Gold Price Declines Signal Further Market Uncertainty

- Written by: Samantha Coventry

Above: File image of Senator Jon Tester.

Global economic uncertainty has caused many challenges for financial institutions and investors alike over the past quarter.

While the pandemic was thought to be one of the greatest calamities for the financial world in decades, recent rising inflation and other challenges have led to ongoing uncertainty in the global economy, despite strong resilience in some markets.

In these difficult times, many investors have turned to gold as an alternative to stocks and bonds, as the precious metal is known to be relatively resistant to inflation.

But as is common in the current market conditions, prices are volatile.

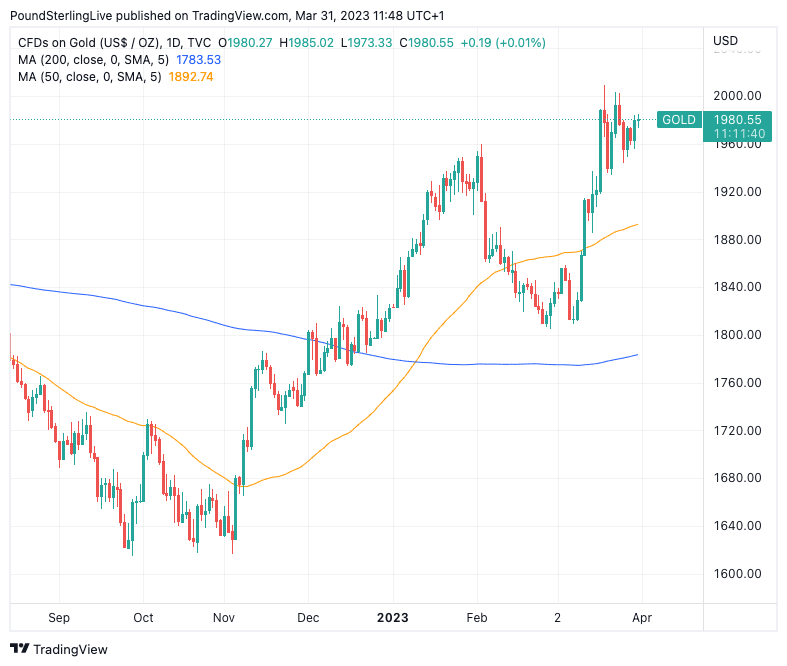

Recent major developments in the global financial market has led to the price of gold falling back from its recent high point.

The gold price has pulled back around £60/oz in the U.K. from the recent all-time high of £1,648.64.

It's also trading below $2000/oz in the U.S. at $63.9 per gram.

Above: Gold price at daily intervals.

In Europe, the price dipped to 58.24 € per gram, with investors around the world affected by this as many keep some reserves of gold, and most financial institutions depend on it.

This recent dip in the gold price reflects the market's relief that Credit Suisse was bought by compatriot bank UBS to alleviate fears of its complete demise. These fears were raised following the previous collapse of the Silicon Valley Bank, which fell apart earlier this month.

While these banking collapses might seem terrifying, they don't signal the end of the financial world as we know it: at least not yet.

Savvy investors have realised that the Swiss bank was bought for around £2 billion, which is £5 billion below its supposed Market Cap from a few days earlier.

This price drop reflects the toxic nature of the bank and its practices and shows that the bank’s balance sheet was worse than previously thought.

Rumoured reasons for the tech-focused financial institution's collapse include poor management and issues arising from Donald Trump-era financial policies in the U.S.

So, the collapse of SVB and the subsequent issues facing Credit Suisse might not be as detrimental to the global economy as previously thought. Regulators are already exploring the records of SVB to determine if mismanagement caused its collapse, and the results of all investigations could help to strengthen future regulations and make it harder for banks to be poorly managed and take excessive risks in the future.

Already, members of the House, including U.S. Senator Jon Tester, have called for greater regulation of banks and more punishment for financial managers who fail to safeguard investors' money and assets.

In a recent Senate Banking Committee meeting, Tester admonished the Federal Reserve for bailing out banks and not focusing on consumers and taxpayers:

"In 2008, I voted against the bailouts of the big banks because I don't support taxpayer bailouts. We do need to protect American consumers and small business folks. We need to hold bank executives when they screw up. And if the regulators were asleep at the wheel, we need to hold them accountable."

The Democratic Senator and professional farmer also called for regulators to change the rules to ensure that bankers are held accountable and that they feel the consequences of their actions when they cause major financial upsets that affect the wider U.S. economy.

"I am not a banker; I ain't even close to being a banker; I'm a dirt farmer. And I'm gonna tell you, when they laid out what had happened at this bank over the last two years, you did not have to be an accountant to figure out what the hell was going on. And all I've got to say is as you do your look back at what transpired, it better be fixed. If it's the regulators' fault, it better be fixed. If it's the regulations' fault, it better be fixed. If it's something else, I hope there's a report to this committee… It looks to me like the regulators knew the problem, but nobody dropped the hammer," said Tester.

So, the fall of SVB and the issues it caused for Credit Suisse could lead to regulatory change and help the banking market to evolve moving forward.

How It's Affecting The Market

In the financial market, the gold price dip and challenges in the global economy have made gold the go-to investment.

The continued fears of a financial contagion have led to investors recognising the gold price dip as an opportunity to increase positions at bargain prices. Many investors suspect that more bad news could be around the corner, which could then push the yellow metal to new all-time highs in the near future.

Gold is traditionally known as a market-resistant investment, as it is a physical product that holds its value well through economic discontent. Unlike stocks and bonds, gold isn’t affected by as many external factors, such as business management, the price of other financial assets and other financial influences.

As such, many investors who are looking to diversify their portfolios and safeguard their money are eager to buy gold.

Therefore, sellers are already seeing an increase in demand for the metal. In the U.K., leading gold seller Physical Gold has seen a renewed appetite for gold this week as sub £1,600/oz prices have lured back worried investors, keen to bolster their protection with gold bars and tax-free gold coins.

The provider charts the gold price and has seen rising gold purchases despite the drop, and believes that the price could rise again shortly as demand continues to accelerate.

Additionally, rising prices of gold and demand for the metal mean that many experts in the mining industry are predicting increased investment in their upcoming projects.

What Happens Next?

Uncertainty remains, but many gold investors and financial experts are optimistic that the metal will bounce back thanks to its reputation as a safe asset.

Still, even more economic upset could lead to further issues in the prices of gold and other investment vehicles. Last week, rumours re-surfaced that Deutsche Bank, the leading European financial powerhouse, could be the next mega bank to hit the wall.

The bank's share prices dropped by 8.5% on the German stock exchange as it furiously tried to deny rumours that it might not be financially stable.

With these potential threats looming, the price of gold and all other major investments could fluctuate significantly depending on the outcome of the next few months. The prices will likely rise again if the outlook remains stable, as demand will outweigh supply.

If a major institution goes under, then the price could drop further as investors look to liquidate assets to deal with cash-flow issues caused by collapsing banks.

Even with this ongoing financial uncertainty, demand for gold in all its various forms looks set to rise.

Many speculators view gold as a safe haven investment and are looking to it to help them weather the storm. As a result, demand is growing for both gold and linked investments, such as gold ETFs and other financial vehicles linked to the price of the metal.

Because gold is such a safe bet, investors who already own it should hold out and not sell up, while those in need of diversification will be clamouring for gold. It's the gold rush in the digital age, and while the price drop might seem negative, it could be a positive for many speculators over the coming months.