Soft EZ Inflation Can Catapult GBP/EUR Rate to Range Highs: The Week Ahead Forecast

- Written by: Gary Howes

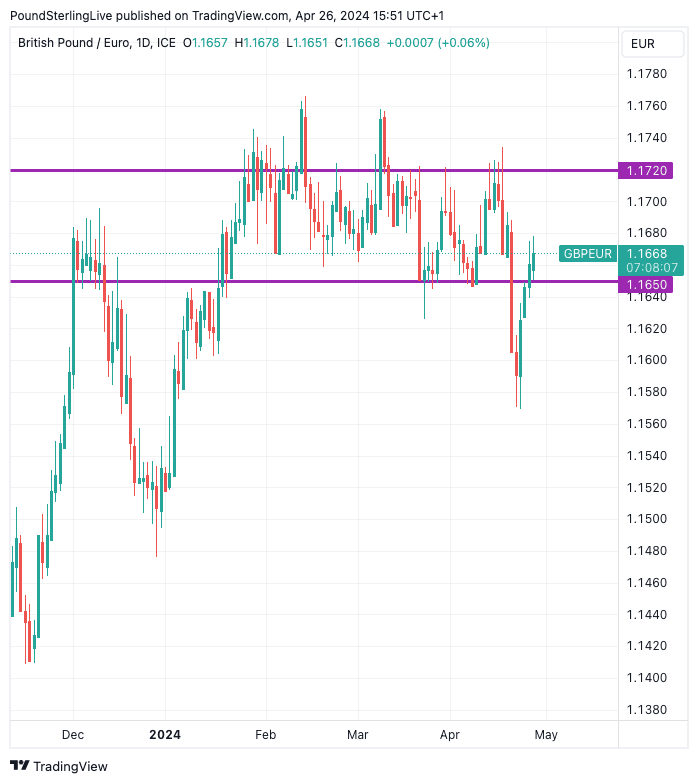

In the coming days we look for the GBP/EUR recovery to consolidate above 1.1650 with a potential test of figures above 1.17 in the event of soft Eurozone inflation numbers.

Last week we said the selloff in Pound Sterling was overdone and, like a moth to a flame, it would recover back into the 2024 range.

That call was on the money and speaks of how well-behaved the Pound to Euro exchange rate has become from a forecasting perspective.

In the coming days we look for the recovery to consolidate above 1.1650 with the potential for a retest of the 1.17-1.1720 a possibility if the Eurozone inflation print due comes in lower than expected.

Above: GBP/EUR at daily intervals with the 2024 range indicated. Track GBP/EUR with your own custom rate alerts. Set Up Here

From a technical perspective, there is little to consider beyond the 1.1650-1.1720 range owing to the clear preference for the exchange rate to trade within these boundaries.

The pair tends to do something akin to a random dance within the area, touching either side depending on whether the Eurozone or UK have had a good spell of data or experienced 'hawkish' central bank developments.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The truth is, though, both the Eurozone and UK economies are subject to similar fortunes, which means the central banks are likely to cut rates more or less in tandem. This diminishes the odds of a significant shift in trend in the near term.

Anything above 1.17 is considered a strong level for euro buyers, while anything below 1.1680 is considered decent value for Pound buyers.

There are no market-moving events due out of the UK this week, but we have some important Eurozone inflation numbers to look forward to.

German inflation figures form the initial focus with state-level releases starting in the European morning Monday, with the final all-Germany release due at 13:00 BST (expected: 2.3% y/y, previous: 2.2%).

French CPI inflation is due Tuesday at 07:45 BST (expected: 2.1%, previous: 2.3%). Between the German and French figures we could get a good steer as to where the Eurozone release is heading.

Eurozone CPI is released at 10:00 BST on Tuesday with the market expecting 2.4% y/y, unchanged on March. The core CPI is expected at 2.8%, down from 2.9%.

Any undershoots will raise the odds that the European Central Bank cuts interest rates again in July, having already done so in June. It is the timing of the second ECB cut that matters for markets, given a June move is well telegraphed.

But, should inflation figures beat expectations, expect the Euro to rally against the Pound and Dollar, as markets would see a low likelihood of a July rate cut.

Indeed, a strong print would raise questions as to whether a June cut is at all appropriate, which would support the Euro.