Pound Below €1.12, AFEX Forecasters think 1.10 Could be Next

Image © Adobe Images

- GBP/EUR near six-month low at 1.1187, had hit 1.1139 earlier

- Hammond threatens to quit on May's spending plans

- Draghi stokes volatility in Euro with promise to for further easing

- GBP/EUR could go to 1.10 and below: AFEX

Pound Sterling is again under selling pressure against the Euro, with the GBP/EUR exchange rate breaking below the psychologically significant 1.12 level over the course of the past 24 hours, and the Pound-to-Euro exchange rate could be on its way to 1.10 according to one analyst we follow.

"Despite a gradual loss of momentum GBP prices have not yet managed to reverse the prevailing bearish pattern here with risk thus for further deterioration before any meaningful low forms," says Trevor Charsley, a foreign exchange analyst at AFEX, a foreign exchange broker based in London.

The exchange rate has however seen some notable volatilty during the course of the London morning, with the Euro suffering a sudden drop after European Central Bank (ECB) President Mario Draghi told a conference in Sintra, Portugal that fresh monetary stimulus would soon be unleashed on the sagging Eurozone economy.

Draghi said that if inflation does not show signs of picking up sustainably toward the bank's target of "close to but below 2%" then additional stimulus for the Eurozone economy could be required.

"Further cuts in policy interest rates and mitigating measures to contain any side effects remain part of our tools. And the [asset purchase programme] still has considerable headroom," Draghi told his audience of central bankers. "All these options were raised and discussed at our last meeting."

"Super Mario is back!" says Chris Beauchamp, Chief Market Analyst at IG. "Despite only having a few months left to his tenure, the head of the ECB has handed his successor a firmly dovish bias, as he leaves the door open to more QE and renewed negative rates at the ECB in order to try once again to kick-start the eurozone economy."

"The Euro has dropped sharply," adds Beauchamp.

However, we don't see Draghi's intervention as significantly shifting the outlook for the GBP/EUR pair. The break below 1.12 signifies the latest impulse lower in the exchange rate that has been under pressure since early May, when markets started to raise their expectations for a 'no deal' Brexit transpiring on October 31.

Adding further pressure to Sterling are recent reports Chancellor of the Exchequer Philip Hammond is reportedly "prepared to resign" over Prime Minister Theresa May's legacy spending plans, a report that is credited with triggering the latest impulse lower in Pound Sterling.

According to the Press Association, senior government sources say tensions between officials at the Treasury and Prime Minister's office have reached boiling point over May's spending intentions.

If true, yet another dose of uncertainty will have been lobbed into the already fragile political landscape in the UK.

Sterling tends to depreciate at times of rising uncertainty.

"How low GBP/EUR can go in the short-term is a question of how bad can the political landscape in the UK get. Hammond's threat of resignation pushed the cross below the €1.12 barrier for the first time in five months with much of the Tory leadership race left to be run," says Simon Harvey, an analyst with Monex Europe.

The GBP/EUR is now at its lowest level since January 10, and looks to be on course to erase all of its 2019 gains on current trends.

"Studies argue an extension nearer 1.1000 may well prove necessary prior to decent support being found and if values fail to base out thereafter a more directly negative picture could take shape (risking prior/notable 1.0750 lows as well)," says Charsley.

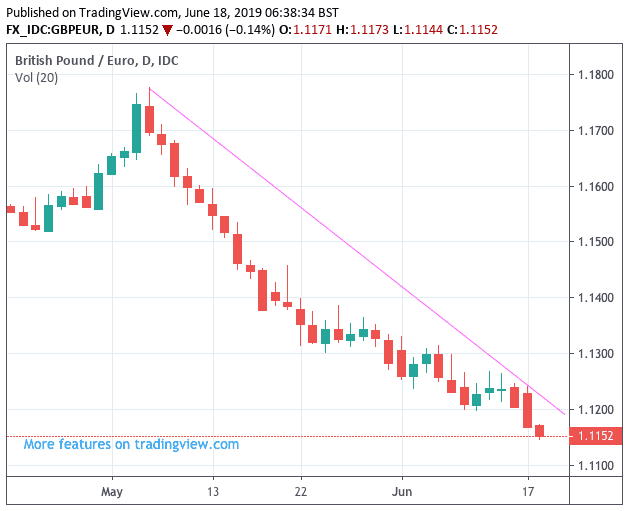

Above: The 'trend is your friend' - it has been one-way traffic lower for Sterling against the Euro since early-May.

The likelihood of a 'no deal' Brexit taking place on October 31 has jumped in the past month, according to economists in a Reuters poll, as most candidates looking to take over as Prime Minister appear to have adopted a tougher stance on the matter than Theresa May's administration.

Frontrunner Boris Johnson has said he would be willing to leave the EU without a deal, and the median forecast for the chance of a disorderly Brexit jumped to 25% in the June 11-14 Reuters poll from the 15% given in May.

We have however made the case that markets might be guilty of overlooking the fact that even though Johnson advocates leaving the EU without a deal, he will only do so should negotiations with the EU fail. He has made it his priority to renegotiate the existing deal.

Of course, the EU might never accept his request to renegotiate, but a flat-out refusal risks making the EU scapegoats for any negative consequences of a 'no deal'.

Looking at the agenda for Sterling for the remainder of the week, the second round of voting for the Conservative Party leadership race takes place today.

In order to progress through the second round of voting, the seven remaining candidates must win the backing of at least 33 Conservative MPs.

The final rounds of voting will take place on Wednesday and Thursday this week.

By Thursday, only two candidates should remain who are then subjected to a final vote by the wide Conservative Party membership.

"Brexit uncertainty continues to simmer in the background to the detriment of the pound. Britain is in the process of choosing a new Conservative leader, one that shows Brexit advocate Boris Johnson in the lead. Anything that raises the risk of Britain taking the disorderly, no-deal route out of the EU tends to play out as pound negative. Britain’s week ahead includes influential inflation data Wednesday followed by a Bank of England policy decision Thursday," says Joe Manimbo, foreign exchange analyst with Western Union.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement