The Euro-to-Pound X-Rate About to Break Higher, BNY Mellon Analyst says Pound's September Rally Built on Sand

"In the first instance, the Pound's rapid ascent was about poor positioning rather than any golden opportunity" - Neil Mellor at BNY Mellon.

The Euro is on the cusp of making another leap higher against Pound Sterling which we are told recovered through the course of September on flimsy technical reasons rather than because of any substantive change in fundamental fortunes.

The Euro fell from £0.93 back in late-August to £0.8746 in late-September. The single-currency is now in the process of recovering and is seen buying £0.8876.

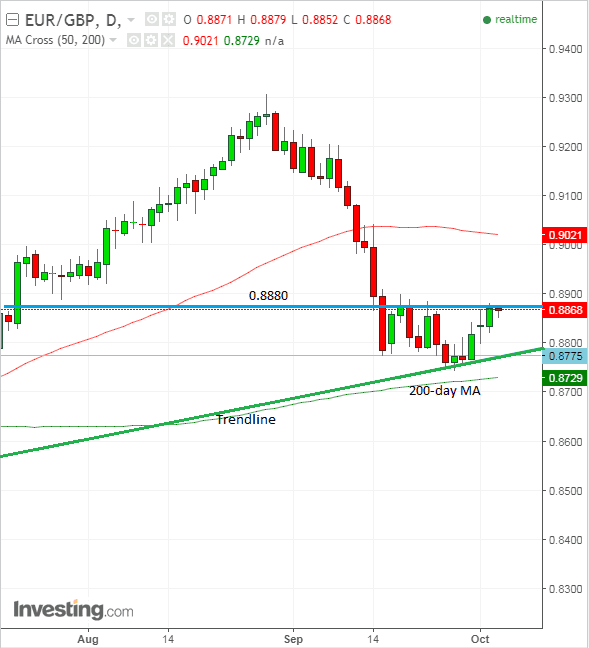

According to technical analyst Richard Perry at Hantec Markets, EUR/GBP recently found a "confluence of long-term support" (green lines) and was able to started rising. "The support held firm and a succession of positive candles in recent days the market has pulled the pair higher as Sterling has underperformed."

Perry studies the structure of foreign exchange markets by reading price charts in order to ascceratain the next likely moves of a currency pair.

But for the Euro to retake further lost ground against the Pound, Perry says a key resistance line observed in the EUR/GBP exchange rate's chart must be crossed first.

The next level to watch is the key £0.8880 pivot (blue line), with a break above that is required to continue the trend higher. A Euro-to-Pound exchange rate at £0.88 gives us a Pound-to-Euro exchange rate at €1.1363 for those inclined to watch the market from the other way around.

"A closing break through £0.8880 looks to form a base pattern which would be confirmed on a move above £0.8900. Momentum indicators are now looking to decisively pick up with the RSI confirming a recovery," says Perry.

He adds that a closing break above £0.8880 would confirm 130 points of upside to a target at £0.9000.

For those watching this market from a Pound into Euro perspective, EUR/GBP at £0.90 gives us a GBP/EUR exchange rate at €1.11.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Pound's September Rally Built on Sand

Suggestions that the Euro is liable to break notably higher against the Pound will mark a sudden reversal in fortunes for the two currencies.

"The Pound was on a roll: just over a week ago... But all the momentum is now with the bears. What happened?" questions BNY Mellon's, Senior FX Strategist, Neil Mellor.

Scroll back to June and an unexpectedly "stoical economy" started the fight-back, after it was given as the reason for Bank of England's, Chief Economist, Andy Haldane's change of heart, when he came out in favour of raising interest rates.

After that the tide steadily turned until only three weeks ago in mid-Septmber 'uber-dove', Gertjan Vlieghe, shocked markets by saying he too could see the wisdom in rasing interest rates; after that Sterling rose 3.0% in the next 24 hours.

But all the talk of the Bank of England and interest rates may actually have masked the real reason for the Pound's rise during September.

"In the first instance, the Pound's rapid ascent was about poor positioning rather than any golden opportunity: the market was simply unprepared for the Bank's particularly assertive line," says Mellor. "Speculators were net short of 46k contracts in GBP, or nearly twice the average short position held in the currency since 1995."

The argument that a rebalancing of extreme short-positioning was at the heart of the recent recovery gained credence last Friday when Carney's re-endorsement of a rate hike had little impact on the Pound.

"Speculative positioning is now neutral and to many, UK economic data have started to make talk of a rate hike incongruous (yesterday's construction figures were abysmal)," says Mellor.

Therefore with technical considerations seen to be driving the market the credibility of technical forecasts like that given by Perry at Hantec Markets is elevated.

Indeed, Mellor notes that Carney's emphasis on "pockets of risk" in consumer debt reinforces expectations that the Bank will proceed with a hike in November when the Inflation Report is released.

But this should be understood against a backdrop where recent data places greater emphasis on the Bank's assurances that normalisation will "be a protracted affair."

Also seeing the markets getting ahead of themselves on the Bank of England's desire to raise interest rates is Andreas Steno Larsen at Nordea Bank who believes the Pound's rally went too far and traders are guilty of "crowd behaviour".

“Neither from the inflation prints, nor the pricing of Bank of England do we see any scope in expecting Sterling positive news in to 2018 (at least on the other side of the hike in November)," says Larsen.

As far as Brexit risk goes, Mellor questions how much the market is likely to be affected by "shrinking Brexit time horizons" and "political infighting" which seems to have lost thier punch as Sterling influencers, but it seems impossible to completely discount as a backdrop influencer even if more eclectic, shorter-term drivers have moved to the fore.

Pound Avoids Potential Political Pitfall

The Conservaitve Party conference has passed without incident for Sterling and the Prime Minister appears to be secure in her position at the helm of Government.

Going into the event currency market commentators expressed concern that Theresa May's apparent weakened position left the door open to a potential leadership challenge which could then in turn lead to another General Election.

We argued there was too much pessimism on the matter and that the Pound might rally once markets agreed with the view that the Government has the ability to endure.

Indeed, unity was the order of the day. Granted, the conference was not a pretty one but the key message is that there is little appetite to dispose of May within the ruling party.

And importantly on Brexit there were no new surprises.

"Overall, the absence of new news in the closing speech may provide a more stable political backdrop. It now looks more likely that Theresa May remains as prime minister in the medium term. Together with a more constructive stance presented at the Florence speech, we believe this removes some of the tail scenarios going into the 5th round of EU-UK negotiations next week," says Sreekala Kochugovindan at Barclays in London.