Pound-Rupee Rate: 82.00 in the Spotlight

Image © Adobe Images

- GBP/INR is falling like a knife and likely to extend

- H&S pattern bearish prediction coming true

- Rupee to be driven by global risk appetite

The Pound-to-Rupee exchange rate is trading at around 84.21 on Monday, down 1.50% this week so far and studies of the charts suggest the exchange rate will probably trade lower in the short-term as a new steep bearish pulse extends.

Sterling is under substantial selling pressure amidst the ratcheting up of 'no deal' Brexit expectations owing to the new administration's commitment to seeking wholesale changes to the existing Brexit deal.

Markets are betting that the EU and UK are simply too far apart to avoid a 'no deal' Brexit scenario on October 31.

This alone should impact GBP/INR direction and reinforce the negative feel to the technical charts.

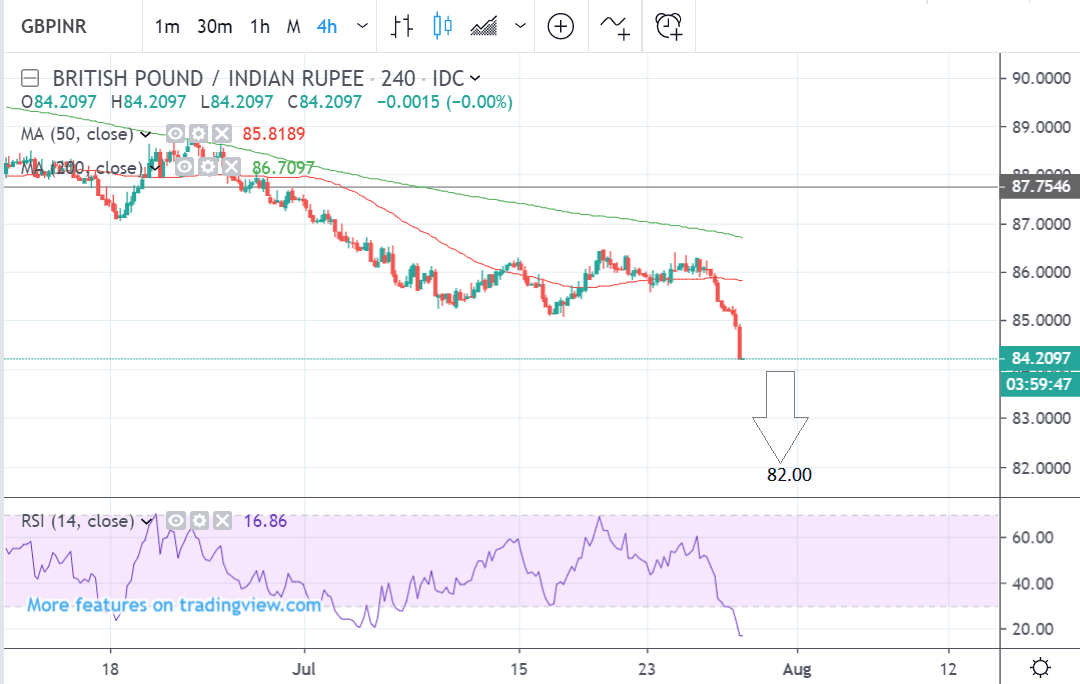

The 4-hr chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair falling like the proverbial ‘knife’ on increased Brexit woes.

This sharp drop is likely to continue subject to a break below the 84.20 level, with a subsequent downside target at 82.00.

The one fly in the ointment is that the RSI momentum indicator which is deep in oversold territory (below 30) and this could indicate an increased risk of a pull-back.

But RSI on its own is not sufficient to overturn our bearish forecast since the direction of the trend trump’s all over considerations.

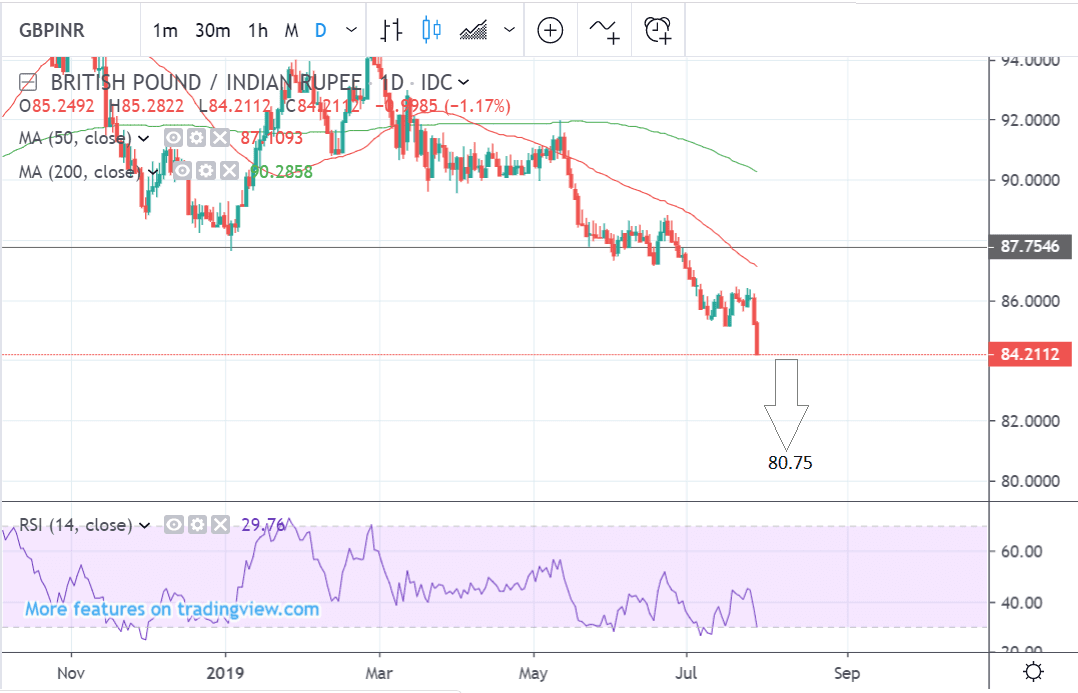

The daily chart - used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead - shows the pair on its way lower to a target at 80.75, which is the longer-term target for the pair.

There is nothing really to add, except that the forecast is also conditional upon a break below the 84.20 level.

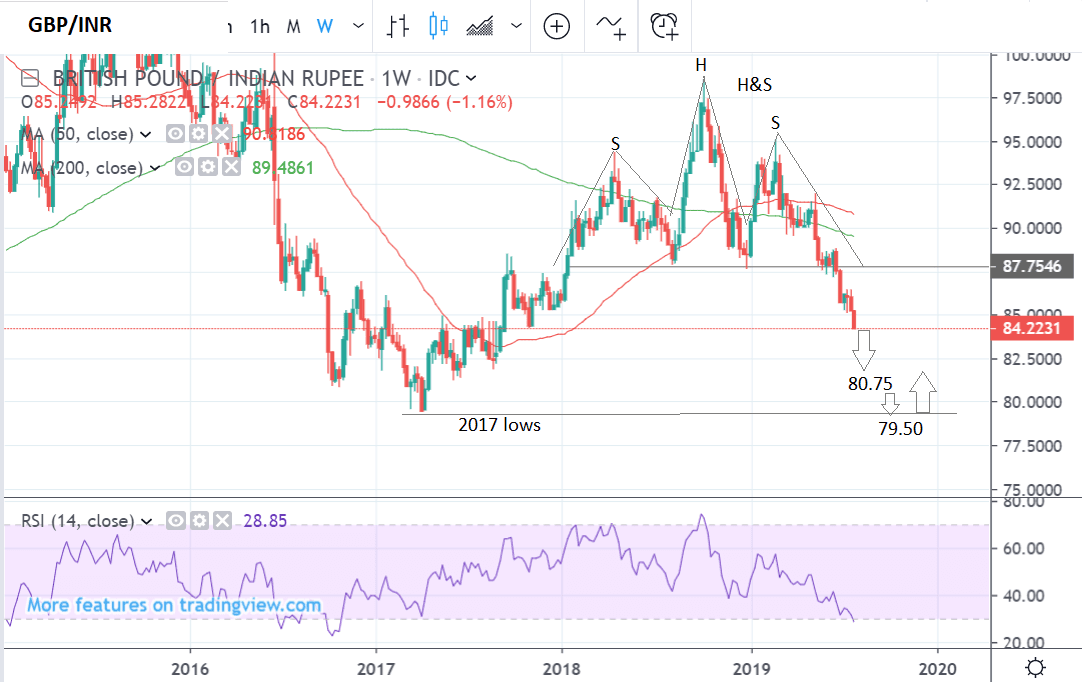

The weekly chart - used to give us an indication of the outlook for the long-term, defined as the next few months - shows the formation of a bearish H&S topping pattern.

The H&S is composed of three peaks - a head and two shoulders. It has broken below the neckline, confirming a decline as deep as the pattern is tall.

This suggests an eventual conservative downside target at 80.75, but a potential target even lower - at around the 79.50 lows - which is our new longer-term target for the pair.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Rupee: What to Watch this Week

The main fundamental driver of the Rupee is global risk trends.

A major driver of global risk appetite will probably the U.S. Federal Reserve decision on whether to cut interest rates and the assessment it provides on the outlook for the U.S. and global economy.

“The United States isn’t an island. We’re part of the global economy. What happens in the rest of the world — in Europe, in Asia — affects the United States. And it’s also true that U.S. monetary policy affects conditions all around the globe,” said Janet Yellen, former Chair of the Federal Reserve said at the Aspen Economic Strategy Group meeting in Aspen, Colorado, on Sunday evening.

Falling interest rates in the U.S. tend to increase the supply of capital to the global economy, which in turn provides a stimulant to emerging markets, such as India.

An interest rate cut is fully expected by the markets, and the communication on future policy is what would likely drive the Dollar and emerging market currencies.

Should the Fed signal lower interest rates in the future, it could well pressure the Dollar lower and send the Rupee higher.

From a global risk appetite perspective, the other important event on the calendar is the release of Chinese Manufacturing PMI data on Wednesday which is forecast to show a recovery to 49.6 from 49.4.

Both Chinese and global manufacturing have been hit recently and investors will be watching the July PMI data for signs as to whether the trend is continuing. If forecasts are accurate and the outlook has improved then the Rupee could further gain from the release.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement