Dollar's Rally Slows as Debate about Powell's "For Now" Interpolation Gains Traction

Image © Adobe Stock

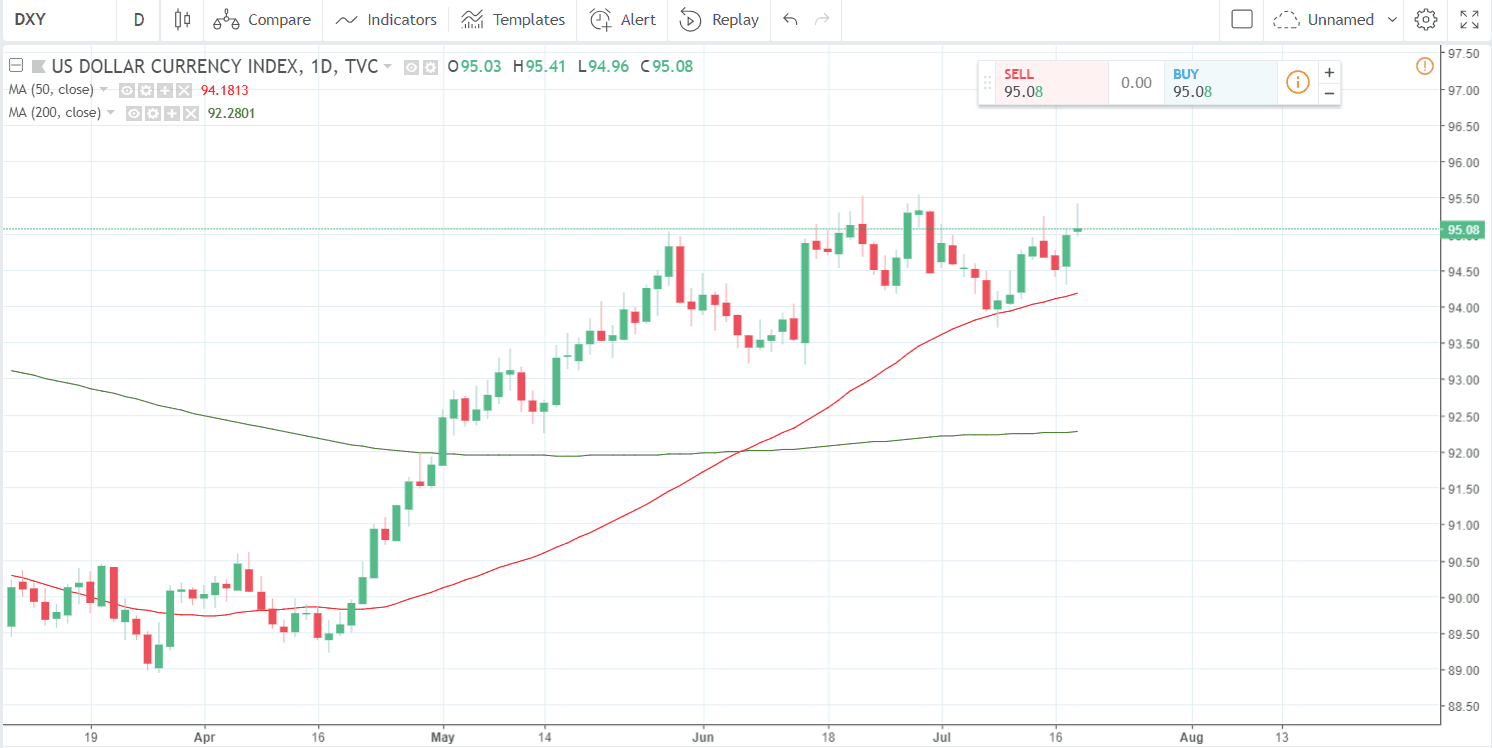

- Dollar Index pares gains on Wednesday and forms bearish shooting star

- Re-examination of Powell's bullish comments find hints of doubt

- Re-awakens debate about neutral rate and flattening yield curve

The Dollar's strong rally slowed down midweek as analysts picked apart US Federal Reserve Chairman Jerome Powell's testimony to US lawmakers on Tuesday and found instances of doubt which took the edge off the optimistic thrust which had previously driven markets higher.

The Dollar Index - a measure of broad-based Dollar performance against a basket of currencies - rose to 95.41 on Wednesday - within spitting distance of the June 28 yearly high at 95.53.

But the Greenback then pared gains as 'analysis paralysis' set in.

The Index, comprised of the Dollar vs a basket of most traded currencies, ended the European session trading back down at only a few points above 95.00, forming a bearish shooting star candlestick pattern in the process.

The cause may have been traders re-assessing Fed Chairman Powell's comments to the Senate Banking Committee, which initially sparked a rally in the Dollar on Tuesday because of their optimistic timbre.

In his testimony Powell had said, "with appropriate monetary policy, the job market will remain strong and inflation will stay near 2 percent over the next several years."

It was his mention of things remaining good for "the next several years," which seemed to get the market excited and led the Dollar to rally.

The comments reaffirmed the US growth story which had come under criticism recently from those who argued the current rate of growth was unsustainable because it was artificially stimulated by the "sugar high" of Trump's tax reforms.

Powell then went on to say that "with a strong job market, inflation close to our objective, and the risks to the outlook roughly balanced, the FOMC believes that – for now – the best way forward is to keep gradually raising the federal funds rate."

The above comments added further fuel to the rally, initially, as they reaffirmed the Fed's gradualist approach to raising interest rates, but as analysts started to meditate more on the exact wording they noted a hint of doubt which had been overlooked previously, and the Dollar started paring its early gains.

The phrase which raised alarm bells was Powell's "for now" condition before "the best way forward is to keep gradually raising the federal funds rate."

'For now' is a condition which introduces a 'get out clause' or 'emergency exit' to allow Powell some flexibility in the event things change.

After further analysis it has now been interpreted more specifically as referring to the risk of the Fed raising interest rates too fast too high and thereby slowing growth and damaging the economy.

One of the key concepts in the debate is where the Fed's 'neutral rate' is, that is the rate at which the US economy would find equilibrium, neither growing nor contracting.

The neutral rate is an ideal, with no exact location, only estimates, but central bankers try to guess where it is and use it as a target for where they want to get interest rates eventually. Currently the Fed thinks it is at 2.9%.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Of the "for now" comment, Priya Misra, head of global rates strategy at TD Securities in New York, says, “he is leaving the door open to slow down the pace of hikes or not hike beyond neutral."

In June Federal Reserve officials signalled via their dot plot that they expected the Fed's funds rate to rise to a median level of 3.1% by the end of 2019. This is in fact slightly above the neutral rate and therefore already in danger territory.

Powell’s “for now” reference “speaks to the idea that if the data starts to deteriorate, say because of trade tensions, they’ll slow down,” says Joseph Song, senior U.S. economist at Bank of America Merrill Lynch.

“But it works the other way. The tax cuts potentially could be more stimulative and could lead to a faster pace of tightening,” says Song.

The discussion about Powell's remarks in relation to the 'neutral rate' relates to growing concerns about the flattening US yield curve, which traditionally is seen as a bad omen for the economy, as it suggests a flat medium-to-long-term outlook for growth and inflation.

The yield curve is a chart plotting the yield on varying maturities of bonds.

Yields are a measure of the compensation bond-holders can expect due to inflation erosion.

In a healthy economy the curve is steep as inflation and growth are expected to rise steadily over time meaning holders of longer-dated debt can expect greater compensation.

Currently, however, the curve is flat; and there are fears it could 'invert' which is usually a sign of a recession, because it implies that expectations about growth and inflation are peaking.

Initially it seemed like Powell was not overly concerned about the flat yield curve inverting, as suggested by his remarks that things would remain good for "the next several years."

"It seems as if Powell is content to keep raising the Fed’s benchmark rate and hope that longer-term treasury yields eventually rise in tandem," says Brian Chapatta, a correspondent for Bloomberg News.

Concerns about the yield curve led a senator on the committee, Toomey, to "almost asked if the Fed would consider a reverse Operation Twist to lift long-end yields, something I contemplated last week, but he left the question open-ended enough for Powell to speak more broadly about his interpretation of the curve," adds Chapatta.

"The overarching view seems to be that policy makers will deal with an inverted yield curve if and when it happens. “For now,” though, the Fed will gradually hike rates until it can’t," concludes the correspondent.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here