than two years citing below-target inflation and an economic outlook that is not sufficient enough to support a sustainable return of the consumer price index to within the 2%-to-3% target band in the short-term.

RBA officials said Tuesday that inflation is still expected to rise within the target band but that this now will probably not happen until some time in 2020.

Australian inflation declined from 1.9% to 1.8% during the final quarter of 2018, but the RBA wants to see it settle comfortably between 2% and 3% before lifting it interest rate.

"We continue to think its key macro forecasts are too optimistic and we anticipate a familiar pattern of further downward revision as this year unfolds," says Su-Lin Ong, an analyst at RBC Capital Markets. "We remain of the view that any move from an historical low of 1.5% will demand much weaker global growth and likely considerable external shock. Rate hikes, however, look set to remain in the very distant future."

Above: AUD/USD rate shown at daily intervals.

The AUD/USD rate was quoted 42% higher at 0.7242 Tuesday and has risen 2.7% for the year-to-date, while the Pound-to-Australian-Dollar rate was -0.34% lower at 1.7998 and has declined -0.40% this year.

Gains came as markets expressed a collective sigh of relief that the RBA took such a laid back tone when all of the recent data has suggested that Australia's economy could be on the verge of a notable slowdown.

"While the recovery from the lows of early this month has been impressive, we do not see it as sustainable. The domestic data are likely to remain below par, and we do not think that the international environment will provide a positive backdrop for much longer," warns Daniel Been, head of currency research at Australia & New Zealand Banking Group (ANZ).

Above: Pound-to-Australian-Dollar rate shown at daily intervals.

The inflation outlook is most key to all future RBA interest rate decisions, but other economic indicators are also crucial because of what they might mean for consumer price pressures further down the line.

In this regard, Tuesday's retail sales data will not have helped given that sales growth for December was much lower than the market had anticipated.

Retail sales fell -0.4% in December, almost completely reversing an upwardly-revised 0.5% gain from the Black Friday month of November, which itself had been disappointing for economists.

"This also challenges our already lowered GDP forecasts and will no doubt feature in the RBA’s revised profile in Friday’s SoMP, where we expect it to lower its estimates by ¼-½% to be 3% for much of the forecast period. Looking further ahead, we are also concerned that the softening in consumption seen in H2 2018 doesn’t yet fully reflect the housing slowdown," says Robert Thompson, an analyst at RBC Capital Markets.

The sales data followed other figures released on Monday that revealed a steep fall in the number of new building projects approved in December and a soft start to the New Year for the labour market.

Australian job advertisements fell by -1.7% in January alone and are now -3.7% below the level seen at the beginning of last year, suggesting momentum in the labour market may now be waining.

The jobs market was a relative bright spot for Australia last year, despite the economy being besieged by a litany of headwinds including volatile commodity prices and a faltering housing market, as well as the U.S.-China trade war that has dented global growth.

However, Monday's figures suggested those days may be coming to an end, just as the downturn in Australia's housing market looks to be gathering pace.

"We expect a weaker AUD over the next week as the RBA softens its tone and higher domestic mortgage rates continue to weigh on data releases, like building approvals," says Hans Redeker, head of currency strategy at Morgan Stanley.

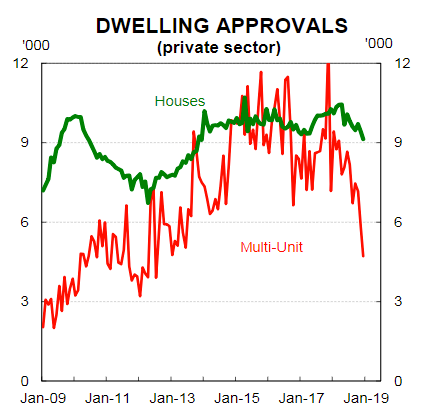

Above: Australian building approvals. Source: Commonwealth Bank of Australia research.

Approvals for the construction of new residential homes fell by an eyewatering -8.4% in December, after having declined by -9.4% in the previous month, which took the annulised rate of decline in approvals to -23%.

"In the coming month, we continue to see higher funding costs leading to negative wealth effects, lower consumption and a weaker AUD," adds Morgan Stanley's Redeker.

Years of runaway price growth, higher international funding costs and changes to bank lending regulations have all contributed to the cracks now opening up in Australia's housing market, which are of increasing concern to policymakers.

Fears are that a prolongued downturn in prices will create negative wealth effects that hurt the economy by deterring households away from spending. That could sap demand from the economy and reduce inflation, which would mean a headache for the RBA.

However, and despite an increasing number of apparent headwinds for the RBA to contend with, some analysts say that the market has become too pessimistic too soon and are backing the Aussie instead of speculating against it.

"With forwards already pricing a greater than 50% chance of an RBA rate cut this year, the risk is that tomorrow’s short statement and Friday’s SOMP are not dovish enough and that AUD rises. Our bias is negative-GBP short-term," says Adam Cole, chief currency strategist at RBC Capital Markets. "Short GBP/AUD position established at 1.8065."

Cole and the RBC Capital Markets team say the Pound-to-Aussie rate will fall from 1.80 to 1.77 over the course of the current week and have recommended that RBC's clients bet accordingly in the currency market.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement