Chinese Renminbi and USD/CNH: An Insight from a PBoC Grandee

- Written by: James Skinner

- -USD/CNH sees largest rally since March 2020

- -Following lengthy period of CNH appreciation

- -Prolonged or rapid fall may draw intervention

Image © Adobe Images

The Chinese Renminbi has probed below a notable level on charts in its largest weekly fall since March 2020, drawing attention from the speculative market that could soon make relevant the following insight from a former member of the People’s Bank of China (PBoC) Monetary Policy Committee.

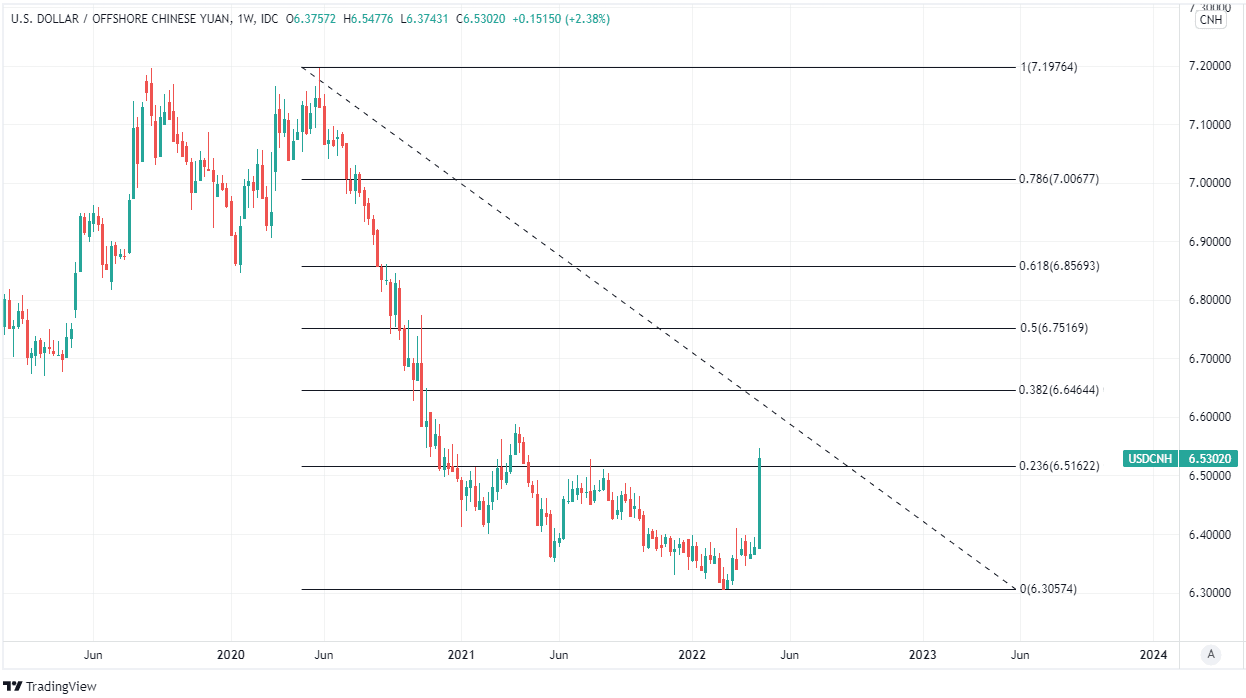

China’s Renminbi fell more than all G20 currencies barring the South African Rand this week in price action that lifted the USD/CNH exchange rate from 6.3761 on Monday to 6.5291 by Friday, taking it up to and above the 23.6% Fibonacci retracement of the downtrend from April 2020.

This marks the largest one week increase since March 2020 and comes amid a slowdown in the economy, which is under pressure from side effects of government reforms as well as the latest containment actions in its ongoing bid to rid the Chinese economy and country of the coronavirus.

While policymakers in Beijing have long frowned upon the two year rally against the Dollar and 21-month long increase in the trade-weighted or overall Renminbi (CFETS index), this week’s rapid decline has been quick to draw the attention of the speculative market, making relevance of the following.

“From 13 August 2015 to the Spring Festival in February 2016, no one was quite sure what was guiding the PBC in setting the RMB central parity rate. A discernable pattern was that whenever the market expected the renminbi to fall, it would instead rise,” writes Yu Yongding.

Above: USD/CNH shown at weekly intervals with annotations and Fibonacci retracements of 2020 decline indicating likely areas of technical resistance. Click image for closer inspection.

Above: USD/CNH shown at weekly intervals with annotations and Fibonacci retracements of 2020 decline indicating likely areas of technical resistance. Click image for closer inspection.

“An obvious explanation for this is that the PBC was manipulating the exchange rate to move it in an unexpected fashion to punish those who were shorting the renminbi, hoping to break depreciation expectations," Yongding also wrote.

The above text was taken from China’s 40 Years of Reform and Development: 1978–2018, chapter 17, which covers exchange rate reform and is especially insightful because the author is described by Caixin Global as “one of China's most influential economists” and served as a member of the PBoC’s policymaking committee in 2004 and 2006.

“The surprising jolt in RMB volatility makes it too difficult to know exactly where the PBoC will draw a firm line in the sand on currency depreciation. But taking today's move, the behavior of the forwards [shown in the below image] and the extent of weakness in other Asian currencies into account, that firm line in the sand has not been drawn yet,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Source: BMO Capital Markets.

“The fact that offshore implied forward rates and other yields have barely budged (and not been forced upwards by PBoC) feeds the CNH depreciation. In terms of a tactical approach to trading USDCNH spot, our preference would be to look for opportunities to fade the move at the appropriate time rather than attempt to piggyback on current momentum,” Gallo also said on Friday.

While not necessarily relevant on Friday, the above insights could become relevant in any market where expectations are deemed by policymakers as having become excessive or divorced from Chinese economic fundamentals.

For readers’ background, China operates a managed floating exchange rate regime using a range of tools, and the system is backstopped ultimately by the world’s largest trove of foreign exchange reserves and its most extensive network of bilateral currency swap lines.

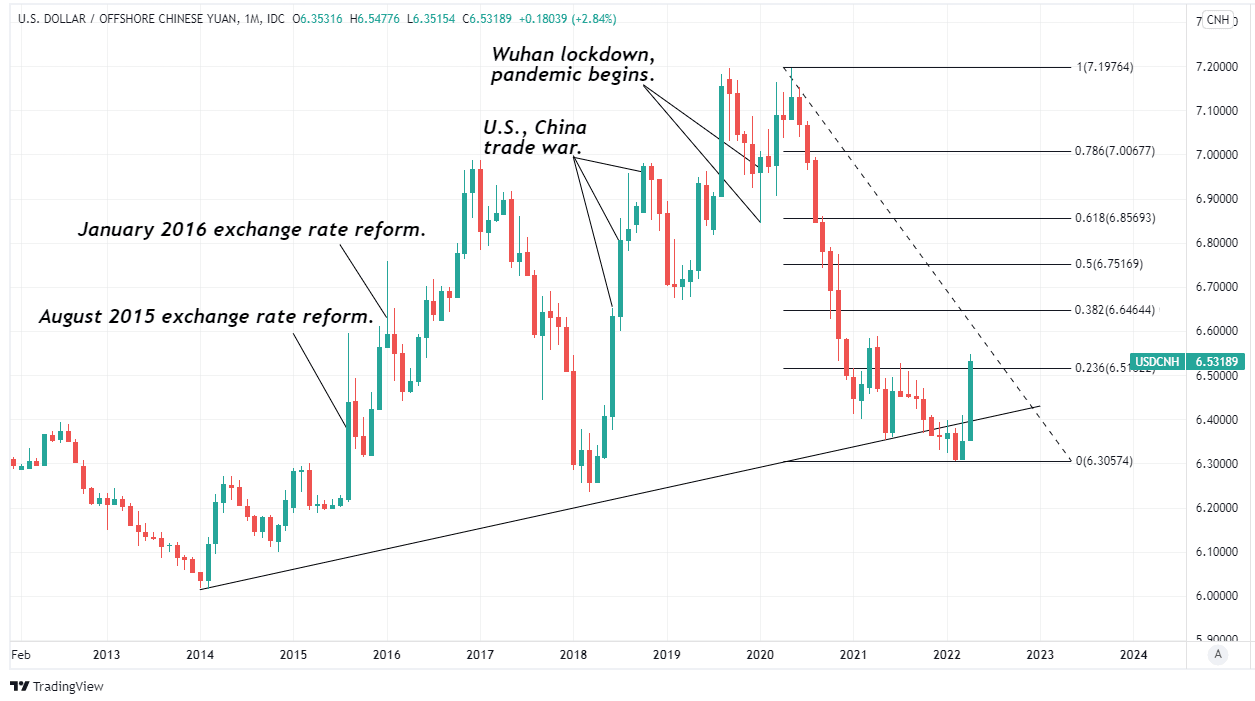

Above: USD/CNH shown at monthly intervals with annotations and Fibonacci retracements of 2020 decline indicating likely areas of technical resistance. Click image for closer inspection.

Above: USD/CNH shown at monthly intervals with annotations and Fibonacci retracements of 2020 decline indicating likely areas of technical resistance. Click image for closer inspection.