US Dollar Extends Gains after Inflation Hits Decade High and as Turkish Panic Escalates

- Written by: James Skinner

-Core-inflation hits decade high, prompting traders to eye Fed.

-Fed near-certain to raise rates in Sept, Dec, supporting the USD.

-But most USD gains Friday the result of escalating Turkish crisis.

© Adobe Stock

The Dollar rose broadly Friday after US inflation hit a decade high, cementing expectations for a Federal Reserve interest rate rise in September and providing further incentive for traders to buy the safe-haven greenback, which is benefiting from escalating concerns over the Turkish currency crisis.

US inflation rose by 0.2% during July, up from 0.1% during June and in line with the consensus, although the annualised pace of consumer price growth held steady at 2.9% when markets had looked for a 3% reading.

The more important core inflation measure, which removes volatile commodity items from the goods basket and so is seen as more representative of domestically generated inflation pressures, also rose by 0.2%.

This was unchanged from the June increase and in line with the consensus but, nonetheless, enough to push the annual pace of core inflation up to a decade high of 2.4%. Markets had looked for it to hold steady at 2.3%.

"The Fed anticipates that core inflation will level off soon, with core PCE inflation ending the year at 2.1%, from 1.9% in June. However, as the July CPI figures make clear, underlying price pressures are still mounting," says Michael Pearce, a senior US economist at Capital Economics. "Our forecast is that core inflation will continue to trend higher from here, with core PCE inflation hitting 2.3% by the end of this year."

Markets care about price and inflation data because it has direct implications for interest rates. Changes in interest rates, or hints of them being in the cards, are only made in response to changes in domestic inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

The Federal Reserve has raised interest rates seven times since the end of 2015, taking the Federal Funds rate range to between 1.75% and 2%. Many economists expect it to raise rates so that the top end of that range hits 3.25% around the end of 2019.

"Core inflation was just 1.8% as recently as February, but it has been pushed up by adverse base effects triggered by the anniversary of last year’s five-month run of very low m/m numbers. The base effects are now over, and core inflation likely will hover in the 2.3-to-2.4% range through the end of the year," says Ian Shepherdson, chief US economist at Pantheon Macroeconomics. "The Fed is well aware of the base effects in the recent data and won’t be unduly spooked by the apparent surge in core inflation."

Most analysts now agree that superior levels of US economic growth have bolstered the case for the Federal Reserve to keep raising its interest rate, at a time when the interest rate outlook elsewhere in the world has deteriorated, which has incentivised traders into selling other developed world currencies and buying US Dollars.

Capital Economics' Pearce says Friday's inflation data means the Federal Reserve is almost certain to raise its interest rate again in September, taking the top end of the Fed Funds range up to 2.25%. He also predicts that it will then raise rates again twice in the first half of 2019. Pantheon's Shepherdson is also anticipating two more rate rises this year.

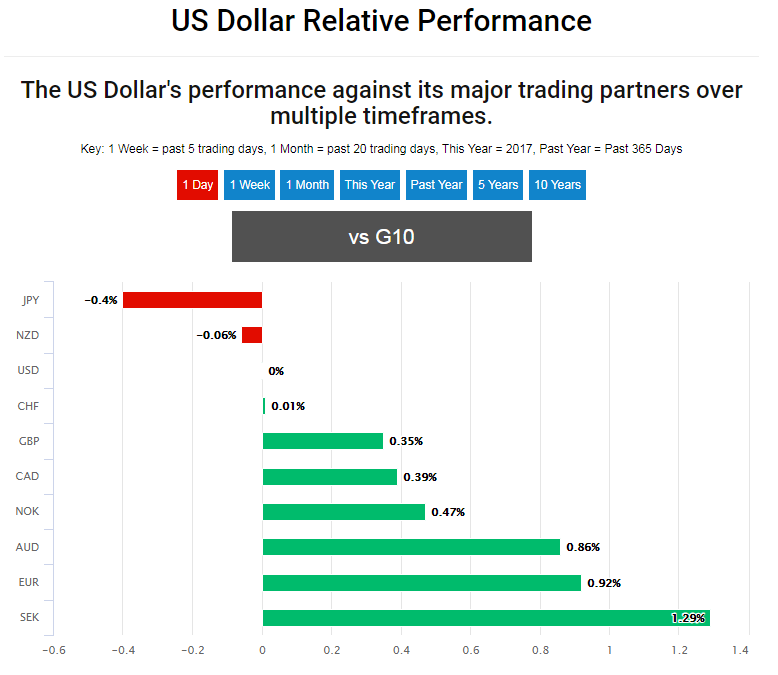

The US Dollar index was quoted 0.72% higher at 95.20 Friday while the Pound-to-Dollar rate was 0.40% lower at 1.2774 and the Euro-to-Dollar rate was 0.83% lower at 1.1428.

Above: US Dollar performance against G10 rivals Friday.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Turkey Votes for Christmas! Why it Matters to Markets

Friday's inflation data is undoubtedly positive for the narrative around the Federal Reserve, and therefore, is also supportive of the US Dollar.

However, much of the greenback's gains Friday are the result of a Turkish currency crisis that now threatens to become an all-out financial crisis, with potential consequences for Europe too.

Above: USD/TRY rate at hourly intervals.

Turkey's Lira has been clobbered on currency markets, falling 17% on Friday and by 76% against the US Dollar this year.

Losses came as markets fret over a politically compromised central bank, an escalating dispute between Ankara and Washington as well as deteriorating economic fundamentals.

Above: USD/TRY rate at daily intervals.

"The amount of Turkey’s FX reserves (ex-gold) are around US$74bln. The country’s minimum required level of reserves is around US$59bln. There’s simply not enough cash in the bank to stop the TRY from falling," says Bipan Rai, a macro strategist at CIBC Capital Markets. "Despite all of this, President Erdogan is calling for domestic banks to increase credit issuance and for the central bank to cut rates."

This puts Turkish financial stability, as well as the solvency of the state, at threat. And the damage may even spillover into the Eurozone.

European Central Bank officials are reportedly growing concerned about the exposure of the continent's banking sector to Turkey.

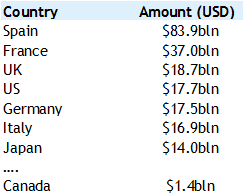

"On its own, Turkey is a small economy but the risk comes from understanding which parties are lending to Turkish businesses and the government," says Rai. "European banks are the most exposed (see Table 1 below). Keep in mind, that EZ bank balance sheets are already under significant stress...It’s not an accident that EUR/USD price action has removed support at the 1.1500 handle today"

Source: CIBC Capital Markets.

Ankara and Washington have locked horns over the detention of US pastor Brunson, who is being detained over alleged terrorism offences connected with the failed 2016 coup in Turkey.

President Trump has spoken out in favour of Brunson and authorised an increase in steel and aluminium tariffs against the country Friday. The US government has imposed sanctions on two Turkish ministers responsible for Brunson's incarceration.

A trip to Washington by Turkish officials this week failed to thaw an increasingly frosty relationship with their US counterparts and in the hours since, the Turkish currency has suffered its severest losses to date.

I have just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey as their currency, the Turkish Lira, slides rapidly downward against our very strong Dollar! Aluminum will now be 20% and Steel 50%. Our relations with Turkey are not good at this time!

— Donald J. Trump (@realDonaldTrump) August 10, 2018

"Yesterday we had a wide-ranging conversation with Turkish Government officials. We made it clear that Pastor Brunson needs to be returned home. Much of this, though, we’re not going to negotiate in public," says Heather Nauert, a spokesperson for the US Department of State, in a briefing Friday.

Turkish President Recep Tayyip Erdogan gave a speech Friday where he sought to rally citizens and supporters with calls not to "surrender to economic hitmen”. Markets had watched the address closely in the hope that measures to support the currency would be unveiled.

"Having stabilised below 6.0 this morning the currency fell sharply on the lack of any concrete measures; Turkish stock market, which had been stable in the morning, also fell 2% during the speech," says James Binny, global head of currency at State Street Global Advisers. "Next to speak Albayrak (Finance Minister and Erdogan son-in law) although in a different venue – perhaps he will have some more specific plans."

Sanctions and Turkish instability come amid a concerted drive by US officials to damage the Russian economy with other sanctions connected to a range of allegations levelled at the Eurasian country.

This other escalating dispute also comes amid an ongoing "trade war" between the US and China. All these factors drove traders into the arms of the Dollar Friday given its position as the international reserve currency and perceived safe-haven status.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here