US Wage Growth Disappoints, Could Spell "Significantly Higher" GBP/USD Exchange Rate

- Written by: Gary Howes

The US Dollar just can’t seem to catch a break - the world’s largest currency has suffered a fresh bout of selling pressures in the wake of the release of some less-than-stellar economic growth numbers.

The Bureau of Economic Analysis reports US GDP for the second quarter of 2017 was at 2.6%, in line with consensus estimates and higher than the previous month’s 1.2% which was incidentally downgraded.

Bear in mind, this is an annualised figure.

The headline data is undoubtedly strong, "the U.S. economy is gaining steam," says Krishen Rangasamy at NBF Economics and Strategy. "The acceleration came courtesy of consumption growth, which found support from better disposable incomes and a one-tick drop in the savings rate to 3.8%. Government, business investment and trade also contributed to growth, offsetting drag from residential investment the latter arguably impeded by lack of supply."

Adding to the good news is the fact that inventories did not impact Q2 results, and Rangasamy says this suggests room for a further pick-up in growth as inventories are rebuilt in the second half of 2017.

However, other numbers disappointed with the employment cost index reading at 0.5% for the second quarter where markets had forecast 0.6% growth.

The GDP price index rose at 1%, below forecasts for 1.3%.

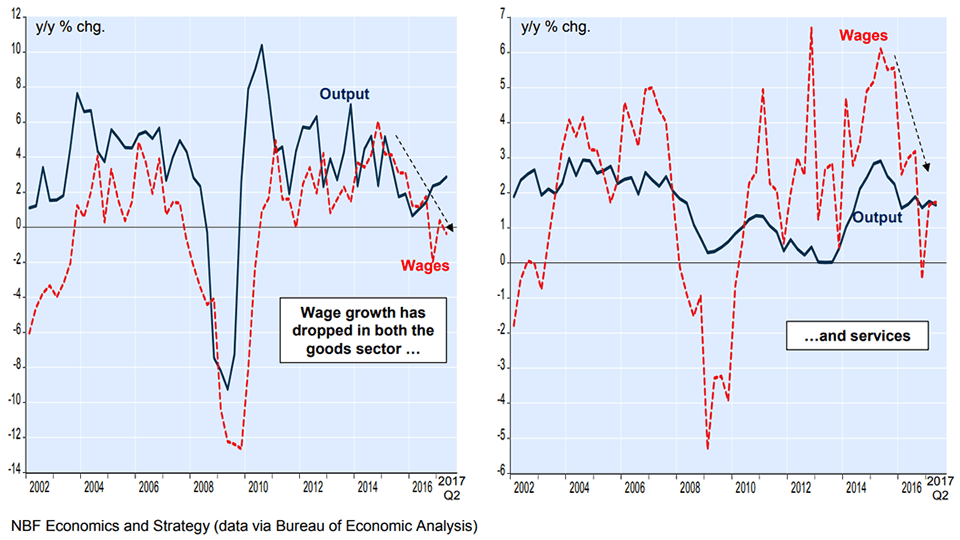

"While the Fed will welcome the acceleration of GDP growth in Q2, it will also be concerned about persistently soft wage inflation. The growth of real wages in the second quarter remained weak in both the goods and services sectors," says Rangasamy.

Markets were not welcoming of the wage numbers and we have seen the US Dollar index - a measure of the Dollar’s value based on a basket of key USD exchange rates - is seen lower 0.37% at 93.27.

The Pound to Dollar exchange rate is up 0.21% at 1.3092.

The Euro to Dollar exchange rate is 1.1742, up 0.56%.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

"Markets were faced this afternoon with more confusing data from the US as GDP increased positively at 2.6% in Q2, only for Q1 to be revised down to 1.2%," says Alex Lydall, Head of Dealing at Foenix Partners. "After Yellen sent mixed messages this Wednesday at the latest Fed meeting, investors could be spared for being perplexed at what progress the US is actually making from an economics perspective."

Questions are now raised as to when the US Fed might raise interest rates again.

Fed officials don't appear to be sending a firm signal on the matter while markets are also expressing doubt, hence the weaker Dollar.

"With Trump causing political shockwaves on a regular basis it will be interesting to see whether or not Yellen takes stock and perhaps stalls the next hike, which for markets could potentially see GBPUSD and EURUSD significantly higher in the short and medium term," says Lydall.