NatWest Forecast Pound Sterling Upside vs. Euro, But Only Early in 2021

- Short-term Sterling strength ahead

- UK vaccination programme offers short-term boost

- GBP/EUR and GBP/CHF tipped to be main beneficiaries

- But strength could be fleeting

Image © Adobe Stock

Foreign exchange strategists at a leading UK high street lender say they are constructive on the British Pound's prospects against the Euro and Swiss franc in the first half of 2021, citing the UK's vaccine-lead economic recovery.

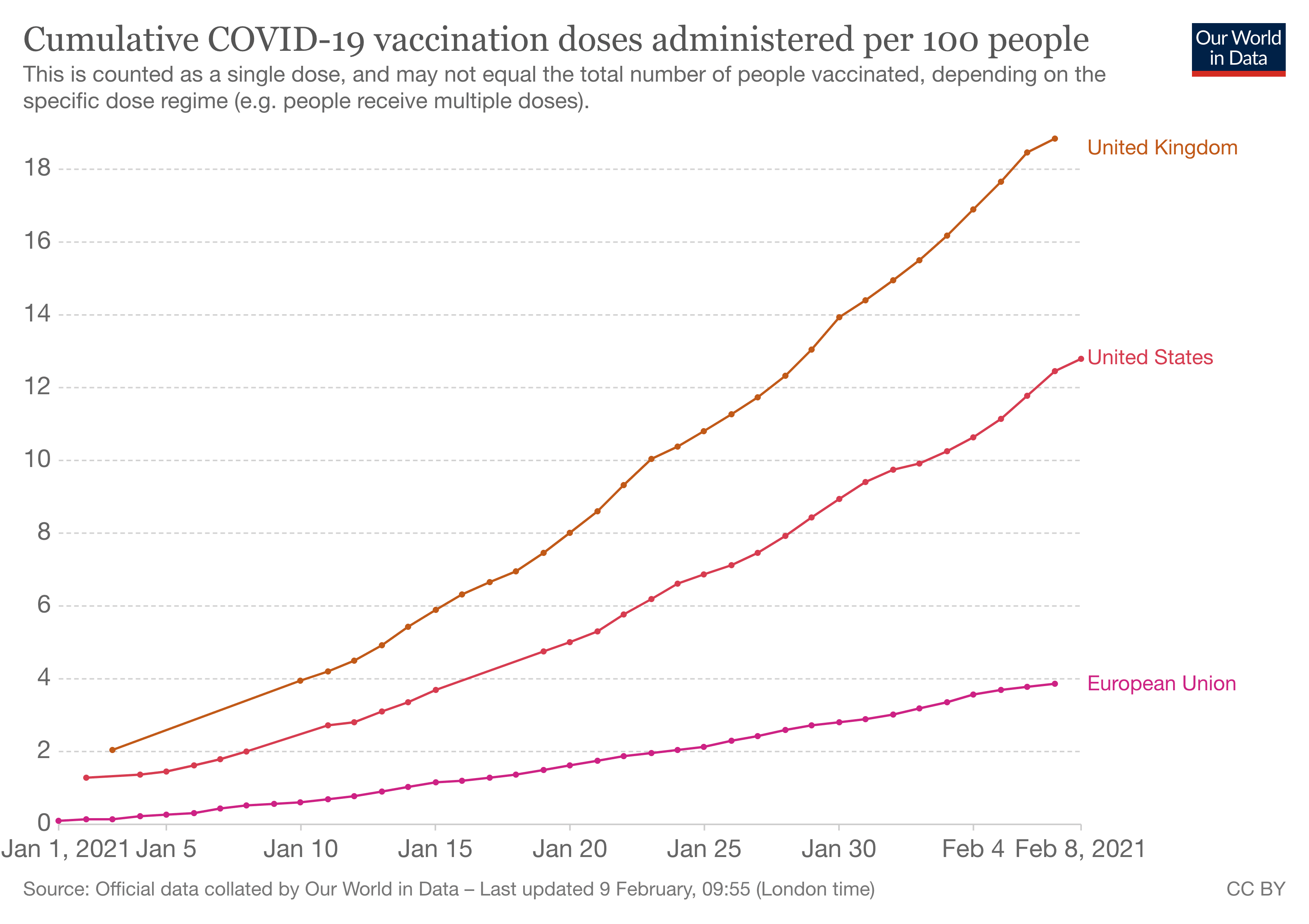

In a research briefing note to clients, NatWest Markets say a "quicker pace of vaccine roll-out will likely lend support to Sterling," noting a clear divergence in the speed of vaccinations between Europe on the one hand and the U.S. and UK on the other.

However, those watching the market to transact out of Sterling should be aware that they only expect any outperformance in the Pound to be relatively short-lived, as the country's economy and currency will struggle under the new post-Brexit dispensation.

"With downside risks for Sterling more fully priced, we see scope for further Sterling strength in the near term amid quicker vaccine roll-out," says Paul Robson, Head of G10 FX Strategy at NatWest Markets.

- GBP/EUR spot at publication: 1.1393

- Bank transfer rate quotes: 1.1094-1.1174

- FX transfer specialist quotes: 1.1244-1.1313

- More information on securing specialist EUR rates, here

"A successful rollout should also mean that the Bank of England (BoE) doesn’t take policy rates negative. This can also support Sterling," says Robson.

The Bank of England triggered a fresh impulse of buying of Sterling on Thursday Feb. 04 when they effectively signalled negative interest rates in the UK are highly unlikely in 2021 unless a notable and unforeseen deterioration in the trajectory of the pandemic and the economy transpired.

In addition, the Bank says a strong economic rebound is likely to materialise once the economy is unlocked and citizens start spending the money they saved during the lockdown.

"The BoE appears to have ruled out using negative rates during the short window where additional policy easing could have been justified. That’s a significant Sterling positive, and we stay long vs EUR and CHF," says Robson.

In an interview with the Observer newspaper at the weekend Bank of England Governor Andrew Bailey said there was a chance that after being cooped up for so long people would "go for it" once the vaccine programme allowed the economy to reopen.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Other economists share this view.

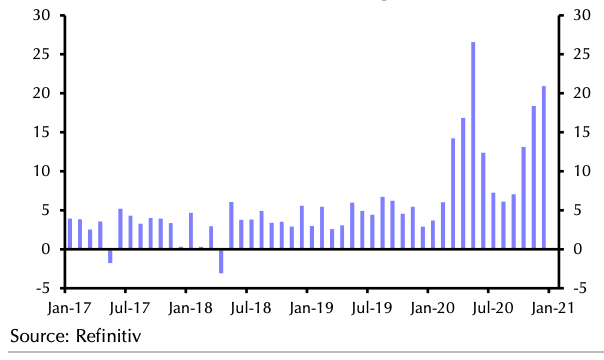

"Our view that the recovery from the COVID-19 pandemic will be quicker and more complete than most forecasters expect suggests that the economic legacy of the crisis may not be a permanently smaller economy but instead higher inflation and bigger public deficits," says Ruth Gregory, Senior UK Economist at Capital Economics.

Above: Consumers are expected to run down savings in 2021, triggering a sharp rebound in the economy say Capital Economics. Chart shows households’ Cash Holdings (M4 ex. £bn, m/m). Image courtesy of Capital Economics.

Any such boost in economic activity, particularly relative to other economies that might be struggling to exit lockdown, will likely boost the Pound. "We see scope for further Sterling strength in the near term amid quicker vaccine roll-out," says Robson.

By contrast, for the Eurozone Robson says "the path from today’s lockdowns to tomorrow’s vaccine-driven recovery feels more fraught".

Reflecting a cautious approach to the single-currency, NatWest Markets say they have exited a 'long' position on the Euro against the Dollar. In addition to concerns over the EU's slow vaccine rollout, analysts at NatWest are nervous of the European Central Bank (ECB)'s increasingly vocal dislike of the Euro's appreciation over recent months.

But any gains in Sterling against the Franc and Euro are expected to be front-loaded in 2021, meaning the peak in the currency's value will likely be in the first half of the year.

One reason for this view is that the positive impact of the vaccination programme will ultimately wear off and the negative impacts of Brexit will be left exposed.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"Sterling’s recovery could fade later in the year as it becomes more apparent that the agreed deal is weighing on trend growth. Softer productivity trends, deep economic scarring and deteriorating sustainable current account deficit position are expected to impact negatively," says Robson.

RBS economist Ross Walker said in a research note in November 2020 that Brexit is likely to exert a longer-term, incremental drag on UK productivity and economic growth as a result of reduced investment and restricted labour mobility.

"Trade deals with non-EU countries will bring a dose of sobering reality – far from taking back control, the UK will be taking whatever it can get from larger trading counterparts less in need of a speedy deal," says Walker.

NatWest Markets forecast the Pound-to-Euro exchange rate to be at 1.14 by the end of March 2021, ahead of an easing back to 1.12 by mid-year and 1.11 by year-end.

The Pound-to-Franc exchange rate is forecast at 1.2610 by the end of March 2021, 1.247 by mid-year and 1.222 by year-end.

"The short-term outlook is arguably more constructive before long-term concerns start to dominate once more," says Robson.