Yen Could be About to Reach a Turning Point

- Written by: Richard Perry, Hantec Markets

Image © Adobe Images

The Dollar-Yen exchange rate is at 105.59 in mid-week trade having risen for seven days in succession now. A risk-off mood following the U.S. Presidential debate could however end the Yen's winning run says analyst Richard Perry of Hantec Markets.

The rally on USD/JPY has turned far more tentative in the past few sessions, although so far remains intact. Once more we see early session weakness.

Repeatedly we have seen weakness consistently bought into as the US session has taken over.

In the wake of the first Presidential debate, the risk aversion that seems to have taken over has dragged USD/JPY lower.

If this is seen into the close then it could mark a turning point in the outlook for Dollar/Yen. We see this near term rally as being an unwinding move within a bigger medium term corrective phase.

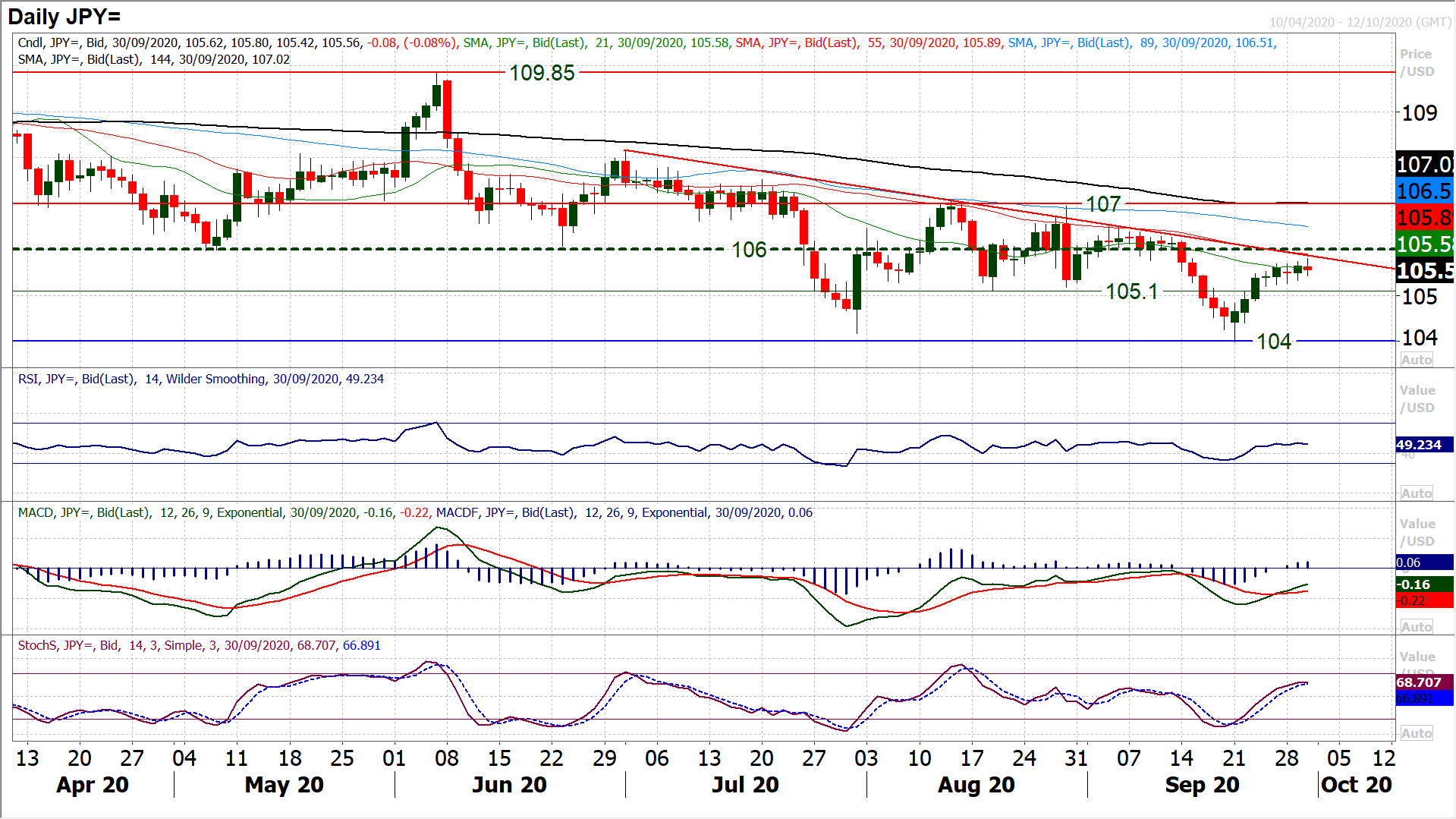

As such with the RSI beginning to falter around 50 (around where previous rallies have faltered), are we beginning to see the bulls struggle?

The three month downtrend and falling 55 day moving average both come in around 105.90, whilst the 106.00 pivot resistance area is just overhead, all of this is key resistance.

This morning’s early high of 105.80 came in the middle of the debate, before turning lower. A close below 105.20 would now suggest the bulls are struggling.

The positive sentiment that was starting to build through major markets has taken a hit again in the wake of the first Presidential debate.

President Trump was never going to go easy on his opponent Joe Biden, but the way that the debate panned out points towards a significant increase in political risk in the weeks and potentially months ahead.

An acrimonious exchange between the candidates ensued, where it is clear that the incumbent, President Trump, could look to win at all costs, even if that means challenging to result in the Supreme Court.

Early suggestions are that the uncertainty over a potential winner in the election could rumble on well beyond 3rd November (where a winner would be declared).

Political risk means market sentiment falters.

Treasury yields are falling this morning, whilst the US dollar in its role as a safe haven is outperforming. Equities are under pressure, with the risk positive mood across forex majors having turned sour again.

The Japanese yen seems to also be a winner if this trend continues. Early this morning, the final reading to UK GDP for Q2 showed a slight positive revision to -19.8% (from -20.4%), whilst the UK Current Account for Q2 came in a -£2.8bn which was a marked improvement on the -£21.1bn of Q1 but slightly worse than the expected -£0.4bn. Traders will be watching out for ECB President Lagarde this morning and the ADP jobs number later.

here are several US data points on the economic calendar today.

The ADP Employment change is at 1315BST and is expected to show an increase to +650,000 jobs in September (up from +428,000 in August).

The US final Q2 GDP is at 1330BST and is not expected to show any revision from the -31.7% annualised prelim reading (aft er fall of -5.0% in Q1).

US Pending Home Sales are at 1500BST and are expected to show monthly growth of +3.4% in August (after +5.9% growth in July). The EIA crude oil inventories are at 1530BST and are expected to show a build of +1.4m barrels (after a drawdown of -1.6m barrels last week).

There one notable central bank governor and a couple of Fed speakers to watch out for today.

ECB President Christine Lagarde speaks early at 0820BST, where her comments on faltering inflation will be watched for. Later in the day, the FOMC’s Neel Kashkari (voter, dovish) speaks at 1600BST, whilst the FOMC’s Michelle Bowman (voter, leans hawkish) speaks 1840BST.