Finally, Vindication for the Maligned Dollar-Bulls and More Gains are seen Ahead

- Much-maligned USD bulls are now finally enjoying their time in the sun

- Trend of a rising Dollar is forecast to continue

- EUR/USD seen falling, with some provisos to bearish stance

© RCP, Adobe Stock

Going against the grain comes at a price, as Ulrich Leuchtman, an analyst at Commerzbank, and his team found when they adopted an unpopular long-Dollar stance at the end of 2017/early 2018.

"The amount of ridicule, malice and criticism my colleagues and I had to face over the past months, was overwhelming!" Says Leuchtmann. "Our view, that the USD depreciation in December and January was fundamentally unfounded - that the market would not be able to ignore the USD-positive arguments forever - and that therefore we would see a recovery of the US currency was rejected by many: by readers, by clients, by colleagues," he says.

Yet revenge is sweet, or vindication at least.

"So it makes me particularly happy to see that the development of the markets is now proving us right. The Dollar has been gradually recovering since late January, but over the past few days this development has accelerated massively," says Leuchtman.

The US Dollar index - a measure of broad Dollar performance against a bucket of currencies - has recovered off a Ferbruary low at 88 to 91.85 at the time of writing, its strongest level since January. This move has been aided by a dip in EUR/USD from just north of 1.25 to the 1.2080 currently seen and a move lower by the GBP/USD rate from highs just below 1.44 earlier this month to the 1.3772 we are seeing now.

The old market adage that the "trend is your friend until the bend at the end" appears to be shared by Leuchtmann, who endorses a cautiously bullish Dollar view in the short-term and a more bullish view in the medium-term with a downside target of 1.16 for EUR/USD.

"Following a move of this nature it is quite possible that the USD-positive momentum runs out of steam for some time, because USD bulls want to make a profit. There may even be a multi-day countermove," acknowledges Leuchtmann, however, he goes on to say that, "it is also true that there is medium-term scope for further USD recovery."

The currency's clear advantage from the perspective of higher expected interest rates (which are a draw for foreign investors looking for somewhere lucrative to park their money), higher inflation and a relatively strong economy, will probably continue fueling the Dollar's rally.

But Commerzbank's Leuchtman was not the only contrarian Dollar-bull. The FX team at Nordea Bank also steadfastly stuck to a Dollar-bullish stance at the end of last year and beginning of this year, though for largely idiosyncratic reasons based on their own proprietary studies and analysis of Dollar liquidity or scarcity.

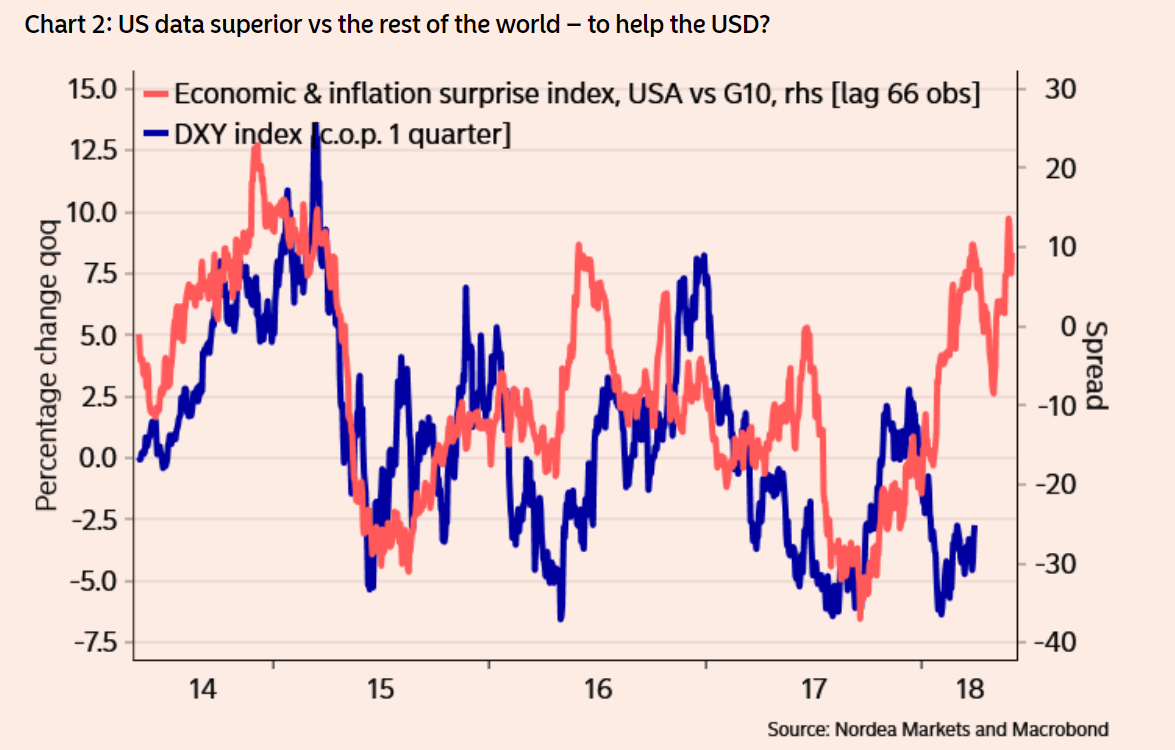

"Less USD liquidity due to quantitative tightening, substantial outperformance by US vs. rest of G10 in the Economic Surprise index, wider US-EA inflation spread, potential USD buying by China in a CNY devaluation etc. The list of USD positives is long," says Andreas Steno Larsen global FX/FI strategist for Nordea Bank.

Does Nordea expect the Dollar's rally to continue as well? In a nutshell "yes" but with important provisos.

In his most recent analysis, Nordea's Steno Larsen asks why EUR/USD has not gone lower given all the arguments for a stronger Dollar. He ends up tempering his previous ultra-Dollar bullish stance with some offsetting bearish rationale.

One factor against the Dollar, for example, is that USD reserves held by international central banks appear to be falling and being replaced by Euros, resulting in a loss of demand for USD.

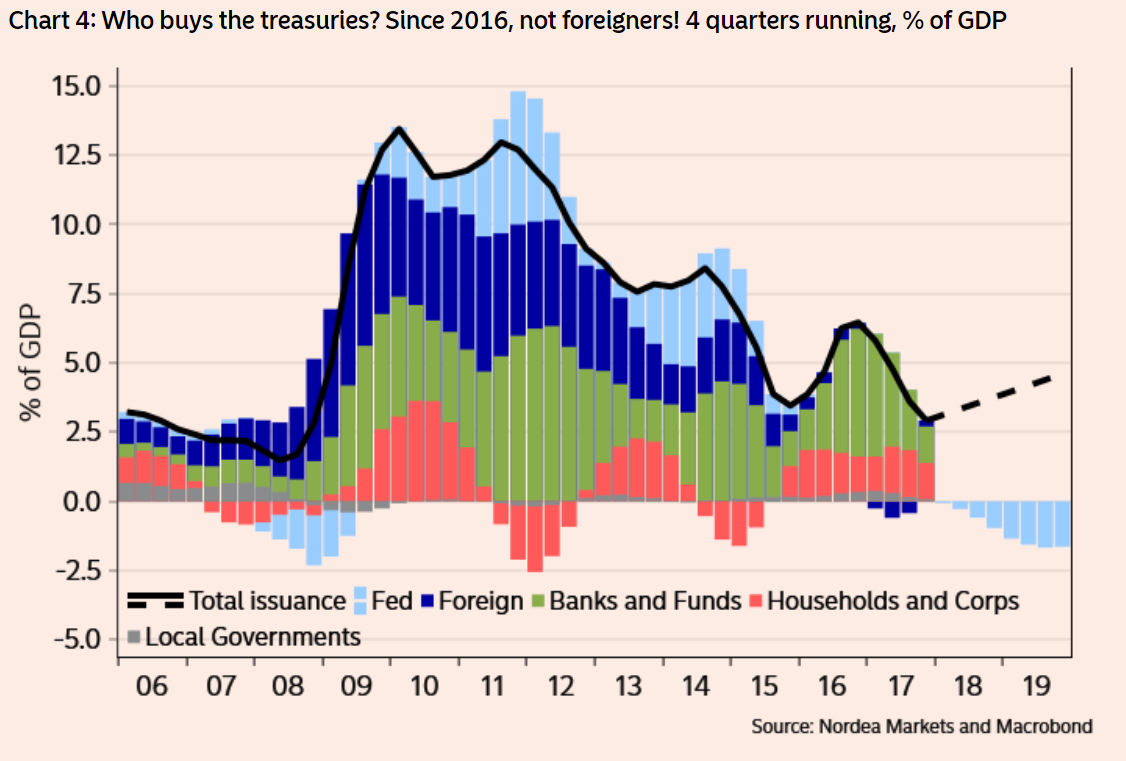

Another major reason is that despite a higher issuance of US Treasury Bonds to fund the growing shortfall in the budget, the demand for Treasuries from foreign investors is falling, suggesting less foreign exchange for Dollars to purchase the Treasuries.

Whilst these reasons may explain EUR/USD's lack of downside Larsen remains a bull overall, and given the central bank reserve factor is specific to the Euro-US Dollar complex, the Dollar could gain by greater degrees in other pairs.

"The bottom-line is that we stick to our view that the USD will gain some ground in the coming months, as e.g. the inflation-spread will continue to move in favour of the USD versus the EUR. But technically we need a breach of either 1.2150 on the downside or 1.2650 on the topside to be really convinced that EUR/USD is out of its recent range," says Steno Larsen.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.