U.S. Dollar Tends to Rally in August says Citi, Starts New Month Stronger against Euro and Pound

- Seasonality favours USD in August

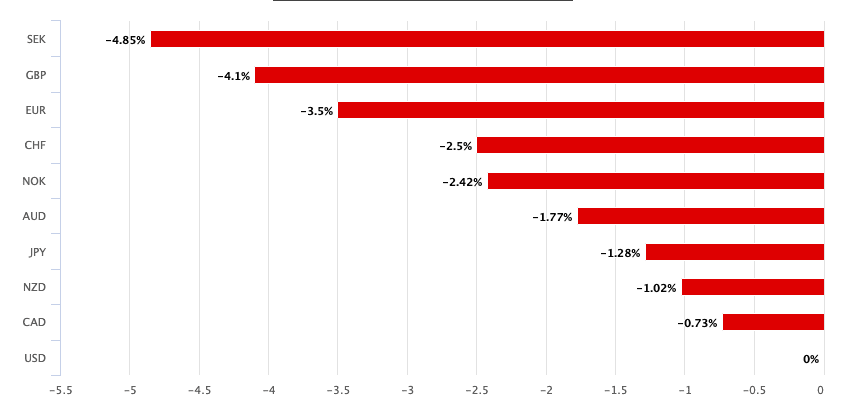

- USD fell sharply in July, but starts new month stronger

- EUR/USD could rise to 1.2425 says Citi

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3022

- Bank transfer rates (indicative guide): 1.2660-1.2758

- FX transfer specialist rates (indicative guide): 1.2780-1.2900

- For more information on FX specialist rates, please see here

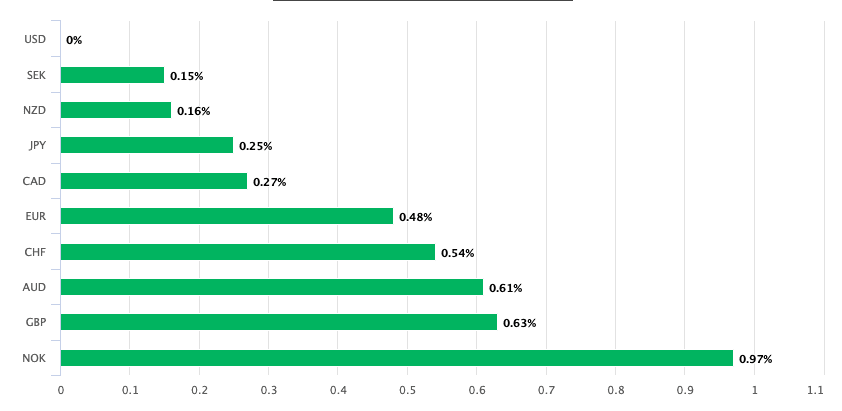

The U.S. Dollar has started the new month on the front foot by going sharply higher against the British Pound, Euro and other major currencies as it looks to overturn some of the sharp losses suffered during July when investors lightened up on exposure to U.S. markets.

New analysis from Citibank - the world's largest foreign exchange dealer - shows an expectation for further losses in the Dollar, however some near-term recovery potential is on the cards, particularly as August tends to favour the U.S. currency.

"We remain broadly constructive on global risk appetite and bearish USD, but remain watchful for temporary corrections due to bumps in the road and others drivers of August seasonality," says Ebrahim Rahbari, Global Head of FX Analysis at Citi. "We remain bearish USD and in particular would sell any USD rallies."

Analysis from Citi shows August tends to be a positive month for the Dollar, and if August 2020 repeats this pattern the sharp losses experienced by the Greenback in July could fade and a period of short-term outperformance might set in meaning a reversal in fortunes for pairs such as EUR/USD and GBP/USD.

"As we enter into August, a seasonally strong month for the USD, squeezes are likely to be more prevalent than over the past couple of months. But we therefore advocate selling into any seasonality-related squeeze," says Rahbari.

The falling Dollar saw most major FX pairs rally, with the Pound-to-Dollar exchange rate rising 5.5% in July from a low of 1.2360 to a peak at 1.3170. The Euro-to-Dollar exchange rate meanwhile 4.50% from a low of 1.1185 to a high of 1.1908.

Falling U.S. yields, recovering stock markets and expectations for further easing at the U.S. Federal Reserve have all been cited by the investor community as contributyinh drivers of Dollar weakness.

Citi analysts note that Dollar sentiment has been bearish for some time in their investor conversations, but what was perhaps notable over the last 1-2 weeks are more more frequent questions about the long-term position of the Dollar as the world's dominant currency.

"In that context, media reports that Chinese authorities are urging Chinese banks to reduce reliance on the SWIFT financial messaging service are significant, if hardly surprising. We have long ascribed the ‘peak dollar dominance’ thesis, even though a peak of the Dollar’s international role should not be confused with a rapid shift away from it, yet alone that another currency would surpass it – of that, there is very little chance for many years to come," says Rahbari.

As an expression of their bearish Dollar stance, Citi remain bullish on the EUR/USD outlook, but note that European equities have begun to underperform U.S. equities, which could muddy any bullish EUR/USD view in the short-term; further aiding the view that the Dollar's recent sell-off might be due a temporary respite.

"Ever-more negative U.S. real yields remain a major driver of the USD sell-off, but also broader market prices," says Rahbari. "That includes the equity market."

There has been a growing argument that the second wave of covid-19 infections in the U.S. would blunt the country's economic recovery and relative outperformance against the rest of the world. Expectations for Eurozone outperformance over the U.S. was one key channel to rising expectations for a stronger Euro.

However, should this view be questioned the Euro could find itself on the backfoot once more.

U.S. equity markets rallied last week thanks to falling interest rates and a lower Dollar, as well as positive second quarter earnings that meant of the 71% of S&P 500 constituents that have now reported, 82% beat expectations, which is unusually high according to Citi.

By contrast, equity markets in Europe and Japan weakened last week, as real yields there did not provide a lift, and exchange rates strengthened. Notably, the Dollar staged a strong comeback on Friday, recovering against all major peers to ensure it recovered at least some of the ground lost during July.

Elsewhere, ECB commentary on the Euro's appreciation could be coming up warn Citi who also continue to watch for the evidence of second virus waves in Europe.

Citi technical analyst Tom Fitzpatrick has meanwhile reiterated a bearish Dollar view, too, comparing recent price action to late 2002 and 2003 and suggesting that EUR/USD could rise to 1.2425 to 1.2625 and a USD index as low as 83.