U.S. Inflation Report is "the Big Danger" to Stock and Crypto Rebound: XM.com

- Equity markets rebound

- Fed Terminal Rate Now Below 5%

- U.S. Inflation Report is "the Big Danger Now"

- Crypto Currencies the Unexpected Winners

Image © Adobe Images

Equity markets were showing some signs of life on Tuesday following a brutal selloff in the preceding days that was led by a plunge in banking stocks triggered by the collapse of SVB and Signature Bank.

Emergency measures announced by the US Treasury and the Federal Reserve on Sunday weren’t enough to completely dispel fears about the health of the banking system in America and globally, as contagion risks remain at the forefront of investors’ minds. US regional bank stocks are still in the danger zone, but the panic appears to be easing today, at least in the broader markets, with Wall Street futures turning positive and European shares opening higher.

Safe havens such as gold and the Japanese yen were handing back some gains, while the US dollar, which failed to benefit from its reserve currency status amid fast-receding rate hike expectations, was recouping a large chunk of its losses on Tuesday.

Fed Terminal Rate Now Below 5%

The Fed issued a statement on Monday, pledging a review of banking regulation that led to the collapse of Silicon Valley Bank.

But with policymakers unable to make any other comments as they’re in the blackout period before next week’s meeting, there is no word as to how the events that have unfolded will impact their policy decision.

That hasn’t stopped investors from drawing their own conclusions, though, as rate hike bets have been slashed in money markets, not just for the Fed, but for all the major central banks.

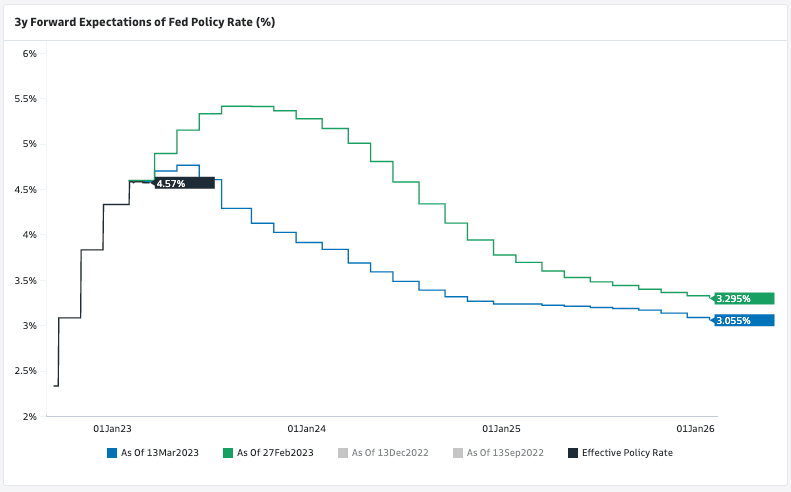

Image courtesy of Goldman Sachs.

The Fed’s terminal rate is now seen at less than 5%, having stood above 5.6% only a few days ago.

However, the market pricing is swinging so wildly minute-to-minute that it’s hard not to assume that investors are still struggling to assess the severity of the SVB fallout.

The VIX volatility index remains elevated and until there’s a more substantial pullback in Wall Street’s ‘fear gauge’, it might be wise not to read too much into the constantly shifting market expectations.

U.S. Inflation Report is "the Big Danger Now"

The big danger now is how markets will react to today’s CPI report. Traders seem to think that this crisis will force the Fed to put its fight against inflation on the back burner, raising rates by just a further 25 basis points before going on pause, followed by rate cuts later in the year.

The February inflation numbers may serve as a reminder as to why it’s unlikely the Fed will drastically scale back its tightening plans, at least in March when it’s too soon to get a clear read on how much collateral damage there will be.

For the Fed, core inflation isn’t declining fast enough as price pressures in the services sector have yet to cool, so they have little reason to stop unless they feel the SVB episode poses a real risk to the US financial system.

Crypto Currencies the Unexpected Winner

Having said all that, a dovish pivot is more than possible at the March FOMC as inflation expectations have fallen rapidly since last week, which may be of some comfort to policymakers, while Treasury yields have slumped too, although they’re firmer today.

Even the Japanese 10-year yield has plummeted, dropping below 0.20% at one point earlier in Asian trading.

Yet, sentiment is fragile and risk-sensitive currencies such as the Australian and New Zealand dollars are pulling back as the greenback recovers.

The euro and pound, both of which jumped above key levels yesterday, are also slightly down, with the latter not enjoying much of a lift from stronger-than-expected UK jobs data.

Gold was on the backfoot too, testing the $1,900/oz level as safe haven demand eased, having surged by almost 6% from last week’s lows.

One surprise winner in all this has been cryptocurrencies.

Bitcoin has shot up more than 25% in less than a week despite the collapse of Signature Bank, whose customers included cryptocurrency firms.

While it was good news for crypto traders that regulators took over the bank to protect depositors and tumbling yields also bode well, there may additionally have been some flight to safety that boosted digital currencies, with Bitcoin coming close to hitting $25,000 on Tuesday

Raffi Boyadjian, Lead Investment Analyst at XM.com. An original of this article can be found here.