Latest Inflation Expectations Survey Adds to Fed Headache and Lifts U.S. Dollar

- Written by: James Skinner

"We are more confident now that the Fed will continue to deliver faster hikes through the rest of this year," - MUFG

Image © Adobe Images

The Pound to Dollar exchange rate remained under pressure ahead of the weekend after a University of Michigan (UoM) survey indicated that U.S. consumers' expectations of inflation moved further in the wrong direction for the Federal Reserve (Fed) this month.

Dollar exchange rates had been in the process of cooling of their heels and reversing earlier gains on Friday when a monthly UoM survey suggested inflation expectations rose at both short and medium-term horizons this month in what is likely a disappointing outcome for the Fed.

"The median expected year-ahead inflation rate rose to 5.1%, with increases reported across age, income, and education," the University of Michigan said in summary of the survey results.

"Long run inflation expectations fell below the narrow 2.9-3.1% range for the first time since July 2021, but since then expectations have returned to that range at 2.9%. After 3 months of expecting minimal increases in gas prices in the year ahead, both short and longer run expectations rebounded," it added.

Inflation expectations are closely monitored and have been widely cited by the Fed this year as key influences on the interest rate outlook because many policymakers believe expectations for price changes can be self-fulfilling.

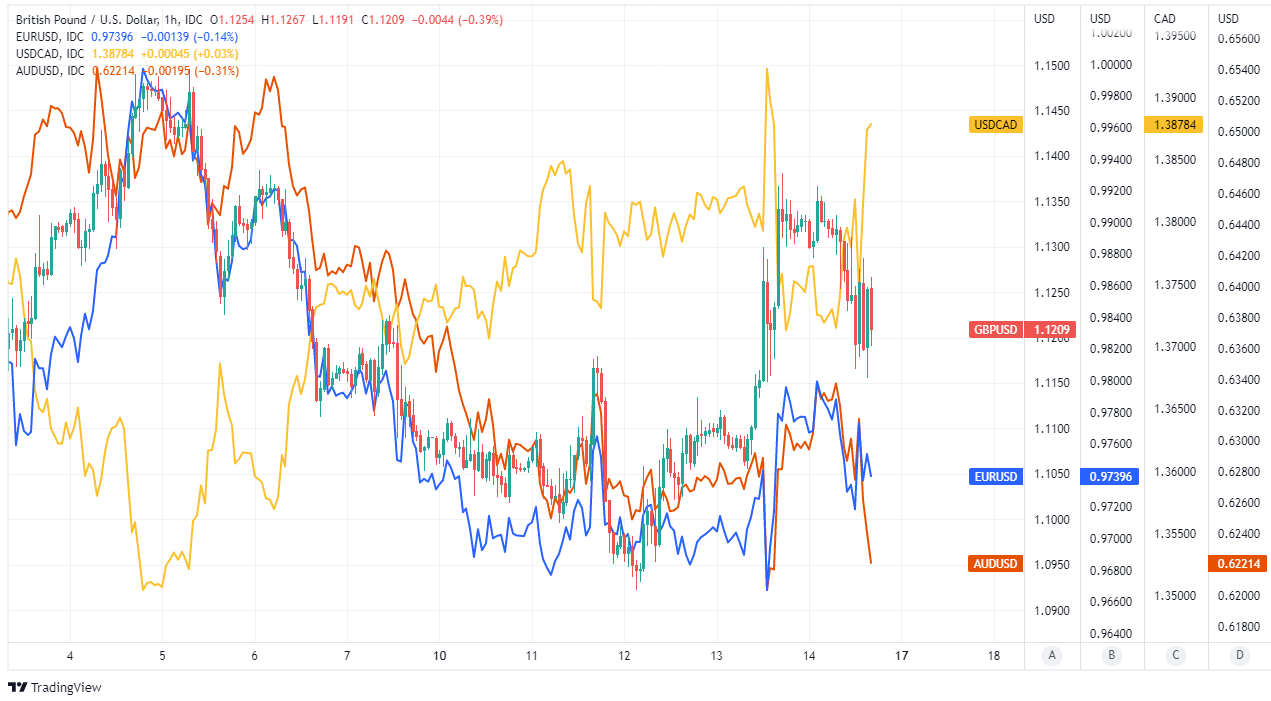

Above: Pound to Dollar rate shown at hourly intervals with other selected exchange rates.

Above: Pound to Dollar rate shown at hourly intervals with other selected exchange rates.

The survey results come hard on the heels of Bureau of Labor Statistics figures revealing that inflation accelerated further in both monthly and annual terms during September after energy and food items are removed from the basket of goods for which prices are analysed.

Inflation rose by 0.6% on the month and 6.6% for the year to the end of September if food and energy is removed from the goods basket while the overall inflation rate remained stubbornly elevated at an annualised 8.2% when food and energy items are included in the basket under the microscope.

"The uptick in inflation expectations probably is a response to the increase in gas prices in recent weeks, in which case it won’t continue. Moreover, this is a preliminary reading and could be revised by as much as +/-0.2pp," says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

"Still, on the heels of the September inflation data this rebound - reversing the drop last month - does not look good, given how closely policymakers appear to track the measure," Shepherdson said of the UoM survey results.

Economists generally reiterated or otherwise lifted forecasts for November's Fed decision following Wednesday's data with almost all now anticipating that Federal Open Market Committee members will vote to lift interest rates by three quarters of a percentage point for a fourth time.

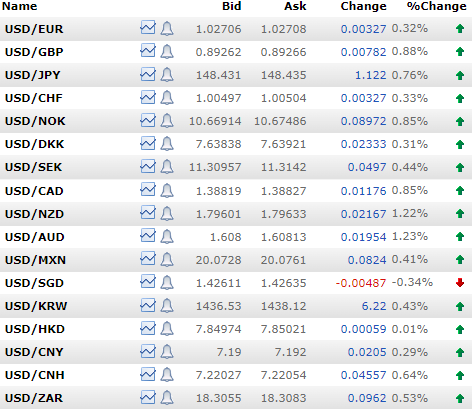

Source: Netdania Markets.

All of this week's data comes with the Fed looking to return U.S. inflation to the 2% target and likely leaves the bank's interest rate setters with little choice but to continue along the rate path outlined by September's forecasts.

September's forecasts suggested borrowing costs would rise a further 1.25% to reach 4.5% by year-end before climbing to 4.75% in the new year, which would see the Dollar offfering the highest interest rate among G10 currencies.

"We are more confident now that the Fed will continue to deliver faster hikes through the rest of this year," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

"The hawkish repricing of Fed rate hike expectations and intensifying fears over a hard landing for the global economy supports our outlook for an even stronger USD," Halpenny wrote in a Friday afternoon research briefing.

The Fed's interest rate policy has been a significant driver of the Dollar's rally against all currencies this year including the Pound, which has been one of the biggest fallers in the G10 contingent of major currencies.

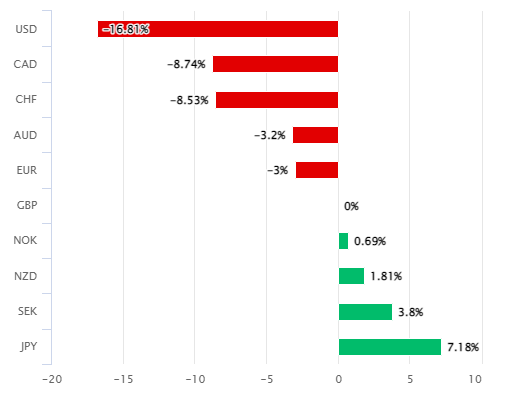

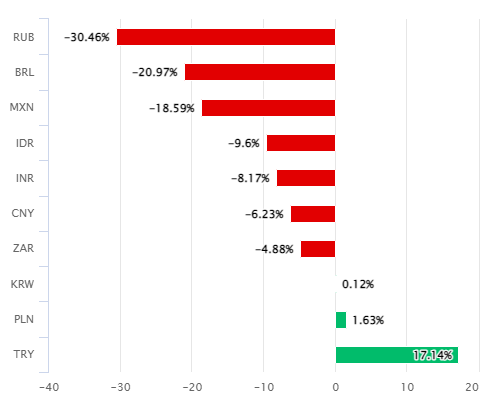

Above: Pound relative to G10 and G20 currencies in 2022. Source: Pound Sterling Live.