Pound-Euro Week Ahead Forecast: Supported at 1.16 as Data Determines Upside

- Written by: James Skinner

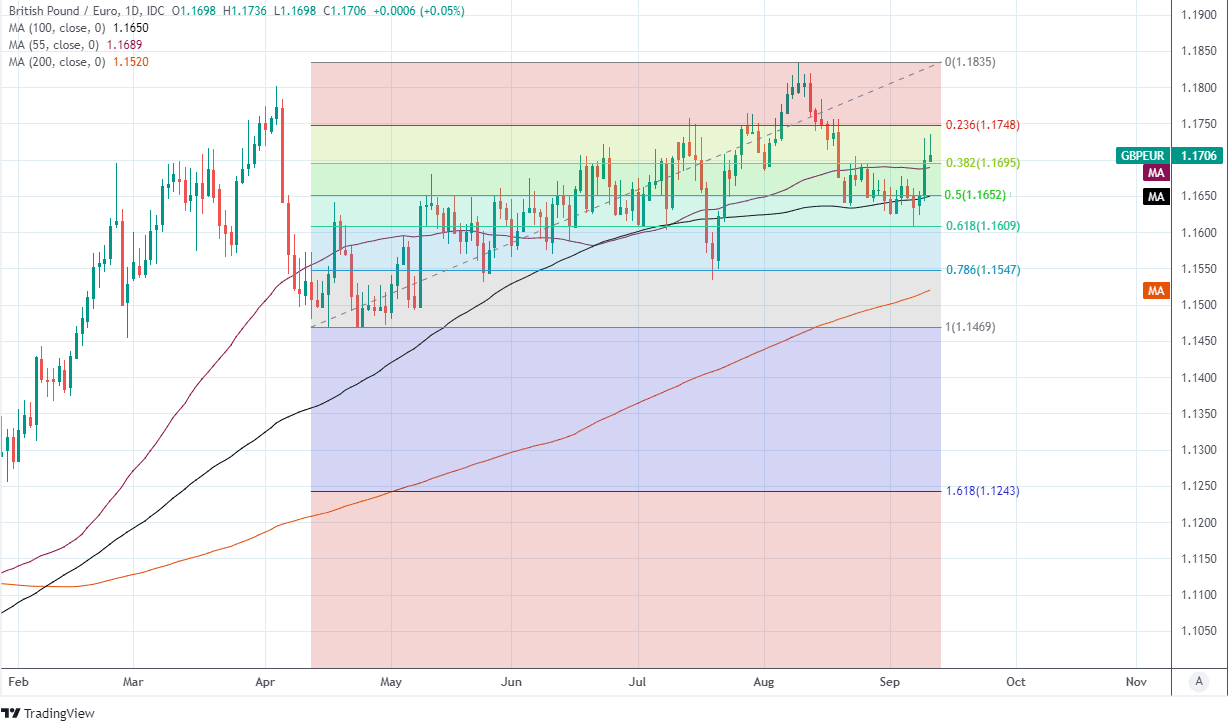

- GBP/EUR supported at 1.16 as corrective pressure wanes

- But struggles to overcome 1.17 without lift from UK data

- As jobs, inflation figures & UK gov’s pandemic plans eyed

Image © Adobe Images

- GBP/EUR reference rates at publication:

- Spot: 1.1709

- Bank transfers (indicative guide): 1.1390-1.1470

- Money transfer specialist rates (indicative): 1.1590-1.1640

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Euro exchange rate enters the new week close to one-month highs having drawn a line under August’s corrective sell-off, although the extent of any further recovery remains to be determined by a busy UK economic data calendar over the coming days.

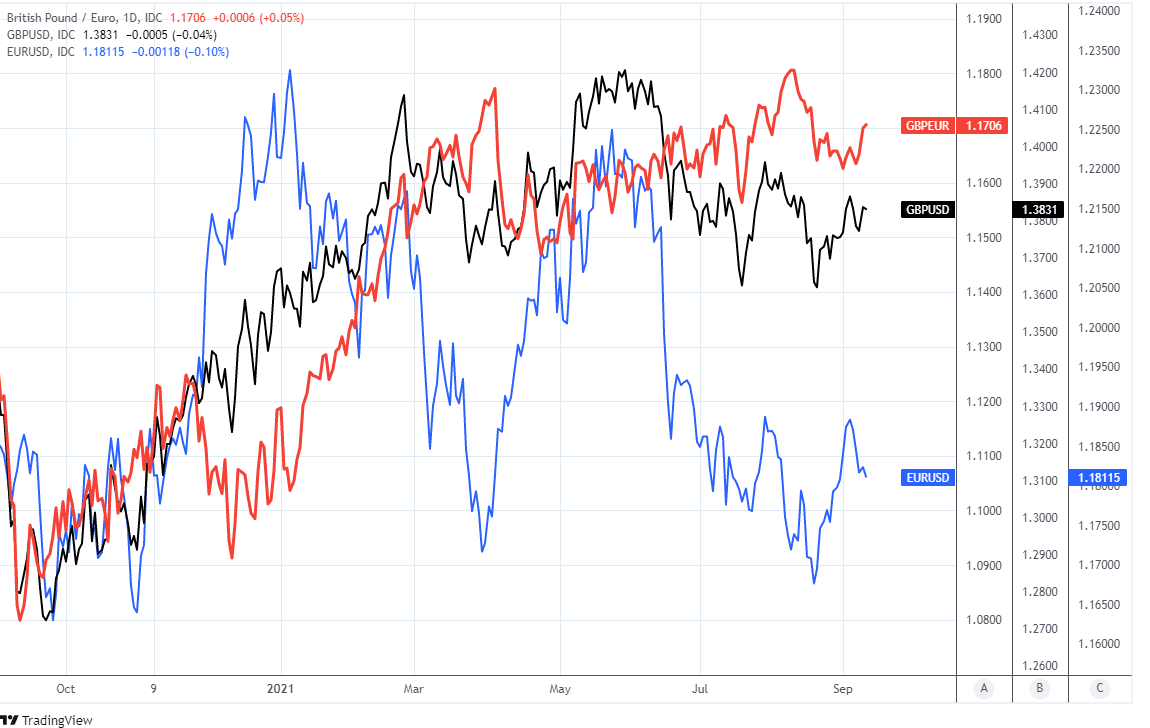

Pound Sterling ended last week as one of the better performing major currencies having risen against both higher and lower-yielding currencies alike despite what was at times a shaky performance from global stock and commodity markets.

The Pound-to-Euro exchange rate was more than half a percent higher to enter the new week above 1.17 after experiencing its strongest one-day gain since July when remarks in parliament from Bank of England Governor Andrew Bailey and colleagues reminded the market that BoE policymakers are actively and openly working on the assumption that the bank will likely need to raise interest rates next year and after in 2023.

Interest rates could rise enough to begin reversing the cuts to borrowing costs that were announced at the beginning of the pandemic due to expectations of sharp increases in inflation over the coming months that are connected with “the persistence of Covid” and which will raise for Sterling the importance of this Wednesday’s inflation data for August.

“GBP is deriving support from the move higher in rate expectations for next year which should provide continued support. However, risks are emerging which, if sustained, could see some reversal of GBP appreciation,” says Lee Hardman, a currency analyst at MUFG.

Above: Pound-to-Euro rate shown at daily intervals with major moving-averages and Fibonacci retracements of April recovery indicating possible areas of support.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Tuesday sees jobs figures for July released at 07:00, which will be scrutinised for signs of any adverse impact on employment from the winding down of the furlough scheme and are said to be the highlight of the week by some analysts.

However, Wednesday's inflation numbers could prove equally as significant for determining if the Pound-to-Euro exchange rate is able to build on its recovery back above 1.17, or if it’s momentum falters and leads Sterling to retest a cluster of support levels close to the 1.16 handle.

“We think the data flow should prove by-and-large supportive for the pound and we could see EUR/GBP press lower towards the 0.8500 mark [GBP/EUR up toward 1.1764] while Cable may break above 1.3900,” says Francesco Pesole, a strategist at ING.

“As we get closer to the BoE’s policy announcement on 23 September, GBP’s sensitivity to domestic data drivers may increase, even more so as this week’s calendar includes higher-frequency data,” Pesole adds.

Consensus looks for Wednesday’s prices data to show UK inflation rising from 2% and exactly the targeted level of the BoE, to 2.9%, but with inflation surprising on the downside already in July the Pound could be especially sensitive to any further underperformance of market expectations.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Such an outcome would potentially prompt questions about whether an interest rate rise is really likely to prove necessary next year, which could in turn prevent the Pound-to-Euro rate from building further on last week’s recovery.

“We have a long standing year-end forecast of EUR/GBP0.84 [GBP/EUR: 1.1904]. However, further signs that the UK economic rebound could be losing momentum will challenge our moderately constructive GBP outlook,” says Jane Foley, head of FX strategy at Rabobank.

“Although the election is a little too far away for GBP investors to take fright from UK political events, they will have to take stock of what a tax hike may mean for the UK economic recovery and for Bank of England policy,” Foley says.

Last week surprise increases in employment taxes were announced by the government and have further dampened already-reduced analyst expectations for the UK’s economic recovery and for Pound Sterling.

However, the effect of these on sentiment could be countered somewhat over the coming days if it materialises that weekend reports about the government’s likely approach to the coronavirus this autumn are accurate

Above: Pound-to-Euro rate shown at daily intervals with GBP/USD and EUR/USD.

Multiple reports have suggested that Prime Minister Boris Johnson could announce over the coming days that the government will relinquish its emergency powers as they expire at the end of the month, and that it will instead rely on guidance and endorsements of less damaging containment measures than the business closures used in the past.

This would provide clarity to businesses and households about the kind of economic conditions that will be faced by all over the coming months, with a less imposing governmental approach providing the economy the best shot it could hope for at recouping the losses incurred over the last 18 months.

“From one perspective, only a resumption of North Sea oil & gas output prevented a negative monthly GDP print,” says Ross Walker, chief UK economist at Natwest Markets. “Whilst there are some individual quirks and distortions in the July data (eg, the drags from the impact of Stamp Duty and Test & Trace), the overall sense is that underlying momentum in the economy is fading a little earlier and to a greater extent than expected.”

While Tuesday and Wednesday’s employment and inflation figures are the highlights of the UK economic calendar this week, Friday does also bring the August retail sales report and this is likely to garner more attention than others after July’ data revealed a surprise -2.5% contraction in sales.

Many economists had expected retail spending to wane after pubs, bars, restaurants and clubs reopened as this was seen as likely to facilitate a shift in spending away from goods and back to services, so many will look at 07:00 on Friday to see if that process has played out already or if it’s still ongoing.