Fed Will Have to Cut After These PCE Inflation Numbers: Pantheon Macroeconomics

- Written by: Gary Howes

Image courtesy of Pantheon Macroeconomics.

The highlight of this week's U.S. economic data docket was a consensus-busting GDP release that says the Federal Reserve has little reason to cut interest rates, with some economists even suggesting such a move in 2024 is now unlikely.

But Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, says if you are only looking at GDP and jobless claims today, you are missing the big picture.

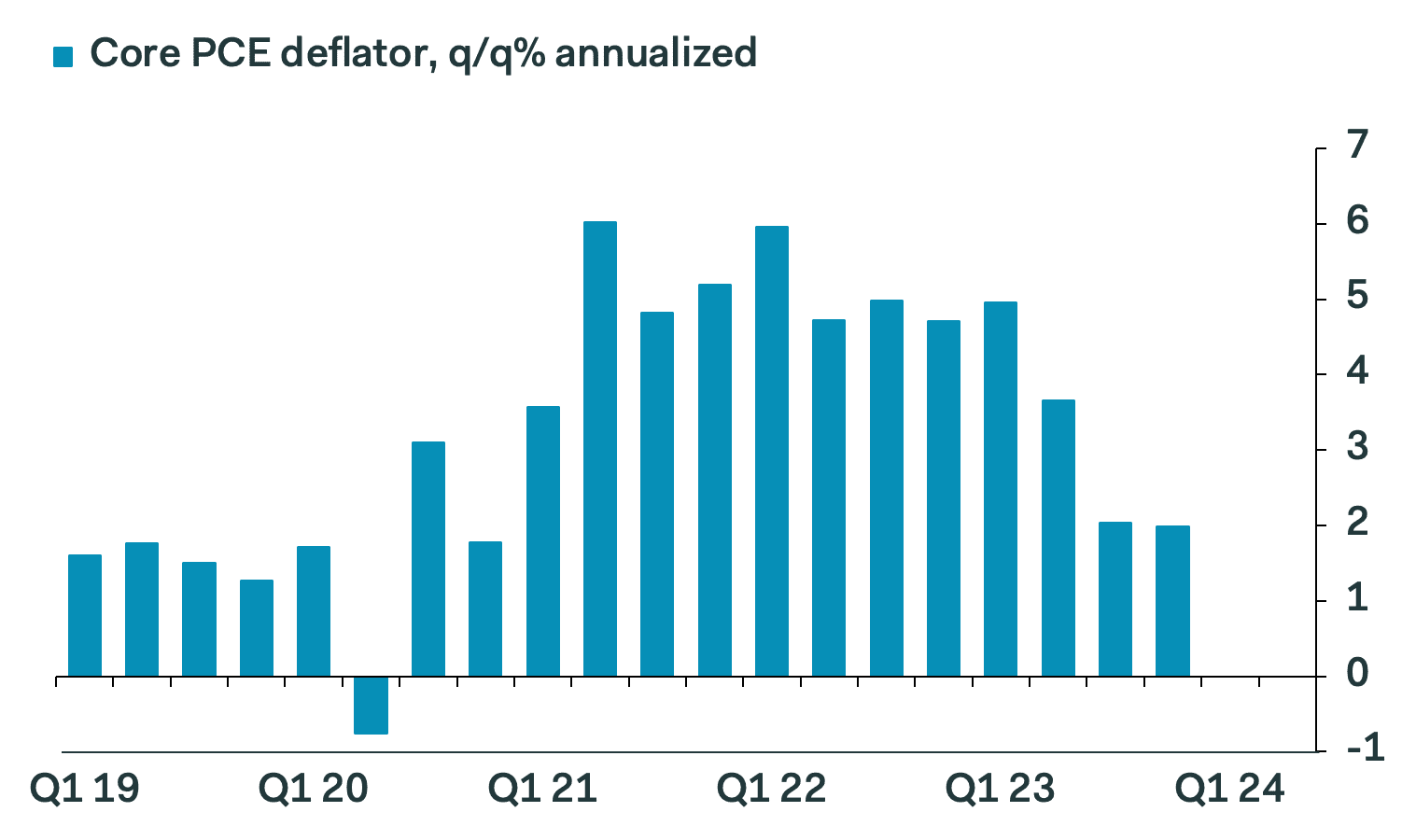

Also released alongside GDP is one of the Federal Reserve's favoured measures of inflation: the core PCE deflator.

This gauges inflation on the personal consumption level, and it rose at a sub-2.0% 1.99% in the final quarter.

This follows the 2.04% of the third quarter.

"So the Fed has now hit its target on this measure on a sequential basis for two straight quarters. Note too that the 1.5% increase in the GDP deflator is the smallest since Q4 2019," says Shepherdson.

Pantheon Macroeconomics predicts the 2% trend in the core PCE deflator will persist, and if markets and the public expect inflation to remain at the target, leaving the economy with 3-1/4% real short rates.

"Something has to give. Don't be distracted by GDP headlines; real rates can't stay this high," says Shepherdson. "No one thinks that is sustainable, so the Fed will have to ease unless they have very good reasons to think the economy is about to re-strengthen or inflation somehow will rebound."

"We doubt those arguments can be made with confidence, so we expect the first easing in March or May, leaning 60/40 in favour of the former," he adds.