The Euro-Dollar up to 1.20: What it Would Take

The Euro to Dollar exchange rate (EUR/USD) has risen strongly over recent weeks as the outlook for the Eurozone economy, its political institutions and rhetoric of the European Central Bank (ECB), have all gone the currency's way.

The pair has now reached the 1.1500 level which represents the top of a long-term range between 1.05 and 1.15.

Some analysts are now saying that all the good news has already been priced in to the exchnage rate and strong selling interest around technical resistance at 1.15 will see the uptrend stall.

The question now is, can EUR/USD break out of its long-term holding pattern, and what would it take to cause such a breakout?

Analyst Carl Hammer of Skandinaviska Enskilda Banken (SEB) poses the question in a slightly different way, asking what it would take for markets to push the EUR/USD pair back up to 1.2000.

According to Hammer, for EUR/USD to trade above the 1.15 range ceiling it would take one of the following conditions:

1. Strong fiscal collaboration within the European Union. By this he means a banking union and a fiscal union to match the existing monetary union.

Such a development is on the cards but the earliest it would be announced would be almost a year ahead in May 2018 when the European Commission are expected to announce such proposals.

A fiscal union would mean de facto a much more integrated Eurozone, much more along the lines of a united national entity in itself, with major political and cultural implications for the region.

2. If internal imbalances within the Eurozone were to lessen. This is a process which is underway ever since the crisis, which brought the imbalances to light.

“There are increasing signs the Eurozone is trying to rectify the internal imbalances that made the common currency vulnerable in the first place.

“In a series of white papers the European Commission is making the case for a stronger and more unified economic and monetary union.

“Likely the re-election of Angela Merkel and Macron will be curcial for this initiative with the German government likely recognising the need for a more generous policy towards the EMU,” said Hammer.

3. The ECB started to raise its refinancing rate or switch off quantitative easing.

Hammer concludes, however, that since none of these are likely to happen in the short-term they are unlikely to be the catalysts to drive the Euro higher now.

Some would argue Hammer is being to cautious.

Daniel Hui at JP Morgan reckons achieving 1.20 in 2017 is not as big an ask as many assume.

"While EUR/USD is already very close to our year-end target of 1.15, this is not necessarily a hurdle, given that the strength in the pair is as much a manifestation of broad USD weakness, given the extreme subdued pricing for the Fed," says Hui in a note dated July 3.

In fact, one key risk scenario JP Morgan earlier flagged which would justify EUR/USD at 1.20 was if ECB turned more hawkish while the Fed fails to tighten again in 2017, "which is roughly what’s currently priced for the Fed," says Hui.

However, JP Morgan also believe markets are guilty of an 'extreme underpricing' of the potential for interest rate rises at the Federal Reserve.

They believe there would be value in betting on a Dollar recovery as a result.

Increased Demand For Eurozone Assets

If there is an argument for the Euro rising substantially higher it is more likely as a result of an increase in interest from international investors including asset managers seeking to invest their money in the area so as to surf the wave of improving economic fundamentals.

Although data from futures exchanges shows an increase in speculators purchasing Euros this is not the same as asset managers investing in hard assets within the Eurozone.

There still appears to be slack which still needs to be taken up in this regard, according to Hammer.

“We have also considered the process of asset managers allocating more capital to European markets. While speculative flows have shifted considerably it is not yet clear how far this process has gone for real money investors,” said the SEB analyst.

His view is backed up by Morgan Stanley’s head of FX research Hans Redeker, who notes a similar slack just waiting to be ‘taken up’.

“We still expect the EUR/USD to rally towards 1.18 by the end of the year, helped by global investors noting the more positive growth story in the Eurozone. Sentiment may have changed but positioning hasn't adjusted in all parts of the investor community. The currency should rally further as that shifts along with a continuation of foreigners buying EUR equities without an FX hedge,” says the Morgan Stanley analyst.

Another factor in the Euro’s favour, specifically versus the Dollar, is that there seems to be evidence that investors may be buying the Euro and Eurozone assets as a hedge versus their Dollar holdings.

This is partly due to Dollar assets having risen to extremely over-priced levels, and investors looking for a hedge against the possibility of a breakdown.

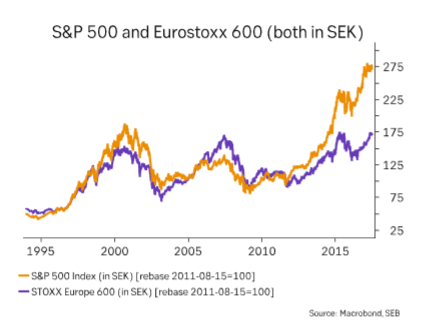

The chart below shows a comparison of the US stock market (S&P 500) and the European stock market (Eurostoxx 600) which shows how elevated valuations are on US equities.

Research from Duetsche Bank points to a 'regime change' in the outlook for EUR/USD.

When the Euro rose sharply following Mario Draghi’s dovish comments at the central banking conference in Sintra last week, it broke well above what would normally be expected from valuation models based on bond yield differentials.

The departure marked a move into ‘new territory’ and a bullish bias now predominates the pair.

Deutsche also note how asset managers remain surprisingly 'underwieght' the Euro, but that soon they are likely to reassert the balance.

“The breakdown in the traditionally tight correlation with the yield spread signals a rare regime break and the possibility of large flows into the Eurozone that could gather more momentum in coming weeks as medium-term investors still retain large underweight positions in EUR/USD," said Winkler.

Although not advocating the pair will reach as 1.2000, winkler does make a trade recommendation to buy at 1.1404 with a target at 1.1600 and a stoploss at 1.1295.