Pound Sterling a Buy, Euro a Sell: Deutsche Bank Could be on the Money with their 'G10 Trade of the Week'

Foreign exchange strategists at Deutsche Bank wrote to clients telling them the British Pound's decline against the Euro was due to take a break and reverse.

So confident were they that Sterling was due a rebound they recommended a trade on the view.

Deutsche Bank's Robin Winkler suggested traders sell the EUR/GBP pair, crowning the strategy his "G10 Trade Idea of the Week".

Looking at the market's reaction the trade is starting to pay off; at the time of writing the Euro to Pound Sterling exchange rate has fallen half a percent to 0.9218. The Pound to Euro exchange rate is therefore at 1.0849.

But the move has further to go.

The Rationale for the Trade

We have covered their views in more detail already, here, but for those seeking a brief assessment, the trade is based on the following convictions:

“While we remain structurally bearish on GBP, we think EUR/GBP is due some correction in the short-term.

“The cross is technically stretched with the 14-day RSI running above 80, a level it has reached only four times since 2008.

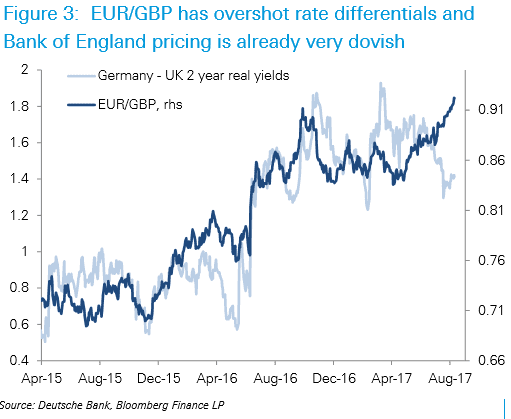

“Moreover, Bank of England pricing looks very dovish again with no hikes priced until late 2019. While we don't expect a hike until there is more political clarity around Brexit, the Bank is likely to express discomfort with the TWI being back to 2016 lows. EUR/GBP has already overshot short-end rates.

Above: The Euro is now overvalued relative to Sterling according to the exchange rate's long-term relationship with the difference in yields on German and UK bonds.

On the question of Brexit negotiations, Deutsche Bank believe the U.K. government's paper proposing an EFTA compromise signals a more pragmatic approach from the UK government, reducing the risk of a cliff-edge Brexit more than the market has appreciated.

As such, analysts are forecasting a fall back to 0.90 in the Euro to Pound exchange rate and have put on a trade for such a move when the rate was at 0.9284.

The stop-loss level; i.e. the level that the trade is stopped to protect against losses, lies at 0.9420.

At the time of this article's update, the exchange rate is at 0.9218.

For those looking at the market from the other direction, this gives us Pound to Euro exchange rate target at 1.11, an entry at 1.077 and a stop-loss at 1.06.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Technicals Confirm Potential for Reversal

Our most recent technical studies of the exchange rate confirm it remains caught in a strong downtrend across all timeframes, and to state an oftstated investment maxim, "the trend is your friend until the bend at the end."

GBP/EUR's downtrend began in May and has seen the exchange rate fall a considerable amount, from 1.18 to 1.08 during that period.

Without any evidence suggesting the contrary we would normally expect the trend to continue.

Nevertheless, there are signs, albeit feint, that it may be losing strength and even a possibility that the pair could be about to reverse and go higher.

The first of these signs is that the exchange rate made an intraday recovery on Tuesday which presented itself as a Japanese hammer reversal candlestick on the daily chart.

According to candlestick lore, hammer candlesticks are more reliable if they are immediately followed up by another upday.

Today has started out looking like an upday but it will need to close higher to provide better confirmation.

The outline of the May to August downtrend is such that it also suggests the possibility of a reversal on the horizon.

We stress this is just a possibility so should be interpreted with caution.

But looking at the whole move down we note how the shape of the downtrend is broadly divided into three parts - a clear and straight downtrend, followed by a messier more consolidative period in June and July, in which there was a relatively strong correction, and then another clear untroubled descent in August, much like the May move.

The tripartite structure of this move is similar to that of a 'measured move' and more importantly the length of the first (a-b) and third (c-d) sections are similar, indicating the move may well be complete - what then follows is likely to be a rebound higher, if not a complete reversal.

This combined with the hammer candlestick provides a case for a correction higher although without a stronger recover in the actual price itself we are not in a position to change the bearish tenor of our forecast.

Fundamentals: Euro Might be Due a Pause

The Euro has reversed some of its strength over recent hours, having popped to fresh eight-year highs against Sterling and two-year highs againts the US Dollar.

Nerves ahead of the key European Central Bank meeting due on September 7 are widely being cited for the retracement.

"At the current level, it is difficult to chase the currency higher ahead of the ECB meeting next week and as long as speculators’ positioning remains so extended," say analysts at UniCredit Bank in a mid-week briefing. "It seems likely we may be entering a period of consolidation as investors decide to take a breather, interpret the ECB’S message on 7 September and reassess."

UniCredit do however remain optimistic on the Euro's prospects over the medium term and eye the Euro's progression as likely to ultimately extend.

Most analysts do however agree that even if the ECB is unhappy with the Euro's strength there is little they can do to halt the rise as fundamentals are such that a stronger currency is almost inevitable.

So weakness is likely to be temporary.