Pound-to-Euro Rate Forecast For The Week Ahead

© DragonImages, Adobe Stock

GBP/EUR is currently trending back up to range highs located in the 1.15s at the start of a new trading week that features a critical stage in Brexit negotiation.

The Pound-to-Euro exchange rate continues unfolding sideways as it has done for almost six months now but at this point in time Pound Sterling is rising up within this narrow range and from a purely technical perspective we expect it to continue as the week ahead unfolds.

The exchange rate achieved our target from last week's forecast at 1.1300, having made a final close of 1.1344 at the end of the week.

A break above the 1.1350 highs next would confirm further upside to an initial target at 1.1430 at the R1 monthly pivot.

Monthly pivots often pose an obstacle to the dominant trend leading to pull-backs or even reversals and they are often used by technical traders to temporarily trade against the trend, to take advantage of this volatility.

It would require a clear break above 1.1470 and the pivot for confirmation of a continuation higher to the next target at the range highs, at 1.1580.

The range highs will present a further tough obstacle and the exchange rate is expected to rotate at the highs and fall back down to the range floor, continuing the sideways trend, rather than breaking out higher.

Only a clear break above the highs, confirmed by a move above 1.1620, would provide confirmation of further upside to a target at 1.1770, which is the minimum target calculated using the golden ratio (0.618) of the height of the range and extrapolating it higher.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events to Watch for the Pound

It is a busy week for UK data with the highlight being the EU summit on March 22-23 which will determine whether the EU and UK will enter a two-year 'transition period' after the official Brexit deadline has passed in March 2019.

A transition period keeps trade settings between the EU and UK more or less unchanged and helps businesses avoid the spectre of a cliff-edge Brexit in 2019 which would see the trade relationship default to World Trade Organisation (WTO) rules tariffs.

The Pound's fate in the coming weeks thus depends very much on whether a transition agreement can be approved.

"If negotiations do indeed proceed in line with the scheduled timetable, this should help to reassure investors that a final deal is indeed possible which should have some upside for the Pound," says a note from global investment bank Investec.

Markets are quietly confident a deal will indeed been reached based on the hints that have been coming through in recent days, Robin Walker - who serves as Parliamentary Under Secretary of State at the Department for Exiting the European Union - said in a speech at the Institute of Directors last week that "we recognise how important it is to secure the deal on the implementation period as soon as possible. I want to stress that we are very close to a deal at this time.”

“Both the prospect and the timing of a transitional deal on Brexit remain highly uncertain. If such a deal does take place, however, it could be an important positive development for Sterling in the near-term by reducing 'cliff-edge' risks," says Lefteris Farmakis, an FX strategist at UBS Group.

However, the issue of the Irish border remains a thorny issue that has long appeared to be at an impasse, and it could yet come to deliver disappointment so nerves will remain elevated.

The other major event for the Pound is the Bank of England (BOE) rate meeting on Thursday at 12.00 GMT.

Although no-change in policy is expected analysts will be carefully combing the meeting minutes, released after the meeting, for signs of which way the monetary policy committee (MPC) appears to be swaying when it comes to future policy.

At the previous meeting, the BOE said they thought markets were underestimating how close the BOE was to increasing interest rates and analysts will be watching for whether this is still the case, according to Nordea Bank's chief analyst Martin Enlund et al.

Much depends on whether the BOE decides to keep the new phrase introduced in its last policy statement that, "monetary policy would need to be tightened somewhat earlier and by a somewhat greater degree over the forecast period."

If the phrase is kept in then it would indicate a greater urgency to raise interest rates than currently expected and result in upside for the Pound.

Higher interest rates are generally bullish for a currency as they increase inflows of foreign capital drawn by the promise of higher returns.

Another major release in the week ahead for the Pound is inflation data out on 9.30 on Tuesday, and this is forecast to show a slow-down in the rate of inflation to 2.8% year-on-year in February, i.e compared to a year ago, from 3.0% in the previous month.

On a monthly basis, it is forecast to show a 0.5% rise from a -0.5% in the previous month of January.

Normally high inflation stimulates currency appreciation because it suggests interest rates will rise, especially if it is caused by stronger growth, but because UK inflation has been caused predominantly by the weak Pound increasing the price of imports rather than growth, the relationship is a little more complex and the Pound may act unpredictably after the release.

Wednesday sees the release of UK labour market data which could also impact on the Pound - if labour data is positive, especially wage data, it is likely to strengthen Sterling.

Average Earnings are forecast to rise to 2.6% in January from 2.5% in December - both including and excluding bonuses - and if this occurs it could provide an impetus to the Pound.

The unemployment rate is forecast to stay unchanged at 4.4% and employment change to show that an extra 85k more jobs were added to the economy when the data is released at 9.30 on Wednesday morning.

Thursday sees the release of another potentially market-moving release in the form of Retail Sales, which is forecast to show a 1.5% rise yoy in February from 1.6% previously and 0.4% month-on-month from 0.1% in January.

Data and Events to Watch for the Euro

The main economic event in the week ahead for the Euro is probably the release of March IHS Markit manufacturing and services PMI data on Thursday at 8.30 GMT.

PMI stands for Purchasing Manager Index and is a gauge based on survey responses from purchasing managers in companies, who have a pivotal role which gives them unique insight into the state of the sector. Taken together, the responses to the PMI survey provide an important indication of growth, both in major industry sectors and the economy in general.

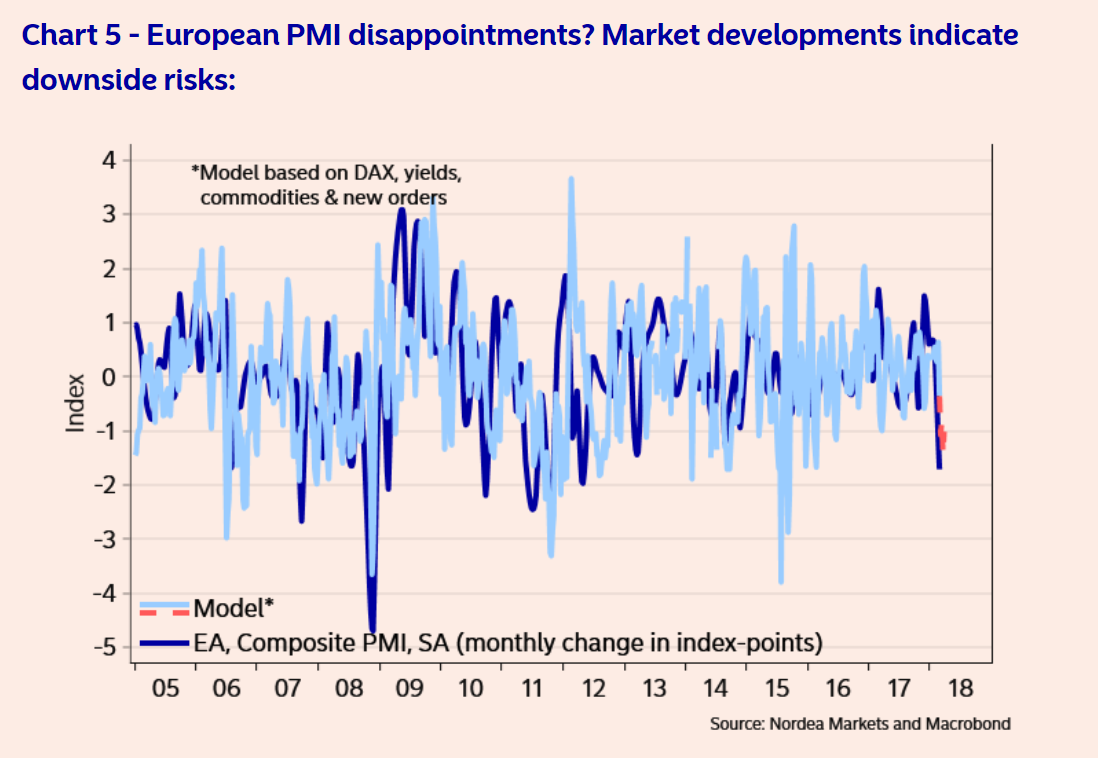

"We continue to judge that European/German PMIs look vulnerable from the current high levels, and next week will give us a string of new clues on whether that story holds. Judging from the financial market developments over the last month, the Composite Euro Area PMI (Thursday) could drop as much as 1 index-point again this month," says Nordea Bank's Martin Englund et al.

Enlund's forecast of an index-point fall is based on Nordea's predictive model for PMIs using Dax yields (see below).

The general consensus is that Manufacturing will slow to 58.1 from 58.6 and Services to 56.0 from 56.2.

Eurozone PMIs peaked at a very high level (above 60) in late 2017 and have since been drifting lower - clearly, the consensus thinks the deterioration will continue, and this may impact negatively on the Euro, especially if the decline is deeper-than-expected.

Another survey-based early warning indicator for the economy is the ZEW economic sentiment gauge for March, scheduled for release at 10.00 on Tuesday, March 20.

The ZEW index is forecast to fall slightly to 28.1 from 29.3.

Eurozone Consumer Confidence for March is out at 10.00 on Tuesday too and is forecast to come out at 0.0 in March from 0.1 previously. Given historic results, this would not be a disastrous result.

(Image courtesy of Tradingeconopmics.com)

From a political perspective the reopening of the Italian parliament after the elections on Friday, March 23, will highlight political risks in the region as it will start the process of coalition talks to form the next government. There is still a risk of an anti-EU coalition forming between the Northern League and 5 Star which could make further integration of Europe problematic and weigh on the Euro, although talks are likely to last for some time before a final agreement has been made.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.