Indian Rupee: USD/INR Struggles at Key Line

Image © Ash T Productions, Adobe Stock

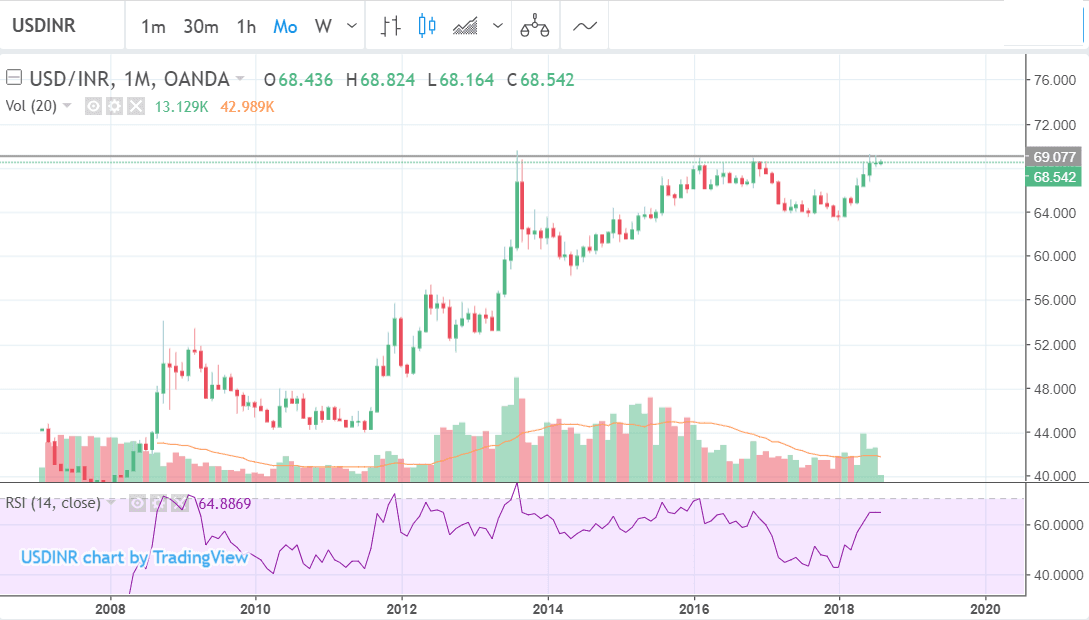

- USD/INR moves towards 69 all-time highs

- INR loses ground early on due to rising oil prices

- Dollar gives up gains, however, on concerns about yield curve and longer-term growth

The USD/INR pair is taking another run at its 69 Rupee all-time highs as headwinds face the Rupee from rising oil prices, whilst the US Dollar may be hit by fresh concerns about longer-term growth.

USD/INR marched higher at the start of the week but gave up its gains as the day progressed and the Dollar fell out of favour.

Nevertheless, its attempt at gaining the 69 highs has the attention of analysts.

69 is notorious as a level which has repeatedly fended off assault after assault from the exchange rate, starting in 2013, then in 2016, and now once again this month.

"USD/INR shy of fresh test at 69.0 handle but bulls remain in control. Rate hike expectations by Fed, trade war fears remain supportive of USD. High oil prices, inflation woes to weigh on growth," writes Catherine Tate on the Thomson Reuters currency desk.

70 rupees is in the cross-hairs should bulls manage to break above the 69.12 "record high" adds the reporter.

The main driver for the gains was probably a rise in oil prices following news that the US imposed fresh trade sanctions on Iran after the country flaunted international restrictions placed on its nuclear research programme.

The Rupee is heavily correlated to the price of oil because India has to import most of its fuel which accounts for a third of total imports, and so directly impacts on Rupee-selling.

Much has been made of trade war fears weighing on emerging market currencies due to the expected hit to growth they will suffer when tariffs are imposed. However, the currencies which are expected to be most heavily affected are those of countries which are predominantly export-orientated, and this may not be the case for India, which imports more than it exports.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Bullard sees Limits to Federal Resere Rate Rises

The US Dollar has paused its ascent versus the Rupee, and more generally across the board.

USD was on a general retreat yesterday in what seems mainly a relief story in the absence of new trade woes.

Today, the Dollar index - a broad-based measure of overall USD performance - is again losing steam ahead of key resistance levels.

The consolidation in USD/CNH has helped stem the broader push higher by the Dollar. Chinese policymakers increased the costs of selling CNH.

Concerning the outlook for the Dollar, we have had some warnings from James Bullard - a leading policy maker at the US Federal Reserve and the head of the Reserve Bank of St Louis - that the Fed will face limits in how far it can raise interest rates.

Bullard's words brought into doubt the the commonly held view that the Fed will continue to raise rates aggressively due to strong economic growth in the US.

A higher interest rate is 'food and drink' for currencies as it attracts greater inflows of foreign capital, drawn by the promise of higher returns, thus increasing demand for the currency which appreciates.

If the Fed continues to raise interest rates at the current pace it will strengthen the Dollar but it will also not be long before the 'yield curve' inverts, warned Bullard, and an inverted yield curve is a reliable indicator of an impending economic recession - something which would be negative for the Dollar.

Bullard's comments reignited a debate about the yield curve which analysts had feared was signalling a potential recession in the US after it started to flatten several months ago.

The yield curve is simply a line that plots the difference between short and long-term interest rates in the US. Normally it describes a rising curve because investors generally require higher interest rates for lending for longer periods of time, due to the heightened risk of inflation erosion, however, in the rare case the curve inverts, and shorter-term interest rates rise above longer-term rates, its a sign the outlook in the long-term is depressed and a recession could be about to kick in.

"I think the state of affairs is good for today. The question is how to play things going forward over the next two years," said Bullard, "if the Fed raises rates 50 basis points and the 10-year (Treasury bond) does not cooperate, you could see an inverted yield curve in the U.S.," continued the official in an interview with CNBC.

Fresh interest rate hikes by the central bank prompt changes to the short end of the yield curve but not necessarily the longer end, which is mainly moved by market expectations for the future.

If the Fed hike rates — steepening the front of the yield curve — but the yield on the 10-year Treasury sovereign bond does not follow suit, the curve will rapidly start to look inverted. This may not be something the central bank is keen to discourage so it could result in a slowdown in the pace of rate hikes which could weigh on the Dollar.

The importance of the issue should not be overlooked, added Bullard.

"I think this is the lead issue right now. Yield curve inversion has had a tremendous track record in the U.S. of predicting recessions," says Bullard. "I think you have to respect the signalling aspect of the yield curve."

The outlook for interest rates in India, by comparison, is marginally more muted though most analysts see a third rate hike by the central bank in December as likely, after two 0.25% rate hikes so far in 2018 already.

Core inflation is rising rapidly in India and a proposed rise in VAT is a hefty back-draught, so the central bank has had to raise rates more than expected.

If oil prices fail to rise in the long-term then the two countries may be quite closely matched from a relative interest rate 'rate of change' perspective and the Rupee may even gain versus the Dollar because of its strong longer-term growth prospects.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here